Authors: Leonard Herchen & Yuchen Wang

Overview

Q2 2025 certainly delivered no shortage of headline drama when Wall Street’s risk indicators swung sharply following April’s “Liberation Day” court decision involving President Trump, and when tanker insurance premiums surged as Israel and Iran exchanged missile strikes mid‑June. Even so, markets responded with efficiency, with supply chains adapting and regional imbalances being managed without major disruptions. As a result, pricing remained primarily anchored in core supply-demand fundamentals rather than reactive policy moves or political uncertainty.

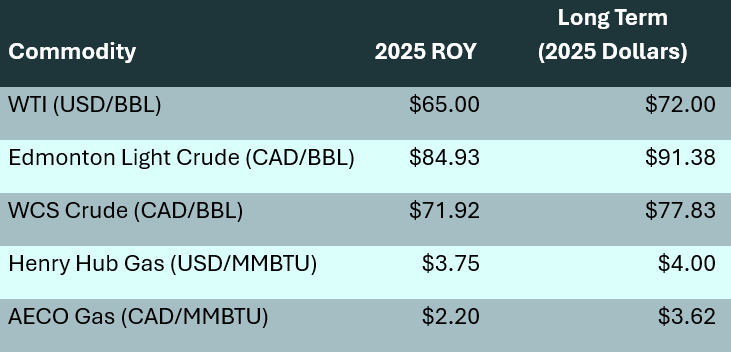

GLJ maintains a fundamentally grounded outlook, revising its long-term real price forecast for WTI to $72.00 USD/bbl, while holding Henry Hub at $4.00 USD/MMBtu. These values reflect confidence in the durability of global supply-demand balances, even amid short-term volatility.

Oil Prices

WTI crude traded between $59–$65 USD/bbl through April and May before spiking to nearly $75 in mid-June on geopolitical tensions. The rally proved short-lived, with prices retreating to around $69 by month-end after signs of de-escalation in the Middle East.

OPEC+ will start gradually increasing oil production in August, rolling back part of the 2.2 million barrels per day in cuts made earlier this year. The first step is an increase of 441,000 barrels per day. This added supply is expected to create a small surplus in the global market and may put some downward pressure on oil prices. This aligns with the IEA’s estimate of a 600,000 barrels per day surplus for 2025.

In the United States, commercial crude inventories declined by 5.8 million barrels in late June, pointing to stronger-than-expected domestic demand. Production remains robust, averaging 13.2–13.5 million bpd, despite a declining rig count—underscoring the impact of improved drilling efficiency and well productivity. Refining margins have also held steady, supported by healthy demand and manageable feedstock costs.

GLJ lowered its long-term WTI price forecast to $72 USD, reflecting recent price movements and the decision by OPEC+ to increase output, shifting the supply-demand balance modestly toward a more supply-heavy outlook.

Natural Gas

Henry Hub prices remained stable through mid-2025, averaging just above $3.50 USD/MMBtu, supported by strong summer cooling demand, resilient LNG exports, and growing industrial and data centre gas consumption. Despite U.S. production hovering near record highs, recent heatwaves and elevated power sector usage have tightened short-term balances. GLJ forecasts Henry Hub to average $3.75 USD/MMBtu for the remainder of the year, reflecting firm demand and manageable supply expansion.

In Western Canada, AECO prices softened to around $1.07 CAD/GJ in June, pressured by seasonal oversupply, constrained takeaway capacity, and storage levels above the five-year average. While short-term fundamentals remain loose, structural relief is anticipated with new LNG offtake capacity. The Alberta Energy Regulator projects AECO-C to average $2.71 CAD/GJ in 2025 and rise to $3.82 CAD/GJ in 2026, supported by improved pipeline utilization and LNG export momentum. The AECO-Henry Hub differential is forecast to narrow from $1.80 USD/MMBtu in 2025 to $1.00 USD/MMBtu in 2026, highlighting improved integration with global benchmarks.

Across the Atlantic, European LNG prices have also shown strength, with Dutch TTF spot prices recently averaging €29–€33/MWh (approximately $9–$11 USD/MMBtu) in response to concerns about storage refill ahead of winter. As of late June, EU gas storage was ~34% full, raising questions about whether the block will meet its 90% target by October. These dynamics have supported global LNG flows toward Europe, helping stabilize global prices while underscoring Western Canada’s long-term opportunity to participate more meaningfully in international markets.

LNG Canada: Canada’s First Major LNG Export Milestone

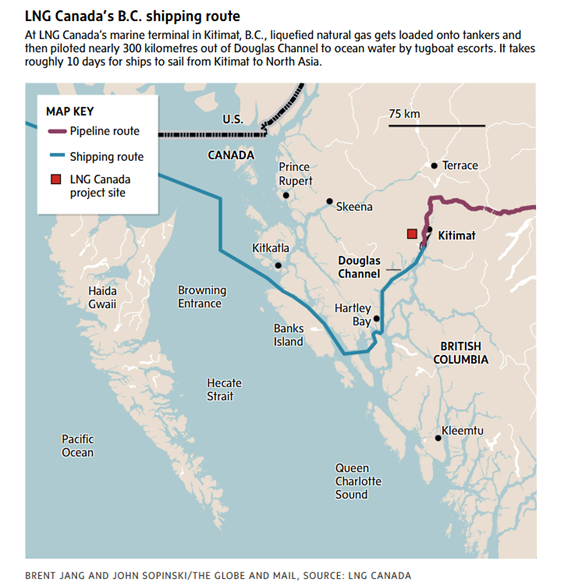

The launch of LNG Canada Phase 1 in late June 2025 represents a pivotal milestone in Canada’s energy sector. Situated in Kitimat, British Columbia, the facility brings 1.8 Bcf/d of liquefaction and export capacity online—enabling direct shipments to Asia and reducing reliance on U.S. infrastructure.

On June 30, 2025, the first commercial cargo departed aboard the Gaslog Glasgow, just days after the terminal achieved initial production, establishing LNG Canada as the country’s first large-scale LNG export terminal. This milestone follows years of development and regulatory hurdles and signals a structural turning point for Western Canadian natural gas.

By providing access to premium Asian markets, LNG Canada enhances upstream netbacks, diversifies market access, and strengthens Canada’s competitive position in global energy trade.

The project is expected to catalyze upstream investment, pipeline expansions, and long-term supply contracts. It also sets the stage for further growth through a potential Train 2 expansion and other West Coast projects—including Cedar LNG and Ksi Lisims LNG—positioning Canada as an increasingly strategic LNG exporter.

Looking Ahead: Market Fundamentals Continue to Anchor Energy Outlook

Looking ahead, energy markets remain anchored by strong supply-demand fundamentals, even as they continue to adjust to shifting trade policies, regulatory uncertainty, and geopolitical volatility. Oil prices have stabilized as U.S. production holds near record highs and OPEC+ begins unwinding voluntary cuts. In natural gas, North American pricing reflects regional imbalances—while AECO softened on storage and takeaway constraints, the launch of LNG Canada Phase 1 marks a turning point for Western Canadian gas, enhancing export capacity and long-term competitiveness. European LNG markets also remain tight amid storage concerns, reinforcing the global nature of gas market dynamics. Despite macroeconomic and policy headwinds, the sector’s adaptability and structural resilience continue to guide market behaviour.

GLJ’s forecast values for key benchmarks are as follows: