Sayer Energy Advisors (“Sayer”) has been engaged to assist Petrocapita Income Trust and its wholly owned subsidiaries, Petrocapita GP 1, Petrocapita GP 2, Petrocapita Oil & Gas L.P. and Petrocapita Processing L.P. (“Petrocapita” or the “Company”) with a strategic alternatives process. The Company is open to reviewing all alternatives which include, but are not limited to, a sale of the Company for cash, a merger of the Company with another oil and natural gas entity, or a sale of some or all of the Company’s assets.

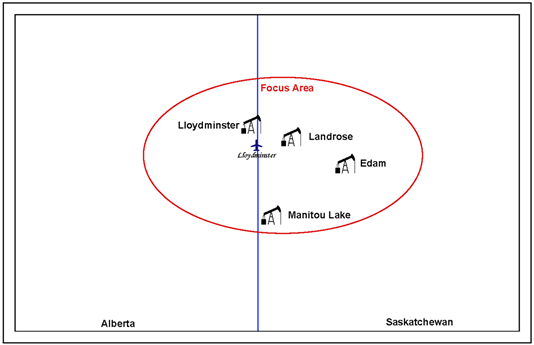

The Company’s main assets consist of high working interests in heavy oil properties focused in the Lloydminster area of Alberta and the Edam, Landrose and Manitou Lake areas of Saskatchewan. Petrocapita also has assets located in the Derwent, Granlea and Provost areas of Alberta and the Dulwich, Lashburn, Maidstone, Northminster and Turtleford areas of Saskatchewan (the “Properties”).

A majority of Petrocapita’s production was shut-in in December 2018, with the exception of seven wells in the Lloydminster area of Alberta producing a total of 131 barrels of oil per day net to Petrocapita and four wells in the Manitou Lake area of Saskatchewan producing approximately 52 barrels of oil per day net to Petrocapita. Prior to the production shut-ins, total production net to Petrocapita from the Properties was approximately 552 boe/d (522 barrels of heavy oil per day and 177 Mcf/d of natural gas).

Petrocapita has a detailed list of all reactivations and possible recompletions on the Properties, which is available in the data room for parties which sign a confidentiality agreement. The workover list contains 62 wells in Alberta and 62 wells in Saskatchewan and includes specific estimated capital requirements for each workover.

The Company operates the majority of the Properties and owns numerous facilities that are valuable in effectively handling Petrocapita’s production and water disposal. The facilities also have potential to handle third party oil and water. Recent water disposal revenue has totaled approximately $67,000 net to Petrocapita (averaging approximately $6,000 per month from third parties).

Chapman Petroleum Engineering Ltd. (“Chapman”) prepared an independent reserves evaluation of Petrocapita’s properties as part of the Company’s year-end reporting (the “Chapman Report”). The Chapman Report is effective December 31, 2017 using Chapman’s January 1, 2018 forecast pricing.

Chapman estimates that, as of December 31, 2017, Petrocapita’s properties contained remaining proved plus probable reserves of 8.8 million barrels of oil and natural gas liquids and 825 MMcf of natural gas (8.9 million boe), with an estimated net present value of $125.0 million using forecast pricing at a 10% discount.

Summary information relating to this divestiture is attached to this correspondence. More specific information is available at www.sayeradvisors.com. A package of more detailed confidential information will be sent to any party executing a Confidentiality Agreement (copy attached).

Click here to view more detailed information

Proposals relating to this divestiture will be accepted until 12:00 pm on Thursday, March 14, 2019.

For further information please feel free to contact: Ryan Ferguson Young, Ben Rye, Tom Pavic, Mark Zalucky, Grazina Palmer or myself at 403.266.6133.

Alan Tambosso

Alan W. Tambosso, P.Eng. P.Geol.

President

SAYER ENERGY ADVISORS

1620, 540 – 5th Avenue SW

Calgary, Alberta T2P 0M2

P: 403.266.6133 C: 403.650.8061 F: 403.266.4467

www.sayeradvisors.com