Tourmaline announced with its Q3 results in November that it would be assessing interest in its Peace River High (PRH) asset for a potential sale. Management further expanded on its rationale on the conference call after the results came out.

This morning an article surfaced suggesting that the company might be one step closer to finding a buyer, as CNRL is said to be exploring Competition Bureau approval for a potential transaction.

So what and where are the assets that might be involved? And why would Tourmaline look to monetize them now?

WHY NOW?

Management made clear on the Q3 FY2025 earnings call that PRH—while high quality and fully developed—no longer competes for capital within Tourmaline’s high quality asset base. The asset, a Charlie Lake light oil and gas complex with associated infrastructure, is now viewed as non-core relative to Tourmaline’s much larger, gas-weighted growth platforms in northeast British Columbia and the Deep Basin.

Tourmaline characterized PRH as a “fully developed” complex that has been on maintenance capital for roughly four to five years. Management emphasized that returns from their two major gas complexes “materially outstrip” the economics of incremental investment at PRH.

This framing suggests PRH has reached a natural maturity point within Tourmaline’s portfolio. For a different operator—particularly one seeking an established operating platform in the Charlie Lake—PRH could represent an attractive entry or consolidation opportunity. For Tourmaline, however, the asset no longer clears the same internal hurdle rate as its core growth projects.

By monetizing PRH, Tourmaline aims to redirect capital toward higher-margin opportunities that better align with its long-term strategy, while also lowering its corporate operating cost structure.

Management explicitly linked the PRH divestment to reducing operating costs and simplifying the business. In that sense, the sale is as much about corporate efficiency as it is about redeploying capital.

Importantly, Tourmaline stressed that the sale process is opportunistic rather than forced. Management was clear that if bids do not meet internal valuation expectations, the company is prepared to retain the asset.

The company also indicated a preference to sell PRH as a complete package, including infrastructure, rather than carving it up—further reinforcing the view that this is about maximizing value, not simply exiting the asset.

Tourmaline revealed that it has contemplated selling PRH for several years, but the current process was catalyzed by inbound interest from potential buyers. That interest suggested external parties may assign greater strategic value to the asset than Tourmaline does internally, prompting management to run a formal process and test the market.

From Tourmaline’s perspective, this timing allows the company to crystallize value from a mature asset while staying focused on its highest-return growth engines—without committing incremental capital to a project that no longer drives the company’s strategic narrative.

Ultimately, the potential PRH sale reflects Tourmaline’s broader philosophy: relentless focus on return on capital and scale efficiency. PRH remains a solid, cash-generating asset—but in a portfolio increasingly dominated by large, low-cost gas complexes, it represents capital that could arguably work harder elsewhere.

Whether or not the sale ultimately closes, the decision to explore it signals Tourmaline’s willingness to continuously reshape its asset base in pursuit of lower costs, higher margins, and long-term value creation.

WHERE ARE THE ASSETS?

