With April NGL data from Alberta now fully released (and all other provinces having previously reported), the complete public data April production picture is now available on BOE Intel and Petro Ninja. We were going through some of the production charts on BOE Intel, and happened to notice some interesting production trends from Whitecap Resources.

REACH OUT HERE FOR YOUR OWN DEMO OF BOE INTEL AND GETS ACCESS TO THESE CHARTS AND DATA FOR YOURSELF.

Whitecap’s gross licensed production in April jumped to a record high (up 6,000 BOE/d from March), driven by increased condensate production coming from the company’s Montney assets. Readers should be aware that gross licensed production considers all wells licensed to the company at 100% working interest, and so would not include any non-op wells or any working interest sharing agreements with other companies. Having said that, gross licensed production is great in that it can still show trends. In this case, the trend suggests that the last few months have seen increased production from Whitecap. April 2024 gross licensed production for Whitecap is 10% higher than what the company produced in January 2024 (Figure 1), although keep in mind that the company did acquire ~4,000 BOE/d of production from Baytex (the licence transfers went through in late December). Nonetheless, most of the increased production appears to be organic.

Figure 1

*Gross licensed production does not equal corporate production. Gross licensed production considers all wells licensed to the company at 100% working interest, and so would not include any non-op wells or any working interest sharing agreements with other companies.

