It’s been quite a year for Ovintiv.

For much of the last 5 years, many wondered what would become of the company’s Canadian assets. In 2019 the company (as Encana) announced it was moving its head office from Calgary to Denver and was changing its name to Ovintiv as part of a rebrand and would focus on its US assets in the Permian and other US basins. While the company never publicly wavered about its intentions in Canada, many in Calgary privately feared that the company had come to symbolize the broader trend of capital and head offices heading south of the border due to political and regulatory obstacles at home. Some even wondered if Ovintiv would ultimately walk away from Canada altogether.

The M&A deals over the last year have answered that question with a resounding “no”.

Ovintiv’s recommitment to Canada began in late 2024, with an announcement that it would acquire Montney assets from Paramount Resources for $3.325 billion. Simultaneously it announced at the time that it would also be disposing of its Uinta Basin assets in Utah to FourPoint Resources.

For industry watchers worried about a withdrawal from Canada, this was an unmistakable sign that Ovintiv had decided to be here for the long haul.

On November 4, 2025, the next piece of the puzzle was revealed. Ovintiv announced that it had reached an agreement to acquire NuVista Energy for $3.8 billion, while announcing a planned divestiture of its Anadarko Basin assets in the US.

It was a shock for some, but to others there was curiosity about just who had bought 9.6% of NuVista’s outstanding equity just weeks earlier. On September 22, 2025, Paramount had announced that it had sold 18,500,000 common shares of NuVista by means of a private agreement for $296,000,000 ($16 per NuVista share). Just who was the mystery buyer? Of course now we know. Along with the announcement of the agreement with NuVista, Ovintiv mentioned that it already owned 9.6% of NuVista’s outstanding common shares.

Once the dust settles, Ovintiv will control an enormous contiguous position in the Alberta Montey to go alongside its world class BC Montney acreage, providing the company with an enviable drilling inventory in Canada.

While the Permian will also remain an integral asset for Ovintiv, the transactions over the last year signal an unmistakable bet on the resource potential of the Canadian Montney – and maybe even a nod to the wheels of commerce beginning to slowly turn again in Canada after a decade of stagnation.

Below in Figure 1 are some comparable transactions that involved Montney production over the last few years.

Figure 1 – M&A Comparables

| Date | Type | Acquirer | Target | Value ($) | BOE/d | % liquids | $/BOE/d |

| 2025-11-04 | Corporate | Ovintiv | Nuvista Energy | 3,700,000,000 | 100,000* | 25 | 37,000 |

| 2025-10-28 | Corporate | Cygnet Energy | Kiwetinohk Energy | 1,400,000,000 | 33,000 | 45 | 42,424 |

| 2025-05-14 | Asset | ARC Resources | Strathcona Resources | 1,695,000,000 | 37,500 | 45,200 | |

| 2025-05-14 | Asset | Canadian Natural Resources | Strathcona Resources | 850,000,000 | 26,500 | 32,075 | |

| 2025-03-10 | Corporate | Whitecap Resources | Veren | 8,500,000,000 | 192,000 | 65 | 44,271 |

| 2024-11-14 | Asset | Ovintiv | Paramount Resources | 3,325,000,000 | 70,000 | 50 | 47,500 |

| 2024-08-12 | Corporate | Tourmaline Oil Corp. | Crew Energy | 1,300,000,000 | 29,500 | 44,068 | |

| 2023-11-06 | Corporate | Crescent Point | Hammerhead Energy | 2,550,000,000 | 56,000 | 48 | 45,536 |

| 2023-08-01 | Corporate | Strathcona Resources | Pipestone Energy Corp. | 920,000,000 | 33,143 | 41 | 27,759 |

| 2023-03-28 | Asset | Crescent Point | Spartan Delta Corp. | 1,700,000,000 | 38,000 | 55 | 44,737 |

| 2022-06-28 | Corporate | Whitecap Resources | XTO Energy Canada | 1,700,000,000 | 32,000 | 30 | 53,125 |

