The Alberta Government brought in $56.3 MM on its November 19th Crown land sale.

In total, 36,896.7 hectares were sold at an average price of $1,526.89/ha.

Click here to see the full land sale results on StackDX Intel.

Click here for more details on the StackDX suite of software solutions for oil & gas data, including client testimonials and case studies.

This was the largest dollar bonus of the year, with some deep rights with Duvernay potential driving the results. Two parcels in particular were responsible for about half of the total amount.

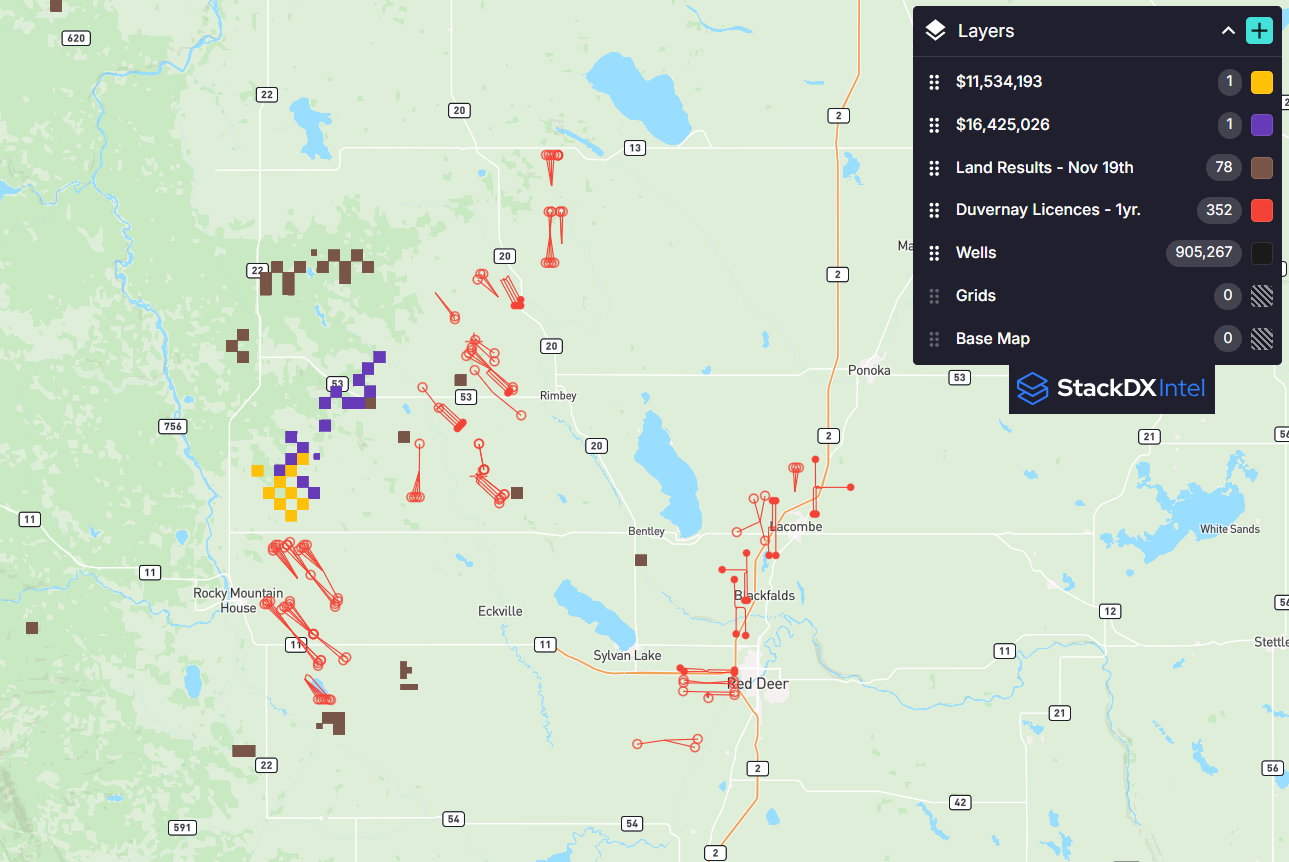

The most richly priced parcel was for 3,904 hectares of mineral rights with Duvernay potential west of Rimbey and north of Rocky Mountain House. This parcel went for a price of $16,425,026, with a land broker representing the buyer. It is shown in purple in the map below in Figure 1.

Another parcel also transacted at a high price nearby. Shown in yellow below, 2,304 hectares of rights went to a land broker for $11,534,193. There is Duvernay potential in these rights as well.

Shown in red are Duvernay licences over the past year.

With oil prices hovering around $60/bbl, this is an encouraging sign of investment for Alberta and the Duvernay in particular.

Figure 1 – Alberta Crown Land Sale results – November 19th