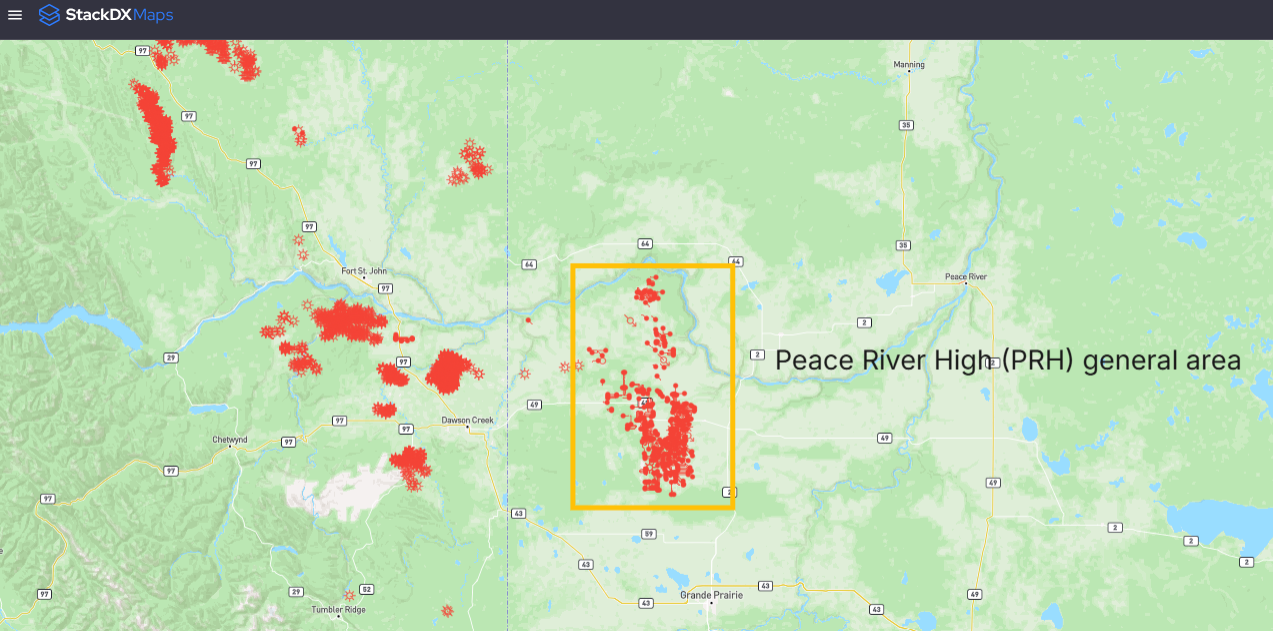

While the exact assets that might transact are not publicly available, the general Peace River High area as defined by Tourmaline in its corporate presentation is in the yellow box shown below in Figure 1. We’ve filtered the map to only show the Active wells licensed to Tourmaline in red. Public data from StackDX Maps suggests that Tourmaline’s gross licensed production (before any potential working interest sharing agreements) would be ~26,000 boe/d in the area, but actual volumes for sale may differ.

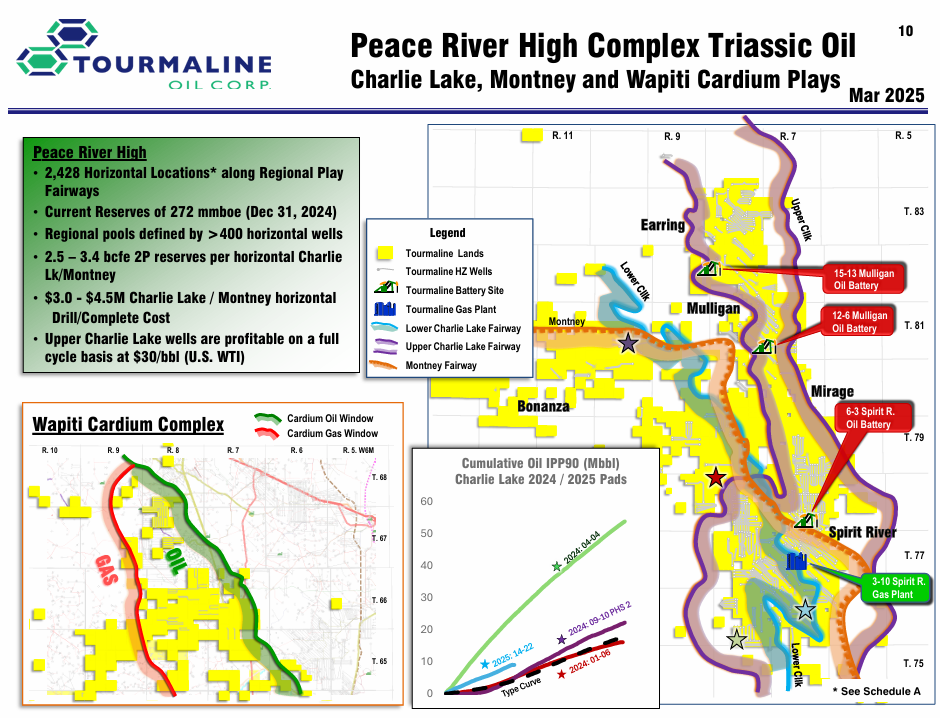

Figure 2 below from Tourmaline’s corporate presentation goes into a little bit more detail on the area.

Figure 1 – Tourmaline wells (red) filtered for Active Status – StackDX Maps

Figure 2 – Tourmaline corporate presentation – PRH area