Elon Musk seemingly can perform the impossible. He, in a sense, invented a whole new segment of the automobile industry, building and commercializing electric vehicles when major manufacturers said it couldn’t be done. He built a rocket company that runs laps around NASA, the long-predominant US governmental space agency. He also made the biggest leap in human history, when he went from environmental hero (for EV breakthroughs) to a Trump-team pariah within the blink of an eye, all while siring 158 children and playing video games seemingly nonstop.

He’s not always right, that’s for sure, but one of his latest predictions is an eye-opener: that data centres will be active in space within 30 months. That’s the sort of Musk technocratic prediction that can be taken with a grain of salt – he famously launched the Tesla Roadster into space to draw attention to its imminent arrival; however that was in 2018, and they Roadster has yet to make it to market.

But the core of his space-data-center ambition is worthy of consideration: that data centres will have to be space based, because there simply isn’t enough energy available in the time frame customers are demanding.

The race isn’t a normal commercial one, as in who can build the best smart phone or car. No, this is an existential race between, in broad strokes, the US and CHina. The AI race has now, rightly or wrongly, been framed as THE ‘can’t lose” battleground.

AI is framed that way because the potential is so vast that it can’t even be imagined yet. Both in good ways and bad ways. Technocrats envision a glorious future where wealth and abundance are everywhere, and people are paid a “universal high income” (Musk term) to essentially do nothing (and in the event this pathway comes to life, buy cannabis stocks like there’s no tomorrow). Others see the rapid destruction of humanity, either through mass unemployment and ensuing chaos or outright seizure of power by machines.

No one knows where it will go, but that doesn’t mean we can’t know anything about it. Some directional signs appear more likely than others.

Most obviously, AI can do some things far better than humans can, primarily in areas like research – pulling vast quantities of information off the web and synthesizing useful answers – and things like computer coding. The latest AI versions can create and test apps within minutes or hours, for example. Machine learning takes on a whole new level of capability as well, when the machine is fed the right data. Many fields will be revolutionized this way, and many jobs will be lost.

Some predict all jobs will be lost, and that is a view which is impossible to rule out. But that doesn’t necessarily mean it is the most likely. While some jobs can be replaced, other occupations will be enhanced by AI because productivity can spike rapidly. And it is becoming well-documented that, as of now anyways, challenging an AI machine’s answer with “Are you sure?” results in a significant reversal of position. Meaning: AI’s assertive responses can’t always be trusted, and human judgement remains vital.

Besides pondering everything solely through the lens of job destruction, there are other aspects that seem very real and pertinent to people at large.

Many countries are facing a ‘demographic time bomb’, faced with aging populations and dwindling workforces. Such countries have two big worries arising from this situation: One, how will productivity improve, because fewer workers will be around to pay taxes to cover all of society’s costs (and government spending seems to go in one direction only), and second, who is going to look after the geezers?

Even now, it is a struggle for the health care industry to find enough doctors and nurses and orderlies; what happens when the workforce shrinks, and the feeble cries of really old people, all kept alive by some AI miracles, what happens when the din of millions of hungry nonagenarians in nursing homes all murmur in unison Where are my pills or How long til dinner or Where’s Matlock, how long til all these questions ring out and there are no workers to attend? Maybe we will be grateful for the hordes of semi-human robots that can fill the void? Robots are now automating tasks like bathroom cleaning; how can that be bad for humanity in any conceivable way?

Overarching the whole AI development discussion is an angle that few are emphasizing enough, but one that is doing it very well is the Australian commentator Craig Tindale. Mr. Tindale argues that the idea of technological advancement is running far ahead of our ability to build it out. From a recent post of his, interesting grammar left intact: “We’re making a fairly large error. People look at AI scaling curves and assume the physical world scales the same way behind them . It cant . You can 10x compute in a few years. You can’t 10x copper supply . You can’t spin up refining capacity or grid infrastructure with a model update. AI doesn’t mine ore. It doesn’t refine gallium. It doesn’t install transformers. It doesn’t compress a ten-year permitting cycle into a product sprint. Every data center is basically a giant industrial object sitting on power plants, transmission lines, substations, cooling systems, fabs and metals that come out of finite geology. It’s fairly straightforward we haven’t got the supply chain to build what they imagine they will build . ”

He is very right. No amount of AI will slice through bureaucracy in a way that needs to happen to build things quickly and efficiently. (Come to think of it, maybe bureaucracy does have a superpower: one of the few things that can go toe to toe with AI and win.)

