According to the Federal Reserve Bank of Dallas, “U.S. oil and gas employment has fallen 14.5 percent (by 70,000 jobs) year over year. Job losses and falling energy prices portend continued distress for the oil and gas sector in 2016.” In their fourth quarter 2015 report titled “OPEC Tips Crude Oil Markets over the Cliff,” the job losses are blamed on the falling U.S. crude oil production.

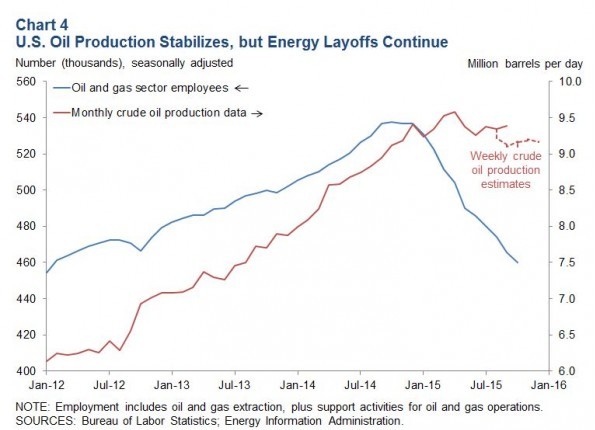

The report includes several charts graphing the rise and decline of crude oil production with oil and gas sector employees. When production peaked around the beginning of 2015, there were approximately 550,000 oil and gas sector employees producing approximately 9.5 million barrels per day. For January 2016, or about a year later, production is expected to drop to around 9 million barrels per day with only about 480,000 oil and gas sector employees.

Bankruptcies in the oil and gas sector have also reached their highest quarterly rate since the Great Recession with at least 10 oil and gas companies in the U.S. filing for bankruptcy in the final quarter and accounting for over $2 billion in debt. The report cites declining oil prices as taking a significant toll on producers coupled with the higher costs of producing locally versus internationally.

Also to blame is increasing production from Iran, which is anticipating a repeal of western sanctions on its oil exports next year. The country has announced that it wants to add an additional 500,000 barrels a day, but some experts believe the nation will only produce 285,000 barrels a day.

“It’s possible that global inventories might not begin to fall until 2017,” the report continued. “Given the great uncertainty surrounding projections and the timing of supply and demand changes, the coming year promises to be a dynamic one for the oil markets.”

Lilia Fabry is the owner of MPP Freelance, a writing and web design firm in Houston, TX.