Quick Trump Tariff update: I listened/watched to the whole inauguration speech and two things stood out: First was how peculiar it was to see Trump shake hands with Biden, then spend 20 minutes explaining how Biden destroyed the country in every conceivable way, then see them shaking hands again and parting ways. At least Kamala looked annoyed. But anyway the second thing was that Trump seemed to veer somewhat form earlier speeches (surprise surprise) when talking about immediate priorities. As far as energy goes, his comments related to a desire to turn the US into an energy powerhouse to power vast new manufacturing capability (plus AI), on the back of affordable energy, and also to make the US a dominant oil/gas exporter. Neither seems terrible to Canadian energy to me. His North American trade venom seemed to be flowing into the leg of the auto industry, mostly, which will create a complicated problem for Canada. Ottawa will no doubt protect that precious voting base in the golden horseshoe…stay tuned. The direction will change again five times in five days. [Late edit Monday night: a new direction arrived within hours, Trump stating late in the day that Canada and Mexico 25% tariffs being “looked at” to “we think start Feb. 1.” The chaos continues, but reality indicates it will not be that quick. One of Trump’s first and foremost overarching proclamations was that “all federal agencies are required to address the cost of living crisis in America.” I don’t think a single soul out there, across the political spectrum, would expect Can/Mex tariffs to drive down the cost of living. But no worries, by the time you read this we’ll be galloping off in another direction. And if you’re getting too stressed, remember that he also signed an executive action called, for real, “Putting People Over Fish“.] [OK one more late-late-night addendum/change of direction so far unreported… after reading the Presidential Action “America First Trade Policy”: Section 4.(g) states:”The Secretary of Commerce and the Secretary of Homeland Security shall assess the unlawful migration and fentanyl flows from Canada, Mexico, the PRC, and any other relevant jurisdictions and recommend appropriate trade and national security measures to resolve that emergency.” Section 5. (a) then follows up: “sections 2(a), 2(h), 3(d), 3(e), 4(a), 4(b), 4(c), 4(d), and 4(g) shall be delivered to me [me, Trump, not me, Terry] in a unified report coordinated by the Secretary of Commerce by April 1, 2025.” SO: President Trump shoots from the hip while signing stuff, but what he signed says no Can/Mex tariffs until specifically laid out by Secretary of Commerce and Secretary of Homeland Security, in a separate report, by Apr 1, 2025. We can therefore most likely skip the panic until then.]

Don’t you wish someone would just tell you more about AI? Yeah, I know, it’s off the charts, it feels like every other mania going back to Y2K. But nevertheless it is here, it is everywhere, and it is most definitely really happening. Consider this development: Elon Musk’s X/Twitter jumped into the AI business last year. They built the largest AI supercomputer in the world, xAI, in 122 days (immodestly but not incorrectly called Colossus). Video clips of it are mind boggling. I can’t build a birdhouse that fast. In Canada you couldn’t find the right government departments to begin to work on the first phase of an application in twice that long. The fun part for the energy industry: This AI machine uses 100,000 Nvidia H1 chips that consume about as much power as 100,000 households. The whole operation started at 150 MW of energy consumption, which doubled in size by December, a whopping 4 months later (now 200,000 chips/200,000 households’ worth) and Musk expects it to increase tenfold in the coming months (article: https://www.commercialappeal.com/story/money/business/development/2025/01/07/xai-in-memphis-energy-use-mlgw-tva/77517315007/ ). Currently the operation is being run by temporary generators while the company works out the grid connection details with the flummoxed local utility (not their fault, it’s quite a whack of new demand out of thin air). What does this tell us about AI’s coming development wave? It will happen, it will not be stopped or slowed, and they will power these things with donkeys if they have to. No one will risk being left out of the race. “All of the above” energy will be the new mantra.

Back to our home and native tariff terror…While we rightfully fret up here in the Great White North, here is a sort of pacifier to calm the nerves, an example of just how complex a tariff trade war would really be. Canada’s lumber exports to the US are of course in the tariff crosshairs, but the economic bomb might go off in a location Trump’s team isn’t expecting. BC’s lumber industry is going on the offensive, proposing a 25 percent increase in lumber prices, effective when tariffs are implemented. Won’t that just shoot Canada in the foot, and help the US timber industry? No, says a prominent US timber voice – the US will pay dearly. The CEO of the Denver Mass Timber Group said that the tariff will “trigger a panic buy the next few weeks causing runaway prices.” As is always, always, always the case, listen to the boots on the ground, not theoreticians (“we don’t need their lumber” – apparently you do). Story: U.S. Lumber Market Chaos Looming From Potential 25-per-cent Tariffs – Canadian Biomass Magazine

Mark Carney’s resurrection into the public eye brings back memories of the immensity of his climate war programs, if for no other reason than the Conservatives have enough footage of said speeches to take us to 2050. Four or five years ago, Carney set out to strangle the hydrocarbon sector’s access to financial markets. That structure is now falling apart, with banks leaving daily, and then on top of this is news from China, still somehow touted as the green energy revolutionary leader (because they buy a lot of EVs and add a lot of solar): China’s coal consumption hit record highs in 2024. The International Energy Agency, world’s most visible sellout, insists coal use will plateau by 2027, yet notes that “Coal is often considered a fuel of the past, but global consumption of it has doubled in the past three decades…”, something they surely did not predict 3 decades ago. Compounding the situation: Future growth is expected to be led by not China but India and Indonesia, whose economies recently grew at 7.8 and 5 percent, respectively (China’s demand expected to grow also). Always on the horizon, that plateau…Story: China’s Coal Consumption At New Highs, As Real Estate Crisis Fails To Slow Energy Demands

In the “Can’t wait til this sh*t is dead” department, here’s a story that in ordinary times would make you feel good, enhance your day, on the environmental front: Researchers have found that the Pacific slope of Peru is greening, with wide-scale changes in the level of vegetation. Satellite images confirm that they are not crazy, that greening is occurring in hot arid desert, then south on the hot arid steppes, then on the cold arid steppes. As pointed out in the story, “The Pacific slope provides water for two-thirds of the country, and this is where most of the food for Peru is coming from too.” But wait! The title, as it appears on the Phys.org site is: “The Pacific slope of Peru is greening, but it’s not good news” Trust the science! You poor imbeciles, you think more food and water is good? Peculiarly, the story contains not a single whimper of bad news, except, right at the end, one of the researchers calling this a “warning sign”. Of what, more food? More vegetation? Isn’t that what we hope for when we badger Brazil to stop burning rainforest? I think the ‘bad news’ is that in the modern world of climate change researchers, there must not under any circumstances be any ‘good news’ if something starts happening differently in the climate. Nihilists – the party’s over. Go home to your chicken and your light bulb. Story: The Pacific slope of Peru is greening, but it’s not good news

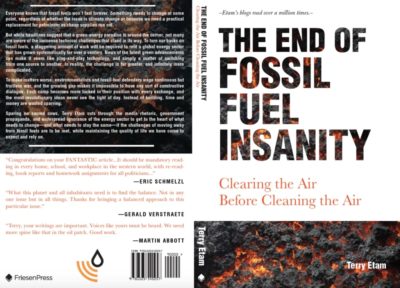

It’s all happening as expected, more or less – an energy transition isn’t quite so simple. Find out what readers knew years ago in The End of Fossil Fuel Insanity – the energy story for those that don’t live it, and want to find out. And laugh. Available at Amazon.ca, Indigo.ca, or Amazon.com.

Read more insightful analysis from Terry Etam here, or email Terry here.