Crown land sales remain one of the clearest and most transparent indicators we have in Western Canada. They represent real dollars, real competition, and a reliable snapshot of where companies are actively building or defending inventory. For teams navigating increasingly competitive land strategies, these sales offer a direct view into where momentum is forming and where disciplined execution matters most.

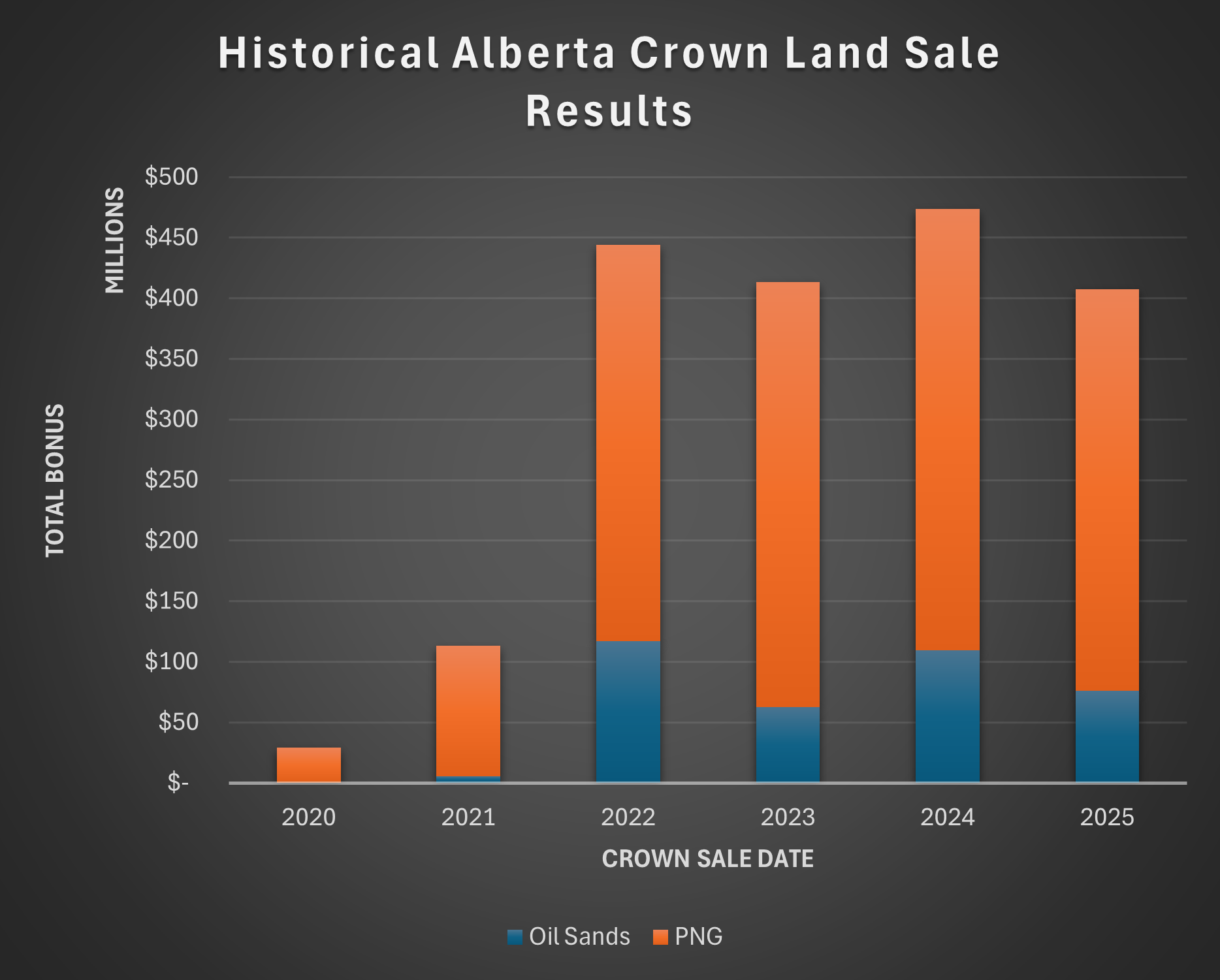

Based on the 2025 results shown in the charts below, Alberta generated $407,244,046.00 in total Crown land sale bonus revenue across Petroleum & Natural Gas (PNG) and Oil Sands rights, while Saskatchewan generated $63,286,539.00 through its Crown offerings.

