Infinity Natural Resources is targeting a valuation of up to $1.24 billion in its initial public offering, joining a bunch of energy industry companies that have rushed to list their shares in recent months.

Infinity Natural Resources is targeting a valuation of up to $1.24 billion in its initial public offering, joining a bunch of energy industry companies that have rushed to list their shares in recent months.

The company, which first filed its IPO paperwork in October, said on Tuesday it is aiming to raise up to $278.25 million through the sale of 13.25 million shares priced between $18 and $21 each.

A flurry of activity has invigorated the energy IPO market, which is gearing up for a boost this week as LNG producer Venture Global moves toward what could be the largest U.S. listing by an oil and gas company in more than a decade.

President Donald Trump’s plan to maximize oil and gas production could also set a favorable tone for the sector that faced heightened scrutiny over its climate commitments under the previous administration.

“Looking at the president’s potential policies, energy is going to play a big role,” said Mike Bellin, IPO services leader at PwC U.S.

“We’re going to continue to see more companies in the energy sector looking to go public,” Bellin said, adding that growing energy demand in high-profile sectors such as artificial intelligence could be a driving force.

Infinity Natural is backed by investment firms Pearl Energy Investments and NGP Capital, which hold a nearly 65.7% stake. The company’s shares will list on the NYSE under the symbol “INR”.

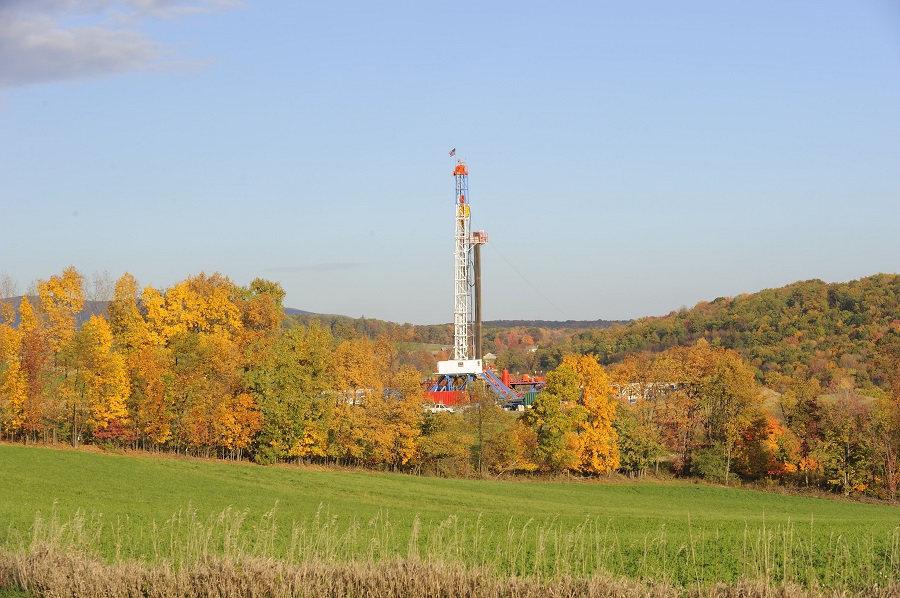

Founded in 2017, the company has oil and natural gas assets in the Appalachian Basin in the United States. Its net income more than doubled in the first nine months of 2024, compared with a year earlier.

Citigroup, Raymond James and RBC Capital Markets are the joint book-running managers for Infinity’s IPO.

(Reporting by Niket Nishant in Bengaluru; Editing by Vijay Kishore and Shounak Dasgupta)