Finance Minister Bill Morneau made the announcement this morning. The plan is to buy the pipeline and pipeline infrastructure assets from Kinder Morgan with cabinet approval already in place and only now subject to a Kinder Morgan shareholder vote. Morneau said the plan is to eventually seek a sale of forthcoming new Crown Corporation to investors. "Interest has already been expressed from investors in Canada including large pension funds," said Morneau. "We plan to exert our jurisdiction [Read more]

David Frum thinks Canada’s politics are the good kind of boring

When the left leaning Alberta NDP came to power in Alberta several years ago, the complaints heard loudest were often not so much about their forthcoming policy, but rather, the uncertainty it was supposedly going to create. For oil and gas executives in Alberta, and around the world for that matter, uncertainty in policy reform is treated with disdain. This is partly because oil and gas executives find themselves in an industry requiring huge swaths of capital to finance growth, and so anything [Read more]

With low commodity prices and billions worth of outstanding environmental obligations, Alberta is between a soft rock and a hard wellsite

Between July 2014 and January 2015, the price of West Texas Intermediate, North American’s crude oil benchmark, declined from roughly $105 to $46. At the time, of course everyone in the energy industry recognized the fallout as simply bad news. Seemingly overnight, entire business plans for the global upstream oil and gas sector and the service industry supporting it turned upside down. And while the immediate effects of such a drastic fall in the price of oil were easy to see coming: layoffs, [Read more]

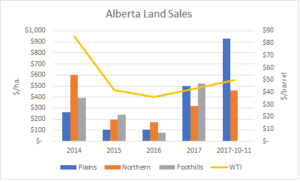

Prices paid in Alberta land sales climb higher than when oil was last at $100

In the October 11 Alberta land sale, each of the three regions Alberta Energy divides the province into received average bonus payments (the amount essentially paid to win a bid) rivaling the average payments received in 2014, when in the first half of that year, WTI averaged roughly $100 per barrel. From July 2014 to January 2015, the price of WTI suffered its sharpest decline (from roughly $105 to $46). Alberta Energy splits the province's land sales (a misnomer as the crown still retains [Read more]

How one oilfield services company differentiates through marketing

Western Canada's oilfield services industry is competitive. And with 2014's drop in the price of oil, competition between companies has only increased. Still to this day, there is far less of an appetite from drillers to use the services of many service companies, meanwhile demanding for service rates go down (of which they have). For many companies, the game plan for the last few years has been to at the very least maintain market share. By doing so, hoping to generate any sort of worthwhile [Read more]

Yesterday’s blockbuster deal indicates Alberta’s mass exodus of multinational oil companies continues

With Cenovus yesterday announcing the blockbuster deal to buy the majority of ConocoPhillips Canadian assets (which primarily resided in Alberta) for $17.7 billion CAD, the exodus of multinational oil companies from Alberta continues. Since 2014, there have been fourteen massive deals done by multinationals to leave Alberta's energy industry. Deal size for each of the fourteen has been valued at anywhere from half a billion dollars to yesterday's largest yet of close to $20 billion. It may [Read more]

Pason Systems Inc. acquires Verdazo Analytics as Calgary’s oil and gas tech industry continues to flourish

Chalk one up for the Calgary tech scene, and one more for the school of hard work, teamwork, and entrepreneurial innovation. Yesterday, Pason Systems Inc. announced its acquisition of all the outstanding shares of Calgary born and bred Verdazo Analytics Inc. Privately owned Verdazo (formerly known as Visage Information Solutions before a Spring 2016 rebrand) was founded from scratch in 2006 without any outside investment. Right from the start, the company's flagship data analytics product [Read more]

BOE Report’s most influential story of 2016

The BOE Report's most read and by far most influential story of 2016 was written by none other than Terry Etam: Saudi oil filling a New Brunswick refinery – what kind of a domestic energy policy is that? - published on January 25th. To date, the article was read 125,000 times and shared on social media over 50,000 times. It was, by far, Canada's most shared business story that day. The crux of the article and what undoubtedly struck a chord in so many readers, was Etam's ability to [Read more]

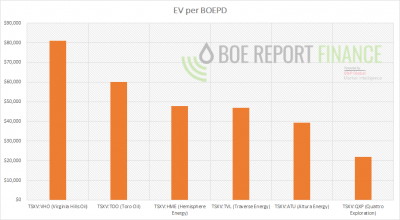

How does Steelhead’s valuation of Toro stack up against similar sized Western Canada juniors?

Steelhead Petroleum, a private ARC Financial Corp. sponsored company, announced yesterday their intent to acquire Toro Oil & Gas Ltd. The valuation Steelhead agreed to pay for Toro's 748 boe/d amounted to roughly $60,000 per barrel. But how does this valuation compare to other similarly sized Western Canadian junior producers? The below chart uses data from BOE Report Finance and compares the enterprise values of publicly traded Western Canada junior producers with daily production [Read more]

Trudeau approves Line 3 & Trans Mountain, rejects Northern Gateway

Prime Minister Justin Trudeau today announced the federal government approval of Enbridge's $7.5 billion Line 3 pipeline project, and the $6.8 billion Kinder Morgan Trans Mountain project. Trudeau however has dismissed the Northern Gateway project and has maintained his government's desire to have a moratorium on tanker traffic on British Columbia's northern coast In April, the National Energy Board recommended approval of the Canadian part of the Line 3 project with 89 conditions. Line 3 [Read more]

- 1

- 2

- 3

- …

- 10

- Next Page »