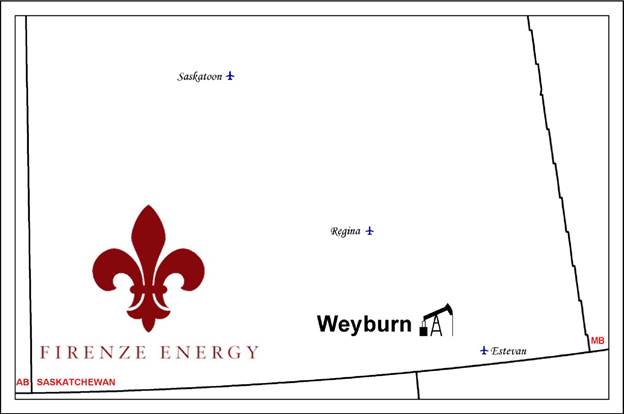

Sayer Energy Advisors has been engaged to assist Firenze Energy Ltd. (“Firenze” or the “Company”), a subsidiary of Toscana Energy Income Corporation(“Toscana”) with the sale of its light, sweet oil property in the Weyburn area of southeastern Saskatchewan (the “Property”). Firenze is selling the Property as part of Toscana’s strategic alternatives process.

Recent total oil sales net to Firenze from the Property have averaged approximately165 barrels of oil per day. The Company’s estimated current net operating income from Weyburn is approximately $130,000 per month (approximately $1.56 million annualized).

Firenze’s Weyburn property is situated adjacent to the large Weyburn Unit (the “Unit”), which is operated by Whitecap Resources Inc. The Unit, which is under enhanced recovery with CO2 injection, has produced over 508 million barrels of oil to date from over 1,400 long-life, low-decline Midale oil wells.

The characteristics of the Property and proximity of it to the Weyburn Unit raises the possibility of the Property, or portions of it, being included in any future expansion of the Unit.

Sproule Associates Limited (“Sproule”) prepared an independent reserves evaluation of Firenze’s Weyburn property as part of the Toscana’s year-end reporting (the “Sproule Report”). The Sproule Report is effective December 31, 2018 using Sproule’s December 31, 2018 forecast pricing.

Sproule estimates that, as of December 31, 2018, the Weyburn property contained remaining proved plus probable reserves of 902,000 barrels of oil, with an estimated net present value of $18.2 million using forecast pricing at a 10% discount. The proved developed producing reserves were valued at approximately $7.2 million at a 10% discount.

Summary information relating to this divestiture is attached to this correspondence. More specific information is available at www.sayeradvisors.com. A package of more detailed confidential information will be sent to any party executing a Confidentiality Agreement (copy attached).

Click here to view more detailed information

Offers relating to this divestiture will be accepted until 12:00 pm on Thursday, May 23, 2019.

For further information please feel free to contact: Ryan Ferguson Young, Ben Rye, Tom Pavic, Grazina Palmer or myself at 403.266.6133.

Alan Tambosso

Alan W. Tambosso, P.Eng. P.Geol.

President

SAYER ENERGY ADVISORS

1620, 540 – 5th Avenue SW

Calgary, Alberta T2P 0M2

P: 403.266.6133 C: 403.650.8061 F: 403.266.4467

www.sayeradvisors.com