Alberta: Another $400M+ year, driven by competitive execution

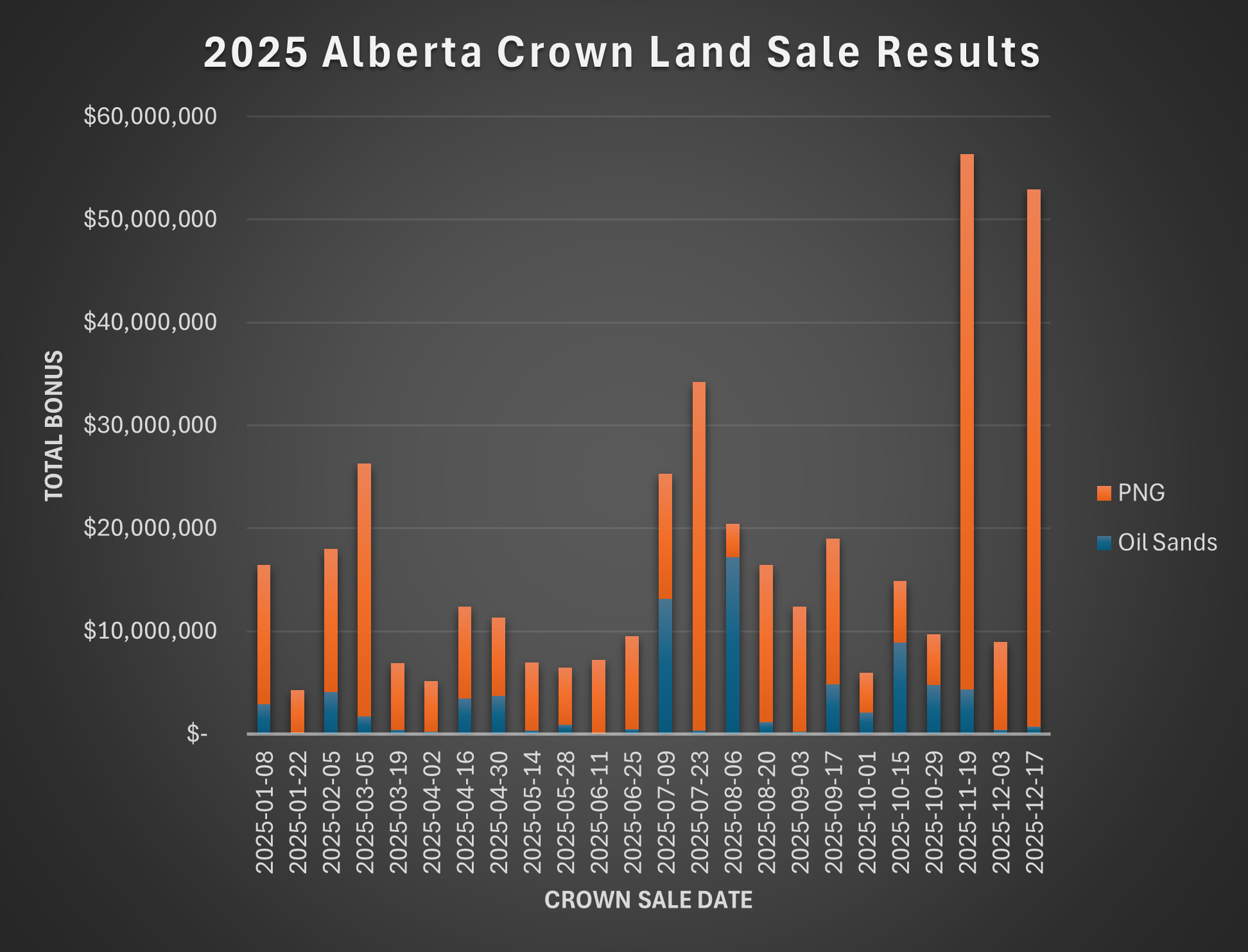

Alberta posted a total of $407,244,046.00 in 2025 Crown land sale bonus revenue, comprised of:

