It has now been seven years since the 2008 Great Financial Crisis swept markets across the world. Closely rivalling the depths of the Great Depression, the market turmoil of 2008 was truly a difficult time for many of the world’s leading and developing economies. Rising from the wreckage of 2008 has been a slow and arduous process for many different industries, with many hoping that such a precipitous drop in asset valuations would indeed remain a once in a generation event.

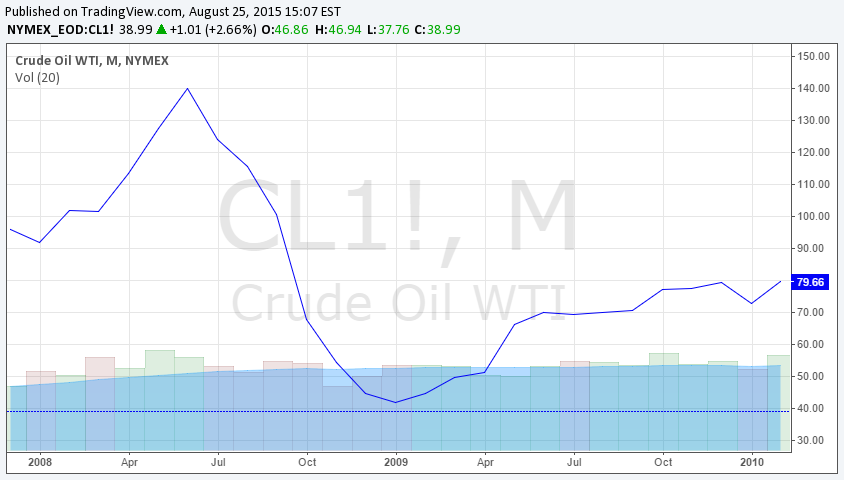

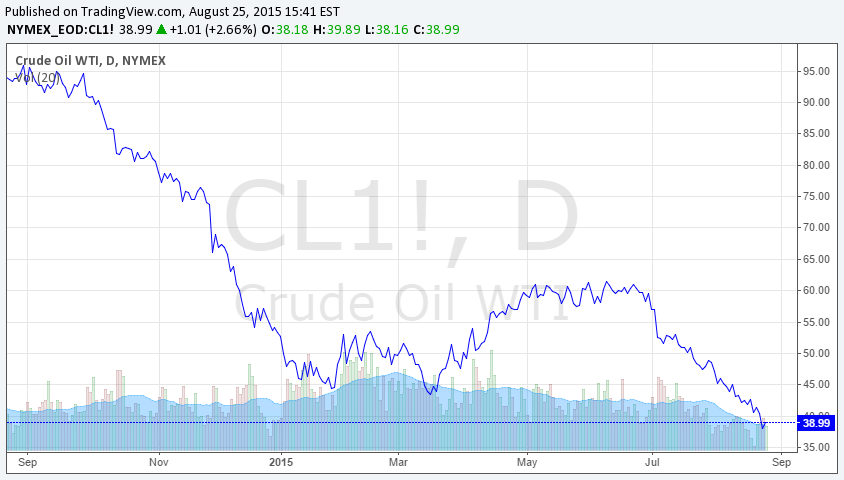

For the oil and gas industry, the recent contraction in commodity prices has now in fact been longer than the oil and gas price collapse of 2008.

If a $70 watermark is used, the duration of oil below $70 is longer now than in 2008. In 2008, the period of time was 8 months (Oct – June).

In contrast, the price of oil has now been below the $70 water mark for 9 months…and counting.

Where the price will go from here is anyone’s guess. It seems that everyday conflicting predictions about where the price will go surface in the media. Amidst this uncertain future, only one thing can be certain: oil and gas companies will have to become leaner, meaner, and smarter to provide sufficient shareholder returns and value creation.