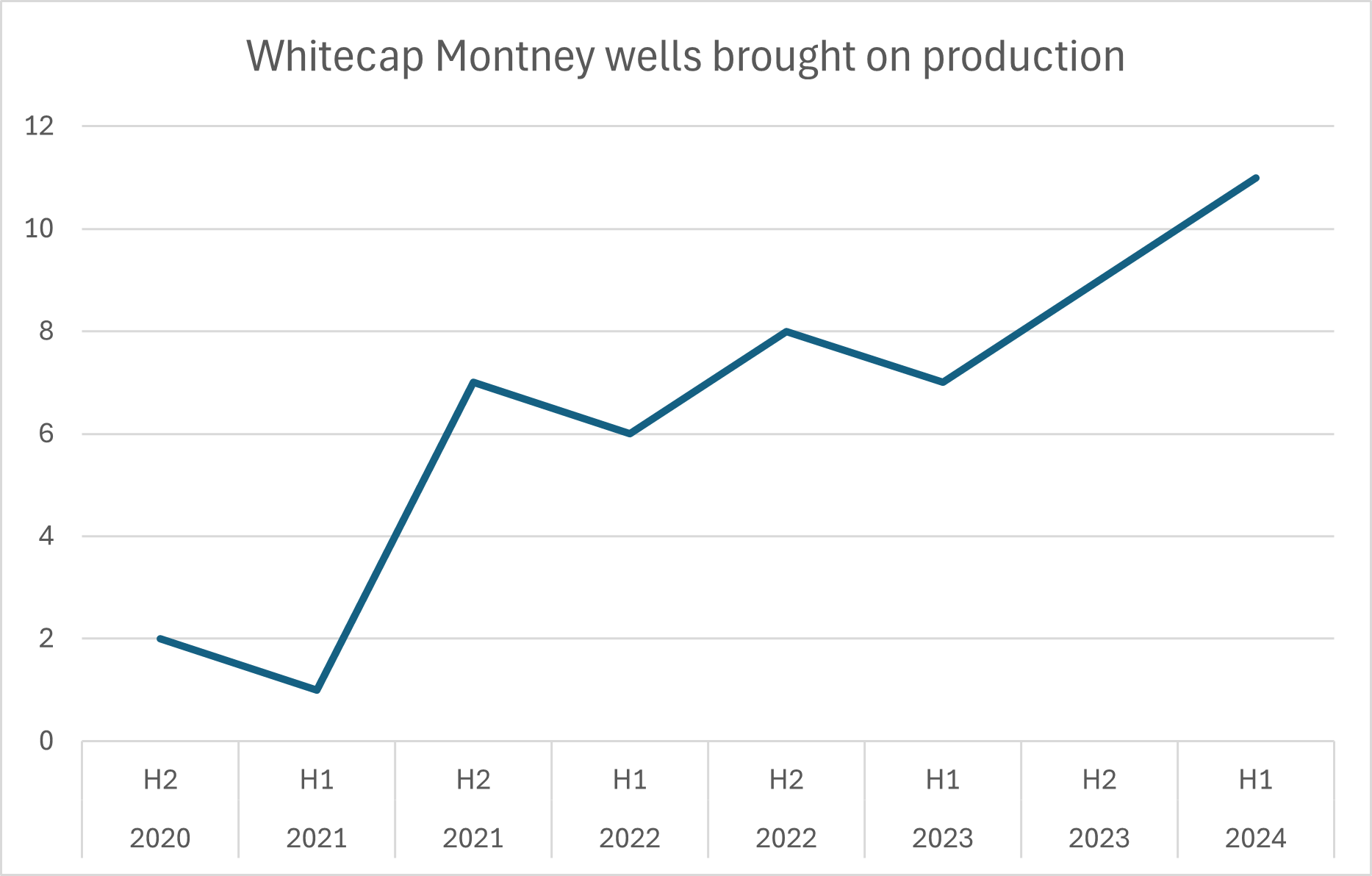

As we use BOE Intel’s “Top Well” feature (Figure 2), we can see the top 20 wells licensed to Whitecap based on oil/condensate (including pentane) results. What’s notable here is the number of Montney wells that the company has recently brought on production. Recall that the second half of 2023 saw Whitecap really commit to drilling more Montney wells, and that seems to be continuing in the first half of 2024 (Figure 3). Of this list of the company’s 20 highest producing wells in April, 10 are Montney wells, and 8 of those 10 are fresh wells that just came on production in March 2024 or later. It’s also worth pointing out that those 8 wells are all on confidential status, meaning that the full production picture, including hours, is not yet available in the public data.

Figure 2

*Condensate includes condensate + pentane, other NGLs not shown here

Figure 3

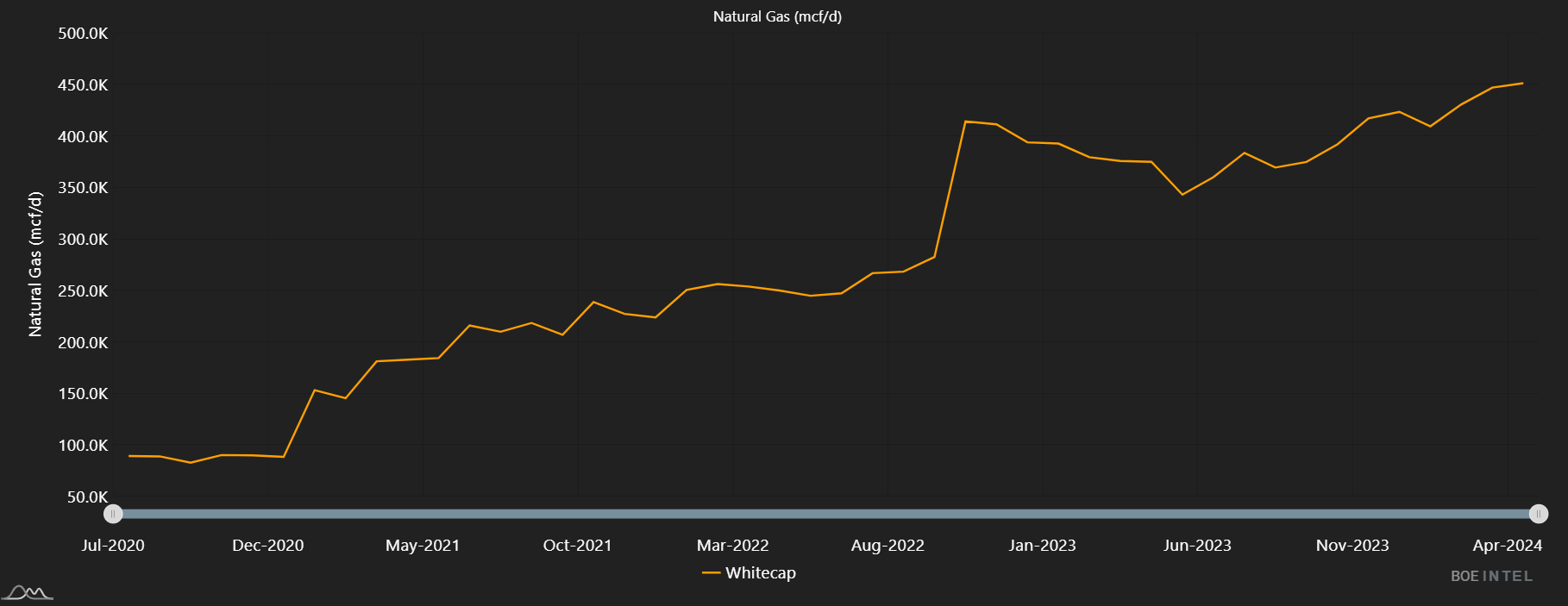

The results can be seen in the Whitecap’s production by commodity type. Condensate production (gross licensed) has jumped over the last 2 months to new highs (Figure 4). Natural gas production also continues to increase at consistent rates (Figure 5), while oil production and NGL production (neither pictured here) remain consistent. Overall, the company’s liquids weighting did increase slightly month over month.

Figure 4 – Whitecap gross licensed condensate production

*Condensate includes only condensate + pentane, but not other NGLs

Figure 5 – Whitecap gross licensed natural gas production