- PNG: $331,034,842.00

- Oil Sands: $76,209,205.00

While 2025 finished below 2024’s high-water mark of $473,611,874.00, it reinforces a key signal the market has been sending for several years. Alberta has now delivered four consecutive years above $400M (2022–2025), a strong indication that competition for quality inventory remains intense and that precision and speed continue to matter in Crown acquisition strategy.

Click here to view the latest data on land sale postings, and results with StackDX Intel.

A concentrated year shaped by a few pivotal sales

As with many Crown sale years, Alberta’s total was not evenly distributed. A small number of highly competitive offerings materially shaped the outcome:

- November 19, 2025: $56,337,343.00

- December 17, 2025: $52,930,028.00

Together, these two sales accounted for approximately 27% of Alberta’s total 2025 bonus revenue. This pattern underscores an important reality of Crown strategy. One or two well-timed, high-tension offerings can define the year, and teams that move quickly, stay organized, and execute with confidence are best positioned to capitalize.

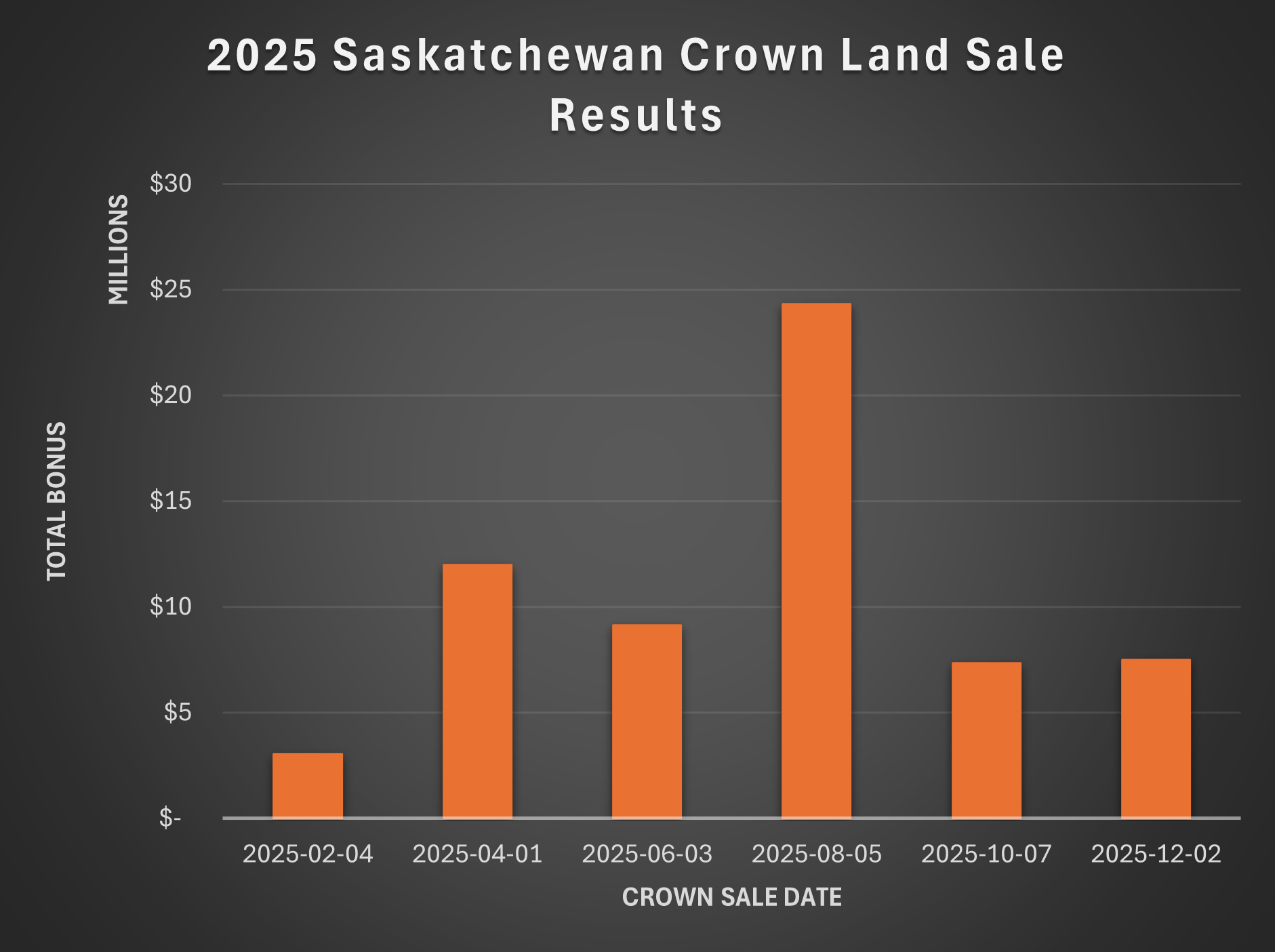

Saskatchewan: Strong total with momentum concentrated in one key sale

Saskatchewan’s 2025 Crown land sale results totaled $63,286,539.00 across six offerings:

- Feb 4: $3,039,589

- Apr 1: $11,983,131

- Jun 3: $9,128,114

- Aug 5: $24,312,737

- Oct 7: $7,338,033

- Dec 2: $7,484,934

The August 5, 2025, sale, which generated $24,312,737, was the defining offering of the year, representing roughly 38% of Saskatchewan’s total 2025 bonus revenue. Once again, the data reinforces a familiar theme. When the right parcels come to market and competitive tension is high, a single sale can quickly reshape the annual narrative. Preparation, clarity, and decisive execution make the difference.

CrownReserve: Built for disciplined Crown acquisition

This is exactly why we built CrownReserve at Millennium Land.

