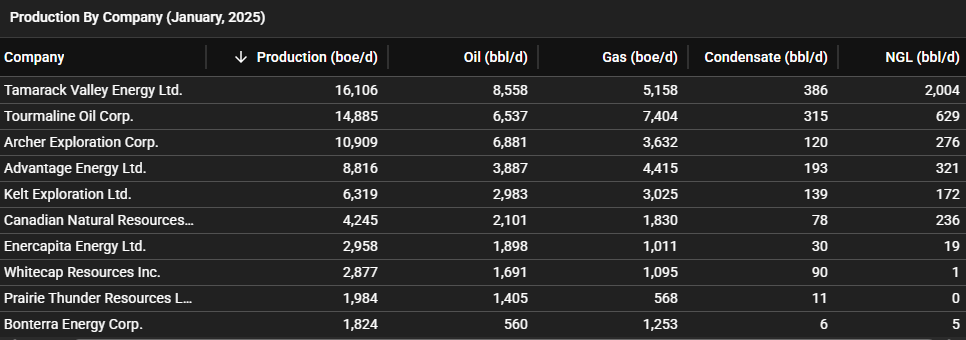

Initial production data is out for February in Alberta. BC and Saskatchewan are yet to report. Alberta has reported oil, condensate, and gas; full Alberta NGL data (including pentane) and marketable gas is due out in a couple weeks. While the February data won’t be considered complete until the rest of the Alberta data has been reported, it is nonetheless worthwhile to show the data as it stands today. Pentane volumes in Alberta will not be represented yet for February which will affect liquids results, and “gas equivalent” volumes will be used instead of “marketable gas” in cases where marketable gas is not yet available. As always, we use calendar day production metrics so these are real volumes produced in the month. Despite the incomplete version of this data, it is still interesting to present it as this data is fresh.

BOE Intel subscribers can generate these reports for themselves whenever they want, and interact with the wells on the BOE Intel activity map. Subscribers are able to generate top well reports with more wells, on an overall basis, by formation, by company, by area, or by well type.

TOP 15 OIL/CONDENSATE WELLS – February volumes – Alberta only (see on map)

Notable oil/condensate wells:

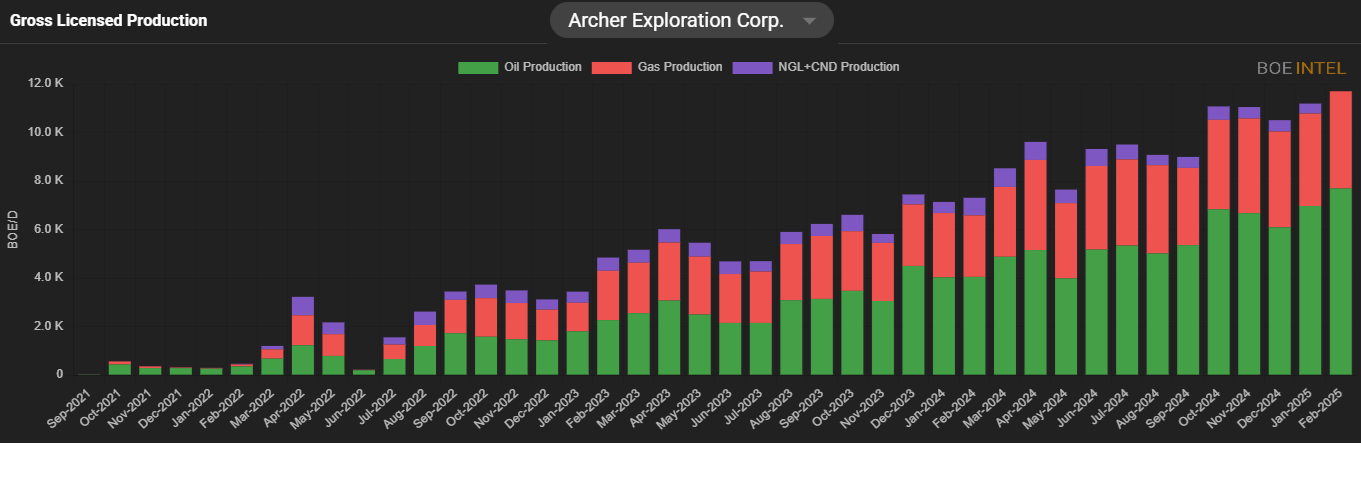

- Archer Exploration pulled off the upset this month, with a Charlie Lake well from Valhalla that outproduced Montney competitors. Its top well produced 1,607 bbl/d of oil in February, and the company also had another well produce 1,035 bbl/d in the month. All told the company has been able to consistently grow production over the last few years (Figure 1), and has become the third largest producer out of the Charlie Lake formation (Figure 2).

- The Whitecap/Veren combined company (assuming deal goes through) will likely be represented on this list rather frequently over the coming years as a result of its significant Montney position in Alberta. All told 8 of the top 15 wells came from this combined entity.

- Advantage Energy had an impressive oil well that produced 984 bbl/d in February. Often more known for its natural gas wells, the company has targeted more liquids production as of late.

- HWN Energy, a private co. that consolidated assets in Alberta over the last couple of years, made its first appearance on our Top Wells list with a 971 bbl/d Montney oil well from Waskahigan.

- Cygnet Energy, the private co. that acquired Montney/Duvernay assets from Murphy Oil and Athabasca in 2023, made its first appearance on our Top Well Report with a 816 bbl/d Montney well from the Placid field.

- ARC Resources had 2 wells of note this month, the top well being a 1,034 bbl/d condensate well from Kakwa.

TOP 15 OIL/CONDENSATE WELLS – February volumes – Alberta only – initial liquids data (pentane volumes not yet reported for February)

*partial February data only, AB pentane volumes not yet reported. “Gas equivalent” volumes represented in gas column until “marketable gas” is reported.

**TOP WELL REPORTS generally filter out oil sands/thermal wells, and only consider onshore Canadian production. However, BOE Intel subscribers can choose their own well types and include or exclude these wells

Figure 1 – Gross Licensed Production – Archer Exploration

*partial February data only, AB pentane volumes not yet reported. “Gas equivalent” volumes represented in gas column until “marketable gas” is reported.

Figure 2 – Charlie Lake Formation – Gross Licensed Production