geoLOGIC systems recently released an all new Frac Analysis module designed to supply detailed proppant, fluid, and stage details for tens of thousands of wells across western Canada. Frac Analysis uses the same data as the Well Completions and Frac Database, carefully built by our in-house experts through a combination of data mining, interpretation, and detailed engineering analysis. This is the world’s only comprehensive database of hydraulic fracturing data for western Canada Join us at [Read more]

Headlines

Sunshine Oilsands Ltd.: Inside Information — West Ells Phase 1 Positive Progress – Production Volume Increased by 73% vs January 2017

HONG KONG, CHINA and CALGARY, ALBERTA--(Marketwired - May 14, 2017) - The Board of Directors of Sunshine Oilsands Ltd. ("the Corporation" or "Sunshine") (HKSE:2012) hereby announces the following: WEST ELLS PHASE 1 POSITIVE PROGRESS - PRODUCTION VOLUME INCREASED BY 73% vs JANUARY 2017 The Corporation is pleased to announce that the daily production volume of West Ells Phase 1 project ("the Project") located in the Athabasca region of Alberta has exceeded 3,800 barrels per day (bbl/day) on [Read more]

Notley’s outlook for Kinder Morgan pipeline unswayed by uncertain B.C. vote

CALGARY - Alberta Premier Rachel Notley says the uncertain outcome of the British Columbia election should not change the fate of the Trans Mountain pipeline expansion. Notley supports the $7.4-billion project proposed by Texas-based Kinder Morgan to triple the amount of crude that flows from the Edmonton area to the B.C. Lower Mainland. The federal government approved the project late last year, so Notley doesn't believe a political shift in Alberta's western neighbour is much [Read more]

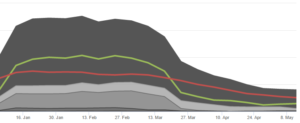

Canada Weekly Rig Count Down 2 to 80

Western Canada’s fleet of drilling rigs are slowing down on account of seasonality in the drilling business with only 80 actively drilling according to data collected by Baker Hughes for the week of May 12. Drilling activity is starting to slow down, but still very active in comparison to last year’s count. Will will see a continued drop in activity due to the upcoming spring breakup. Rigs activity will stay low likely until June, when activity will start to pick up again. From one week [Read more]

Government of Canada introduces Oil Tanker Moratorium Act

OTTAWA, May 12, 2017 /CNW/ - The transportation system is something Canadians rely on every day, from getting us to work, or bringing us the products we use in our homes. The Government of Canada is working to ensure that goods are transported in a safe and responsible way while protecting our marine environment and clean water. Today, the Government of Canada introduced C-48, the proposed Oil Tanker Moratorium Act in Parliament. This Act will deliver on the Prime Minister's commitment to [Read more]

Eagle Energy Inc. Provides Update to Shareholders on Growth Strategy and Announces First Quarter 2017 Results

CALGARY, ALBERTA--(Marketwired - May 12, 2017) - Eagle Energy Inc. ("Eagle") (TSX:EGL) is pleased to update shareholders and report its results for the first quarter ended March 31, 2017. Richard Clark, Eagle's Chief Executive Officer, stated, "Eagle has been quietly working to put all of the pieces in place to execute our growth strategy. We successfully closed the White Oak financing in mid-March, which gives us sufficient capital and the time to do our work, even with volatile commodity [Read more]

Petrus Resources Announces First Quarter 2017 Financial and Operating Results

CALGARY, ALBERTA--(Marketwired - May 12, 2017) - Petrus Resources Ltd. ("Petrus" or the "Company") (TSX:PRQ) is pleased to report financial and operating results for the first quarter of 2017. Petrus is focused on organic growth and infrastructure control in its core area, Ferrier, Alberta. The Company is targeting liquids rich natural gas in the Cardium formation as well as investing in infrastructure in Ferrier to control operations and maximize the Company's return on investment. The [Read more]

Sunshine Oilsands Ltd.: Announcement of Results for the First Quarter Ended March 31, 2017 and an Update on West Ells Progress

HONG KONG, CHINA and CALGARY, ALBERTA--(Marketwired - May 12, 2017) - Sunshine Oilsands Ltd. (the "Corporation" or "Sunshine") (HKSE:2012) today announced its financial results for the first quarter ended March 31, 2017. The Corporation's condensed consolidated interim financial statements, notes to the condensed consolidated interim financial statements and management's discussion and analysis have been filed on SEDAR (www.sedar.com) and with The Stock Exchange of Hong Kong Limited (the "Hong [Read more]

US-China deal may shake up global LNG trade says Wood Mackenzie

EDINBURGH/HOUSTON/SINGAPORE, 12 May 2017 – Last night’s announcement of the 100-day action plan between the US and China has the potential to alter global LNG trade, opening the door of the world’s largest LNG growth market to the world’s fastest-growing LNG supplier. Under the action plan, which falls under the framework of the US-China Comprehensive Economic Dialogue, Chinese companies can now negotiate long-term contracts to source liquefied natural gas from US suppliers, the US Commerce [Read more]

Development drilling continues at Kakwa for Questerre Energy

CALGARY, May 11, 2017 /CNW/ - Questerre Energy Corporation ("Questerre" or the "Company") (TSX,OSE:QEC) reported today on its financial and operating results for the quarter ended March 31, 2017. Michael Binnion, President and Chief Executive Officer of Questerre, commented, "We had a good start to the year with progress on all our major assets in the quarter. At Kakwa we have now drilled four of the eight wells planned on our joint venture acreage, including one well that spud last December. [Read more]