CrownReserve was designed to bring precise, proactive, and protective oversight to Crown strategy, particularly when teams are screening dozens or hundreds of parcels across multiple sales, internal stakeholders, and tight deadlines. As competition increases, mishandled processes, internal bottlenecks, and version-control chaos can quickly lead to costly delays, missed opportunities, or unnecessary exposure.

In practical terms, CrownReserve helps clients:

- Centralize parcel reservations to eliminate spreadsheet and email confusion,

- Keep priorities tight and transparent so nothing slips through the cracks,

- Move with speed under a deadline by reserving names in seconds rather than relying on back-and-forth emails,

- Reduce internal bottlenecks through real-time visibility, allowing decisions and approvals to happen immediately, and

- Protect confidentiality by keeping Crown strategy, parcel interest, and internal notes secure, controlled, and traceable

The result is a more precise, proactive, and protected Crown acquisition process. Fewer missed opportunities. Fewer internal delays. Stronger execution in a competitive market where margins for error continue to shrink.

A note from Millennium Land Ltd.

At Millennium Land Ltd., Crown sales are a big part of our DNA, but they’re only one piece of how we support clients. Millennium Land provides end-to-end land services across Crown strategy and execution, A&D services, mineral land acquisitions, and surface land acquisitions. In Saskatchewan, we also deliver comprehensive environmental and field support to keep projects moving.

Our role is simple: We handle the Land and Environment. You build with confidence.

Land and environmental solutions that move fast, think ahead, and safeguard your project and your reputation.

If you’re planning on adding to your inventory, divestments, or new projects in 2026, we’re always open to a conversation.

CrownReserve: https://crownreserve.mland.ca

Millennium Land Ltd.: www.mland.ca

Adam Stewart – Vice President, Mineral Land – Adam@mland.ca

Meaghan Lyons-Kubek – Manager, Mineral Land Administration and Crown Sale Coordinator – Meaghan@mland.ca