There are so many questions about the Alberta-Canada energy MOU…anyone thinking they’ve figured it out is probably spending too much time with the bong. There’s a good chance that, at this stage, it’s not even meant to be figured out, just open to interpretation so that everyone can score a win and everyone can be mad about it and then hey at least we have some sort of energy homeostasis which good Lord is what any sane person wants.

The MOU is like something that fell out of a spaceship, like some big alien obelisk in a sci-fi film where people start tearing each other apart because some think it is great and some think a disaster. Some people are calling the MOU a victory for Alberta because a coastal pipeline is ‘granted’, and if it sent Greenpeace activist/cabinet minister Steven Guilbeault abandoning cabinet, it must be a good thing. But is a $130/tonne carbon tax a victory for Alberta? Hard to square that circle.

But we’re not really meant to be able to square the circle at this time; reading the official PMO announcement it is clear that there are endless big question marks still in the air, and scant details of what any of this will actually look like on the ground.

You can read it literally, and in that case it sounds quite bad, or you can analyze it from another level and see a lot of potential. The complexity is not a bad thing; anything of the scope intended in the MOU has consequences that will potentially reach from Brooks to Venezuela and maybe far beyond.

The MOU is mostly messaging, both AB and CAN showing they can work together by finding common ground, or arm wrestle to a standstill, or whatever desired outcome pleases the right people in either’s camp. Smith needs to show Albertans she can work with the feds, the feds need to show they’ve actually done something on the energy file.

Without knowing the details, it is pointless to get too agitated one way or the other. But the agreement is a big deal even without the detail, oddly enough. There are angles to the MOU that could potentially be of global significance.

So what do I mean by that. Well, stepping up to the 35,000 ft level of geopolitical analysis – which is far more interesting, because things at that level move big levers (thirty or fifty dollar swings in the price of oil will have far more impact than most anything else in the MOU). Looking at the forest instead of the trees, from the highest level, geopolitical machinations are the strong forces that are worth analyzing first.

President Trump is working overtime, around the world, to keep oil prices down in whatever way he can. He understands how critical low oil prices are to economic good times; higher oil prices are like a tax on everything, and so in his world view, if he lowers the price of oil, it is like lowering everyone’s taxes, and then they’ll love him oh so much. So he says anyways.

There are many wheels in motion that support this hypothesis, but none is more clear at the moment than the US’ sudden aggression towards Venezuela. Just a few days ago, Trump ramped things up considerably, announcing on social media this past weekend:“To all Airlines, Pilots, Drug Dealers, and Human Traffickers, please consider THE AIRSPACE ABOVE AND SURROUNDING VENEZUELA TO BE CLOSED IN ITS ENTIRETY…”

What the hell is that all about, you might mutter, whether or not looking up from a bong. The reasoning given is that Venezuela is somehow central to the US’ drug problem, and thus lethal military force is somehow warranted.

That rationale seems wildly off base; even a US Southern Command General issued a report to Congress stating that most US come via Columbia, Brazil, and Mexico, not Venezuela. The report is a thorough cataloguing of external threats to the US, and Venezuela is singled out as being problematic because of close ties to Russia, and the fact that it is run by a despot.

But so is North Korea, and so is Russia, so why aren’t those countries dealing having their airspace shut down? And if drugs are the problem, why is airspace not closed over Mexico or Colombia? Both are much handier for that sort of thing.

The answer is most likely oil, and that’s where the Canadian MOU connection comes into the scene as possibly a fascinating cog.

Once upon a time, the US loved Venezuelan oil, and feasted on it. US Gulf Coast refineries were built to handle heavy crude grades from Mexico and Venezuela (not just Gulf Coast but other refineries throughout the US as well – the US consumes a lot of heavy oil, and exports the light stuff from shale plays). It made total sense; both countries had vast reserves, far more than they could use, and the geographical link from Gulf of Mexico drilling and Venezuelan bitumen production was a refreshingly straight line to Texas compared to sourcing the heavy stuff from around the world.

But that traditional flow has dried up. Mexican production has collapsed; Cantarell, the Mexican crown jewel oil field, produced over 2 million b/d in 2004, much of it headed straight into US refineries; in 2024 production had collapsed to 140,000 b/d. There are no big bright lights on the Mexican exploration scene.

Venezuela is quite different. The country boasts the world’s largest amount of proven oil reserves, which is music to Trumpian ears. Production in Venezuela has collapsed due to socialistic incompetence, nothing more, and so those reserves are just laying there, available for use, when a proper government is in place that can facilitate development.

In the meantime, over the past 20 years as Mexican and Venezuelan crude output has collapsed, Canada has stepped in as the main supplier of heavy crude to US refineries, not just in the Gulf Coast region but elsewhere in the US as well.