And all of that challenge begins with energy. It takes energy to mine, to process, to manufacture, to build, to power data centres. The whole process requires affordable reliable energy, the kind that BOE Report readers are intimately familiar with on a day to day basis. 2019’s ‘stranded assets’, the ones that supposedly no one would want in a few years, that would be unsellable capital black holes, are now the very assets the world is clamouring for, to the surprise of no one that reads the BOE Report.

The race is on now to secure reliable “five nines” electricity, with a 99.999% reliability rating. Nuclear is the prime choice because of low emissions, but new reactors take a very, very long time, and many are needed (even a small modular reactor, the most nimble of the upcoming generation, is a massive undertaking as can be seen in this snappy video full of cranes and equipment and giant holes in the earth).

Same goes for mining, an industry that has been out of favour forever in the investment community. Who wanted to put money into mining projects that would take two decades to go into production, if they came into production at all, that could be derailed permanently by a new government or policy, where billions in capital investment could indeed be stranded at the stroke of a legislative pen?

And now we wish there had been a lot more money going into such projects, because by most accounts the world is going to be unbelievably short of key building blocks like copper over the next decades. A startling chart by mining analyst Paola Rojas shows how the size of new copper discoveries are tiny relative to those made in the 1990s.

While humanity races headlong and quickly into a new world that no one can understand or contemplate, at the exact same time, humanity is being pulled backwards to the primacy of extractive industries and base utility functions. Sidelined no more. Energy is everything, which is why Musk desperately wants to have solar powered data centres in outer space. His solution may be far fetched in any commercially viable time frame (or it may not, the guy is a freak of nature) but underlying his urgency is full recognition that the world can’t meet the energy requirements of the new world, as things stand.

Here’s an interesting thought for resource folks. The concept of ‘price discovery’ is critically important here. Price discovery is where an asset becomes priced in the market due to supply and demand. Right now, AI builds have no price discovery. It is a free-for-all, the world’s biggest companies spending hundreds of billions to get into or stay in the game. Four US tech giants have committed to spending over $600 billion this year alone, with no line of sight into how those investments will generate adequate rates of return. AI build outs need price discovery, but won’t have it for a while until the potential is understood more clearly.

Right now, we have adequate price discovery for energy; if the price rises by some amount, the market effectively brings new energy to market. But if the AI buildout continues, that demand will exceed supply in a significant way, and then a new level of price might be required to balance markets. Technological innovation has done wonders for oil and gas production from shale plays, but to develop the next round might cost significantly more. We are seeing this already in the Permian, where producers are stepping back from aggressive drilling at these price levels. In other words, better days might be ahead for producers. To be clear, there are still vast amounts of oil and gas resources yet to be developed, but if demand growth continues, the price will have to be high enough to warrant developing them.

Metals and minerals are something else entirely. The price signal can have little effect on supply, because it takes decades to build new mines. If the resource can actually be found (and oh lord are they trying, just observe the junior mining space for details).

The most tangible thing we’re going to see on the ground once demand for metals strips supply are price spikes in copper and other necessary metals, and the corresponding rise in theft that will only get worse until Darwin Award-winning thieves achieve a ‘danger-discovery’ market balancing point. It won’t be pretty.

Of course, technological advances could change everything, either in AI processing or new energy forms that become commercially viable and quickly. It is impossible to gauge when unknown unknowns might make themselves clear. But from what we can see now, where the companies are putting money where their mouths are, the trajectory is inescapable: energy and metals/mining are going to take centre stage.

AI is going to upend many things, but in some ways it will take us back to fundamentals. Real things are going to matter: real energy, real metals, real people, real conversations, real humanity.

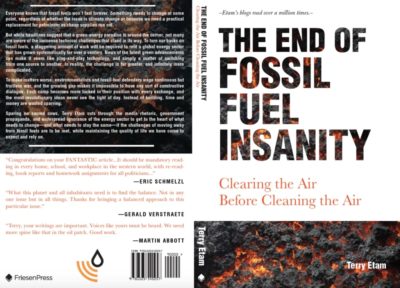

At the peak of the energy wars, The End of Fossil Fuel Insanity challenged the narrative of imminent fossil fuel demise, facing into the storm. And now everyone is coming around to this realization as well. Read the energy story for those that don’t live in the energy world, but want to find out. And laugh. Available at Amazon.ca, Indigo.ca, or Amazon.com.

Email Terry here. (His personal energy site, Public Energy Number One, is on hiatus until there are more hours in the day.)