The Alberta Government brought in $18.2 MM on its December 11th Crown land sale.

In total, 38,027.65 hectares were sold at an average price of $479.76/ha.

Click here to see the full land sale results on BOE Intel.

There were only 3 parcels of land that fetched bonuses of greater than $1 MM, combining for $3.7 MM. Those three parcels are shown in pink in Figure 1, and come from the far northwestern corner of the regional Clearwater area, north of the Cadotte field. Those 3 parcels all went to land brokers. Shown also just for reference as the largest player in the area are mineral rights held by Spur Petroleum in yellow.

Figure 1

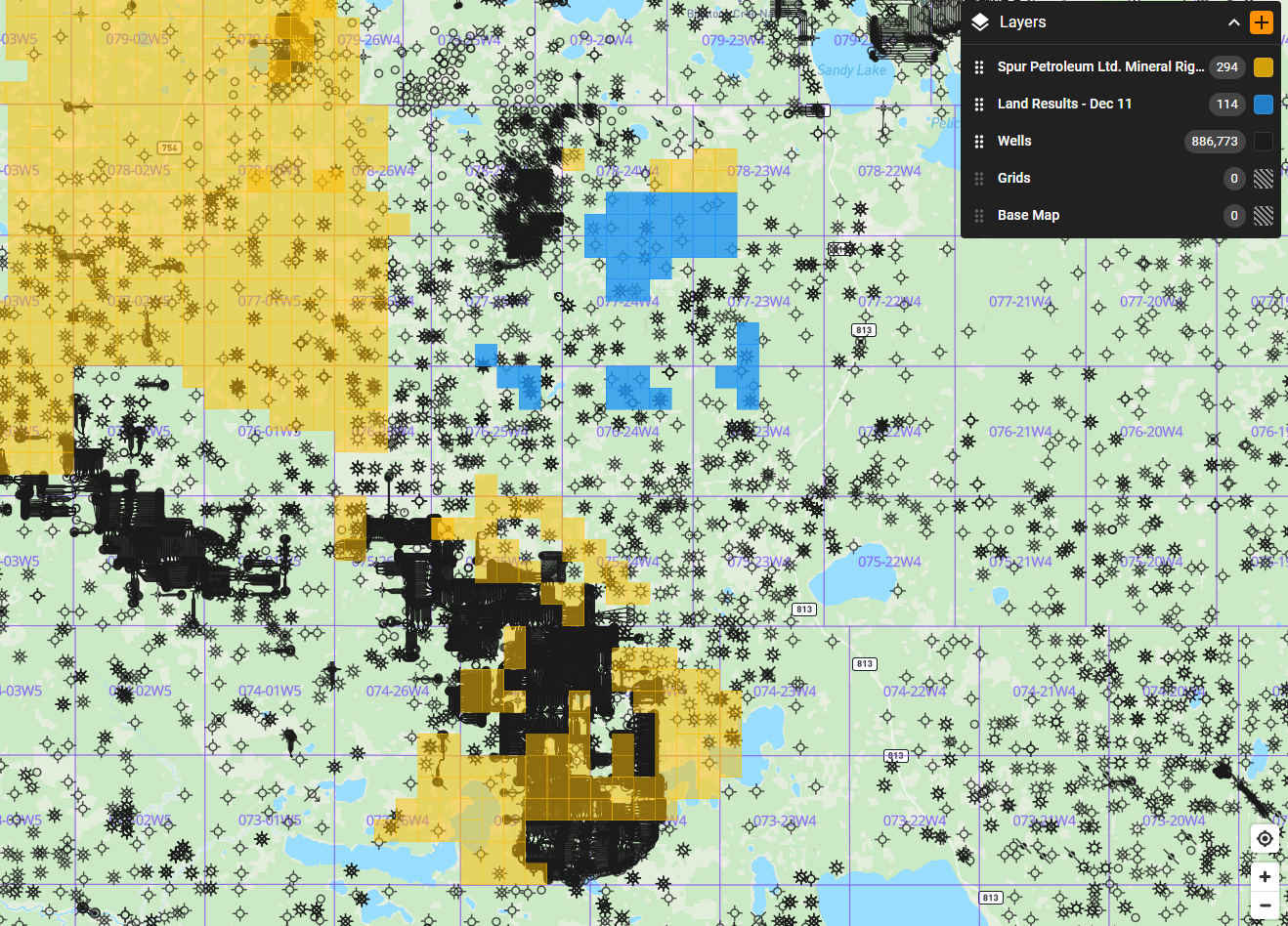

Continuing with the regional Clearwater area theme, there were also some parcels of land near Marten Hills that were notable (Figure 2). Here there was a combined $7.9 MM spent on 9,984 hectares (39 sections) of mineral rights. This area represented 43% of the total bonus at the December 11th land sale. There were 39 separate parcels here, with land brokers representing the buyer(s) for 28 of the parcels. Canadian Natural Resources was the buyer for 8 of these parcels (a total of 8 sections or 2,048 hectares).

Figure 2