Alberta is not the fiscally prudent jurisdiction it once was. This new consensuses comes from each of Moody’s, Standard & Poor (S&P), and the Dominion Bond Rating Service (DBRS): the highest profile ratings agencies on the planet.

Over the past month, downgrades and alarm bells have been sounded as the provincial government plans on running the largest deficit in Alberta’s history and running the province into a negative net-debt position.

S&P lowered Alberta’s long-term rating to AA+ from AAA, the province’s first downgrade by the rating company since 1992.

“The downgrade reflects our assessment of Alberta’s now-average economic prospects resulting from low oil prices; projected weak budgetary performances in the next two years; and moderate, but rapidly rising, tax-supported debt burden,” S&P said in a statement earlier this month.

Moody’s meanwhile, adjusted its Alberta credit rating outlook to negative.

“The negative outlook for the province of Alberta reflects the rising risk that the province’s fiscal position will deteriorate further than previously expected in an environment of protracted low oil prices and deterioration of economic activity,” said Moody’s in a press release.

And just as Moody’s and S&P made their downward revisions, Toronto based DBRS sounded alarm bells as well on Alberta’s debt situation.

DBRS says with oil prices so low and the government’s borrowing plans so high, Alberta will exceed its own self-imposed legislated debt limits this fiscal year.

“The negative trend reflects DBRS’s expectation that the continued weakness in oil prices will contribute to a material erosion in the province’s fiscal performance and accumulation of debt,” said the DBRS report.

“DBRS believes that the fiscal response is unlikely to be adequate to maintain credit metrics consistent with the AAA rating, in particular maintaining a DBRS-adjusted debt burden below 15 per cent of GDP,” it added.

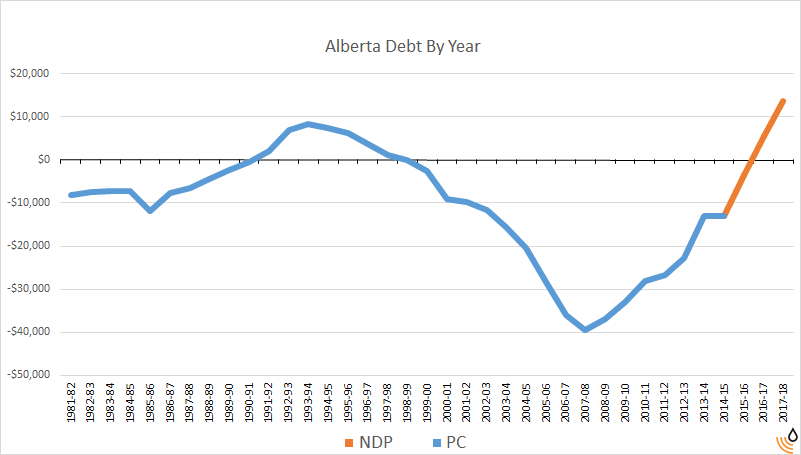

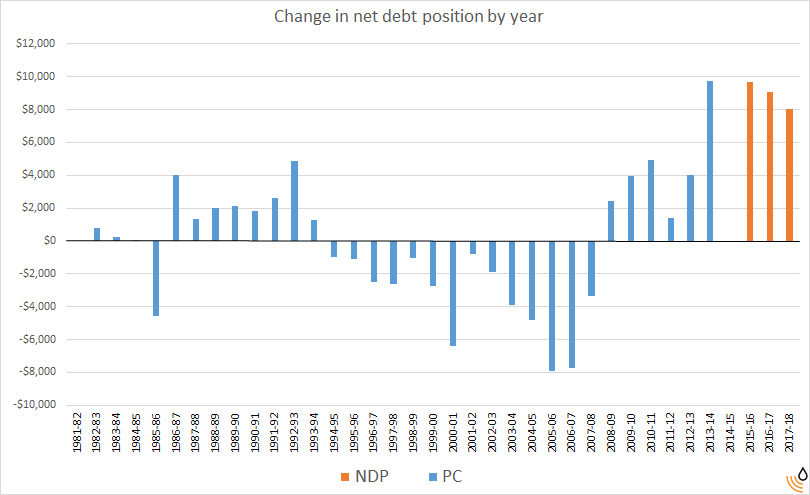

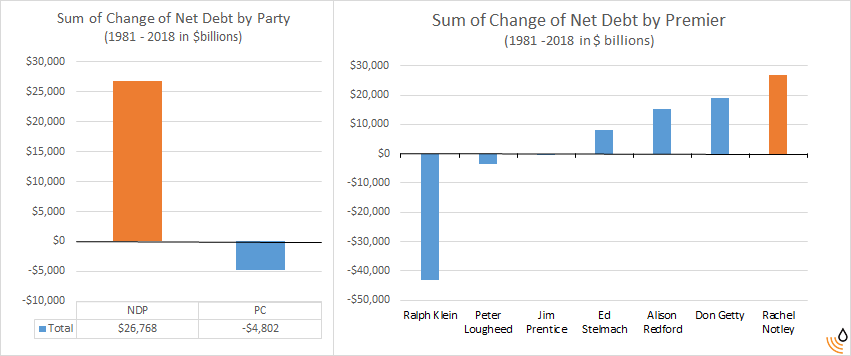

Here are several charts breaking down Alberta’s debt position from 1981-2018 (note 2015-2018 data is based on provincial government projections):

*2013-14 figures onwards are presented on a consolidated basis as current Alberta government framework. Data sourced from RBC fiscal tables