The relationship worked well, particularly as a home for rapidly expanding bitumen development from the oil sands over the past 15 years. Canada had a market for all that oil, albeit somewhat discounted, and the US had a phenomenal supply source, just across the world’s longest unguarded border, from a friendly nation that the US was protecting militarily anyway. No external country could mess with the US’ feedstock from Canada due to the landlocked nature of the oil sands, which was a beautiful thing for an American economy that had spent decades beefing up military presences around the world to protect shipping lanes for energy. No such challenge with the Canucks.

And this is where the MOU really gets interesting. Trump has been turning the screws on Canada, looking to extract better deals on many things the US imports (just like every other country). Trump knows, with Alberta crude landlocked, that all that bitumen has no where else to go (coastal pipelines of course are a natural route, but we all know how that is going). Negotiating with someone with no leverage or options – surely Trump’s favourite thing in the whole world.

But…if Alberta and the federal government can overcome all the challenges in front of them and build another significant pipeline to a Canadian coast, the US would lose that leverage – Canada would greatly expand its customer base by sending crude all over the world (this has happened to some extent already with TMX going into service, many cargoes are bound for Asia).

In most other spheres, Canada has little leverage against the US, because our exporting economy has been logically built around supplying our bountiful resources with our closest neighbour, right across that imaginary line that is our shared border. New coastal pipelines change that dynamic considerably, particularly for Trump, who as discussed earlier is hypersensitive to oil prices and supply.

Trump might say the US needs nothing from Canada, yet he surely knows that isn’t true, particularly with respect to oil (and many other things, topics of discussion for other trade publications).

And then in Canada we can see that Trump sees this, and now the light bulbs are going on in Ottawa: LEVERAGE! SWEET LEVERAGE! Which can come via a new coastal export pipeline that will provide Canadian producers with alternative markets, and potentially higher priced ones. As any producer knows, it is a great thing to have more than one customer.

So maybe that was one of the main points of this nebulous MOU that has Canadians acting like we all have photosensitive epilepsy and the world is a strobe light.

We aren’t alone in knowing which way to turn with respect to oil markets. We no longer have a relatively simplistic world, where oil prices went up or down depending on how OPEC decided to yank everyone’s chain. There is still that part to deal with, but it’s not the only big game in town now; global oil markets have really changed in the past decade. US export levels alone, where the US went from a big importer to a big exporter in 15 years, have been plenty destabilizing.

But that’s just the tip of the iceberg, with respect to the complexity ahead. Other actors are now material players that were not until recently. Two decades ago, India didn’t really register at all in global oil markets. But now with a rapidly growing (and big) economy, their exports have shot up and what they do matters. In very complicated ways.

India needs cheap oil. Everyone wants that, but India really needs it. So when the west placed sanctions on Russian oil to try to stop the mauling of Ukraine, India said Hey, we’ll take that cheap stuff. And they did. In this excellent article entitled “The Geoeconomics Conundrum of India’s Oil Purchases”, it is outlined how Indian purchases of Russian oil went from a million b/d to two million in just a few years.

But as the article’s title suggests, there is a conundrum here. What will be the fate of Russia? It will win the war with Ukraine, or settle on some fraction of the country, sadly, it seems, but then what? Should India pivot away from Russia or towards it?

And then it gets super complicated, and oil becomes entangled with everything else. With the tariff chaos on the global scene, China and India are now bff’s, and looking to double trade by 2030 (a bit shift from the animosity of even a year ago).

India must deal with on again/off again US tariffs, and at the same time needs to keep acquiring oil as cheaply as possible. And there is no guarantee that Russia will be in the penalty box for long, post-war (whenever that is) because it is possible that dealmaker Trump will grant them legitimacy on the world stage rapidly enough if Russia plays nicely with economic deals, as in, forming economic ties with the US. Don’t laugh, it could happen soon enough.

So is Canada/India oil trade about to become a thing? BC to India is not a bad shipping route…

There are so many strategic moves to be made. The undercurrents to the global oil market have never been so fascinating.

While we can’t see how it all plays out, Canadians at least and long last have reason to feel some positivity. If Canada, Alberta and the feds, are thinking in international strategic terms, that is the most welcome development that has been absent on the landscape for some time.

And beyond that, the fact that Ottawa and Alberta are not just talking energy but seeking to achieve smooth workable at the provincial and the national level is an amazing development.

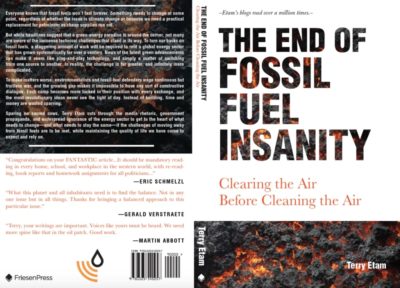

Here it is, the ideal non-denominational present. At the peak of the energy wars, The End of Fossil Fuel Insanity challenged the narrative, facing into the storm. And now everyone is coming around to this realization as well. Read the energy story for those that don’t live in the energy world, but want to find out. And laugh. Available at Amazon.ca, Indigo.ca, or Amazon.com.

Email Terry here. (His personal energy site, Public Energy Number One, is on hiatus until there are more hours in the day.)