Canadian energy stocks diverged from their US counterparts on Monday, as Bloomberg headlines surrounding Premier Danielle Smith’s visit with Donald Trump made their way around.

👀AB PREMIER SMITH ON TRUMP MEETING:

*🇨🇦 SHOULD BE PREPARED THAT TARIFFS ARE COMING

*HAVE NOT SEEN INDICATION TRUMP IS CHANGING COURSE

*🇨🇦 WILL HAVE TO RESPOND IF THERE IS 25% TARIFF

*NO EXPECTED EXEMPTIONS FROM TARIFFS

*OIL EXPORT CUT OFF WOULD LEAD TO NATIONAL UNITY CRISES

— Rory Johnston (@Rory_Johnston) January 13, 2025

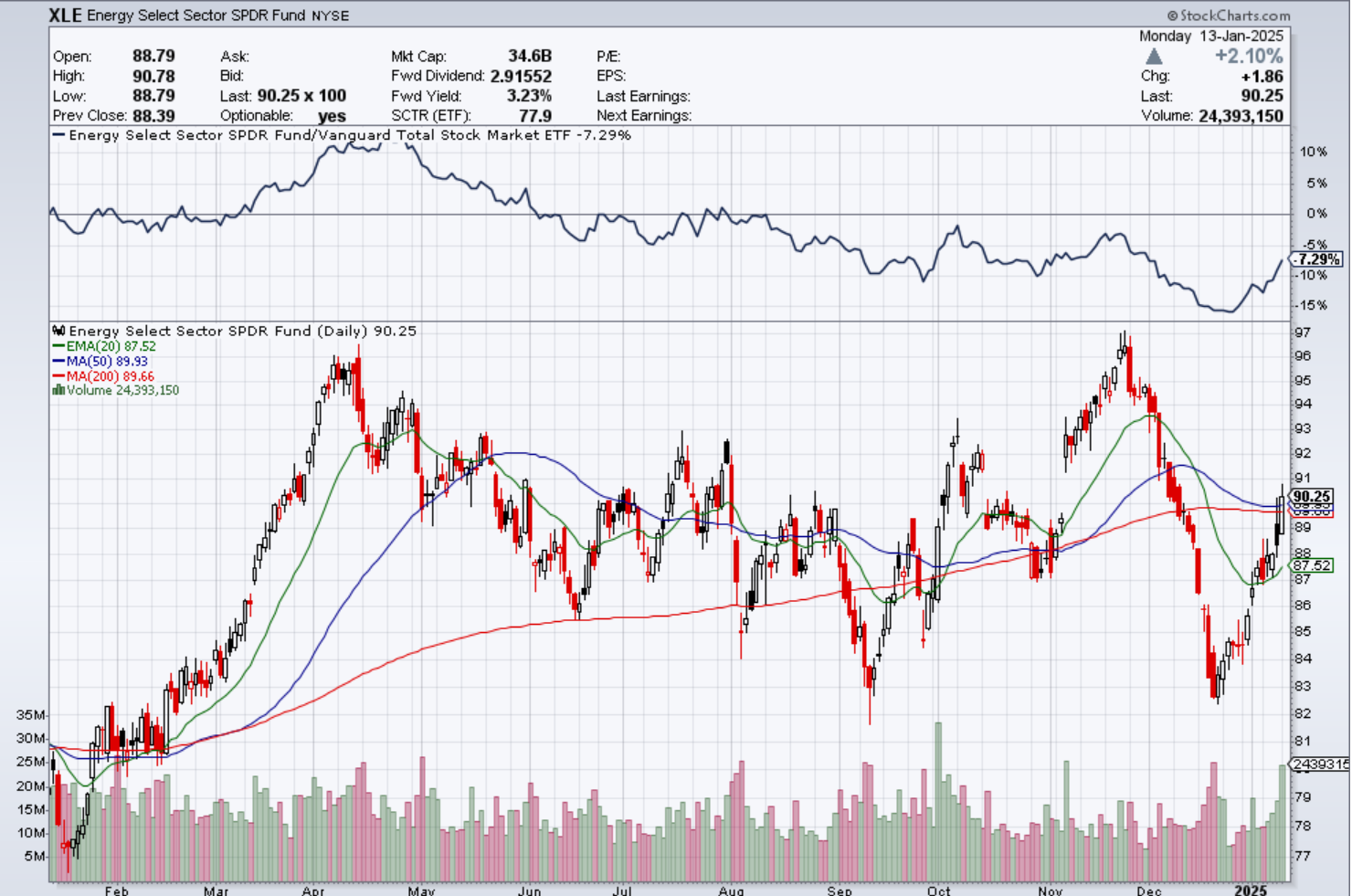

The end result is that despite oil and natural gas both having good days, Canadian energy stocks had a bit of a tantrum and closed down about 1.8% while US energy stocks were up about 2.1%.

Chart courtesy of StockCharts.com

Chart courtesy of StockCharts.com

For some background on the tariff threats, see below:

The following content was generated by Grok, created by xAI:

The Canadian energy sector has expressed significant concern over potential tariffs threatened by Donald Trump, particularly those announced during his campaign for a second term in office. Here’s a summary based on recent discussions and reactions:

Tariff Threats: Trump has threatened to impose a 25% tariff on all Canadian imports, including energy products, unless Canada addresses issues related to border security, immigration, and drug trafficking. This has caused unease in Canada, especially in provinces like Alberta where the energy sector is a major economic driver.

Economic Impact: Analysts have warned that such tariffs could severely impact industries like energy, which is one of Canada’s largest exports to the U.S. Specifically, the oil and gas sector would be affected, with potential implications for Canada’s GDP and employment. There’s also a concern about retaliatory measures, which could disrupt the integrated North American energy market.

Retaliatory Measures: In response, some Canadian leaders, notably Ontario Premier Doug Ford, have threatened to restrict energy exports to the U.S., particularly to states like Michigan, New York, and Wisconsin. This could involve cutting off electricity or other energy supplies as a countermeasure to any imposed tariffs. However, this stance has not been universally supported among Canadian premiers, with some advocating for a more diplomatic approach.

Skepticism and Strategy: There’s skepticism regarding whether these tariffs would actually be applied to Canadian energy due to the mutual dependency between the U.S. and Canada in the energy sector. Some experts and former officials suggest that Trump might exempt Canadian energy from tariffs because of the negative impact on American consumers, particularly in terms of gas prices. Canada’s strategy includes working on border security and immigration issues to potentially avert these tariffs.

Political and Public Sentiment: Posts on X reflect a range of sentiments, from outright concern about the economic implications to strategic discussions on how Canada might respond. There’s a clear message that Canada is not willing to simply accept these tariffs without a fight, with some political leaders publicly stating their readiness to retaliate in kind.

In summary, the Canadian energy sector faces significant uncertainty due to Trump’s tariff threats, with potential economic ramifications prompting discussions on various retaliatory and diplomatic strategies. However, the exact outcome depends on negotiations and the political climate between the two nations.

For a deeper dive (and human based analysis) on tariffs, click through to check out Rory Johnston’s work over at Commodity Context:

The above piece was co-written with @JoeCalnan for @CAGlobalAffairs.

If you want a deeper, more updated look at tariffs, how they’d work, who would feel the brunt of the pain and why, and how Canada could best respond, subscribe and check out this piece:https://t.co/wzUrKzfrYs

— Rory Johnston (@Rory_Johnston) January 13, 2025

For what it’s worth, Polymarket implied odds suggest only about a 32% chance of tariffs being applied to Canada in Trump’s first week.

Despite the concerns shown today by the market, there remains many reasons to remain optimistic about Canadian Energy in 2025.