*2026 production guidance from Ovintiv acquisition press release

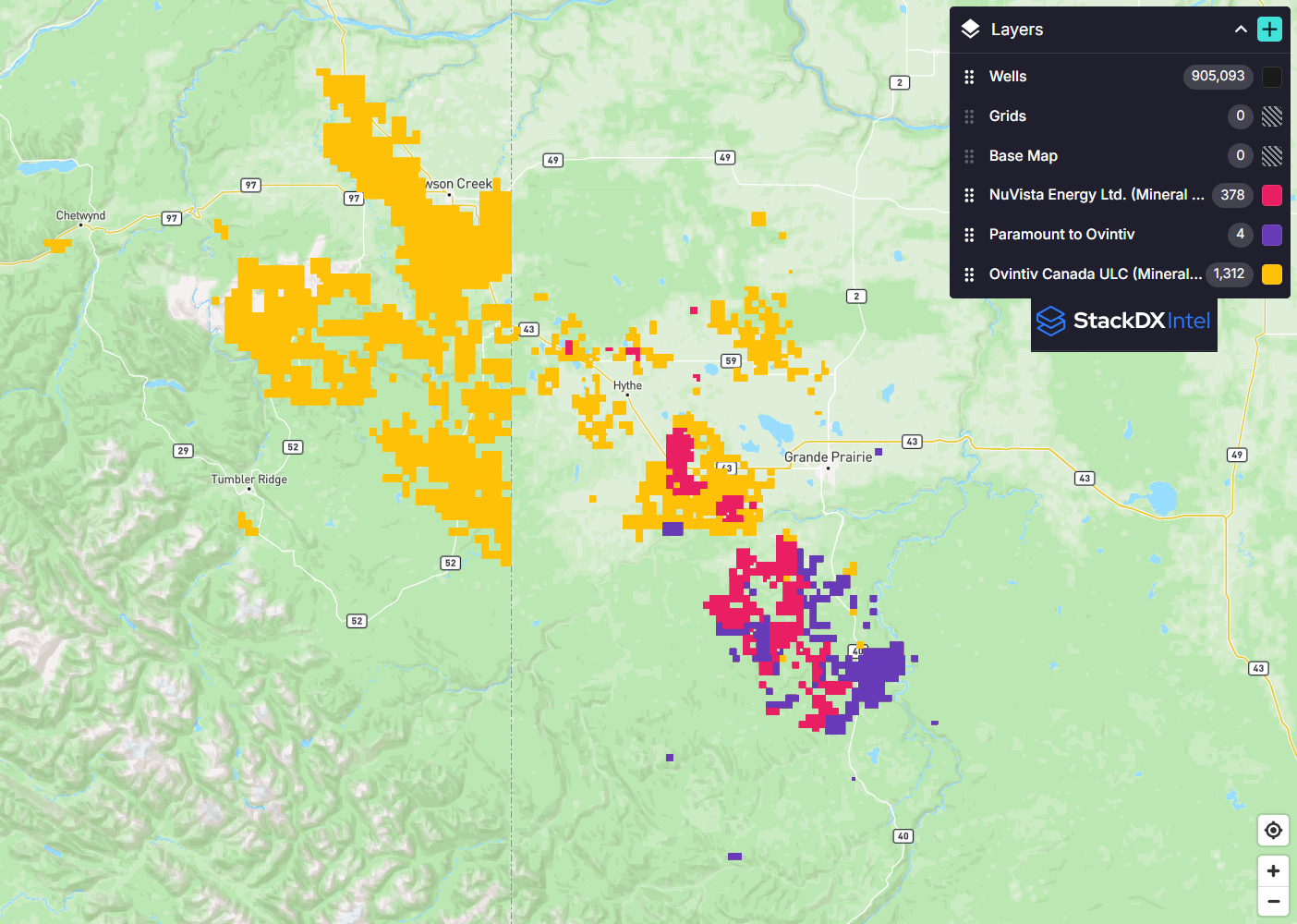

Below in Figure 2, the StackDX Intel map takes a look at Crown mineral rights (all formations) publicly held by Ovintiv and how those have changed over the year. In yellow are Ovintiv mineral rights, in purple are the mineral rights transferred from Paramount to Ovintiv from the earlier transaction and in pink are the NuVista mineral rights that are set to become Ovintiv’s once the transaction receives approval and closes.

Figure 2 – Mineral Rights Map