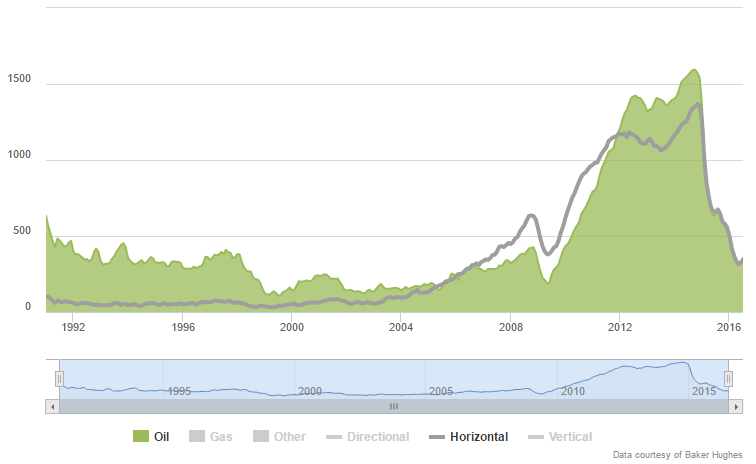

There are many reasons why oil prices crashed, however, one chart sticks out the most when seeking the primary catalyst for the price drop.

The United States rig count, developed by Baker Hughes, is one of the major barometers of the oil and gas industry. When oil prices are high, there are typically many rigs drilling for oil, and when prices are lower, rig rates follow suit.

But what happens when oil prices are high and newly developed drilling techniques are deployed?

An unprecedented spike in drilling.

An unprecedented spike in drilling.

The above chart not only highlights oil rigs, but also rigs that are drilling horizontally. Which makes the chart even harder to comprehend. Not only did oil rig counts rise 3-4 times historic levels, but the vast majority of these rigs were drilling horizontally–which exponentially adds more oil volumes into the market. Couple that with hydraulic fracturing and there’s the perfect storm for an oil price collapse.

There has been a major decline in drilling recently, but a balanced market will still take time to achieve. Simply removing drilling rigs from the equation does not solve the glut overnight.

Could the United States once again add rigs at the pace of 2009-2012? Might be best to watch this chart to figure that out.

Josh Groberman is the Publisher of the BOE Report – The Source for oil & gas news and information