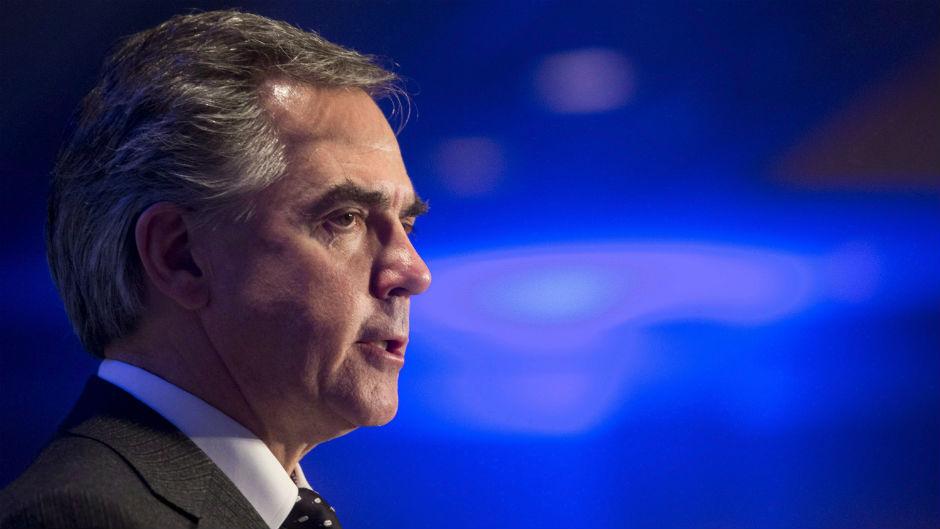

CALGARY – Premier Jim Prentice is scoffing at a suggestion by the Conference Board of Canada that Alberta is likely to face a recession as crude prices continue to plunge.

“I don’t agree with it,” he said Tuesday of the Ottawa-based economic think-tank’s assessment.

“I didn’t find their analysis to be particularly cogent, to be frank, and the opinion that they put forward is an outlier amongst all of the other opinions that have been put forward by every one of Canada’s chartered banks and by other respected economic forecasters.”

The Conference Board notes that Alberta’s latest employment and new housing start numbers are holding steady, but if oil prices stay low the province will slip into recession.

Chief economist Glen Hodgson said even if oil prices rebound to US$65 dollars a barrel investment, profits and consumer spending will be down.

Oil prices settled below US$46 a barrel on Tuesday, less than half of where they were less than six months ago.

Lower oil revenues are hurting Alberta’s coffers, with the province’s budget surplus this year turning into a $500-million deficit.

Todd Hirsch, chief economist at ATB Financial, also disagreed that the Alberta economy is going to shrink this year.

He said the Conference Board and ATB, Alberta’s Crown-owned financial institution, are on the same page when it comes to a gloomy forecast for this year, but they differ on how long they expect the downturn to last.

Hirsch is expecting a modest two per cent growth rate in Alberta, about half of what it’s enjoyed over the past four years.

“It may actually feel a bit recessionary,” Hirsch told a Calgary Chamber of Commerce luncheon.

Hirsch is expecting unemployment to rise, and for the picture to be especially tough for new graduates. Bonuses and overtime pay will likely be slashed as well as companies look to protect their bottom lines.

“Employers so far seem to be holding on as well as they can, but I do think at some point we will start to see more pink slips flying and that is unpleasant,” he said.

Forestry, agriculture and tourism should fare well in the current environment, but those industries are merely a “shadow” of what the oilpatch represents in Alberta.

Follow @LaurenKrugel on Twitter