Despite current challenges that face the Canadian energy industry, there are continued plans for future development reinforcing the assumption that conditions will eventually improve. With a deep-rooted sense of determination, Canadian industry continues to work towards developing our resources and building out market access in a socially responsible way.

Slow and Steady

To a certain degree, it has been one step forward, and two steps back with the approval of the TMX pipeline and the passage of Bills C-69 and C-48. As we have seen with the TMX project recently, along with Enbridge Line 3 replacement project and Keystone XL, there are many hurdles and barriers for new projects to overcome. Fortunately, these projects also demonstrate that continuing industry determination and resilience will eventually get projects moving forward. With the completion of these pipelines anticipated over the next 2-4 years, Canadian oil prices are anticipated to improve, bringing investment money back into Western Canada.

Hit the Gas

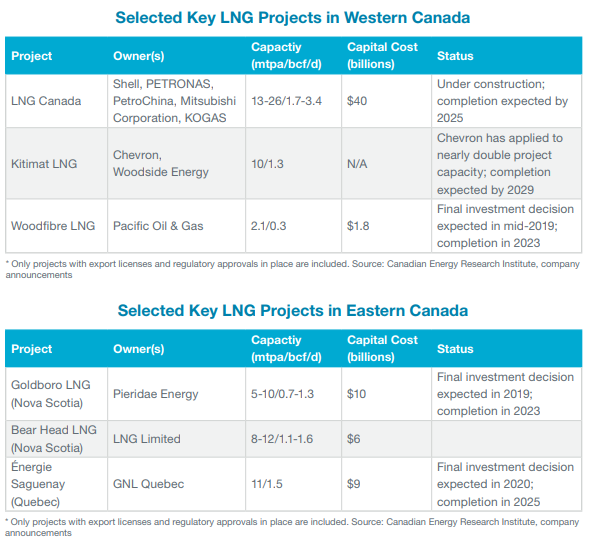

As with oil, Canadian gas continues to face its own set of challenges, becoming increasingly undervalued as our only customer – the US, has aggressively ramped up their own gas production. The future is finally looking brighter as the excess of low-cost Canadian gas has created increasing interest in projects targeting international markets. Currently, there are multiple LNG projects in the planning and development phases with several final investment decisions expected over the next few years (see table below). With most of these projects slated for completion in 2023 or later, there is still a few years ahead of oversupply and associated low natural gas pricing in Canada, but there is optimism that prices will improve in the future.

Source: Gov’t of Alberta’s Oil and Gas Quarterly

The Right Choice

Both North America and the world will continually need Canadian resources, especially with the on-going push toward socially responsible energy. Canada boasts one of the best track records among producing countries when it comes to producing and transporting our oil and gas. With increasing media coverage and availability of information regarding social and environmental impacts of production, Canada needs to continue marketing our resources as the preferred option as the world takes the steps to transition to cleaner and more responsibly produced sources of energy.

GLJ’s July 2019 Forecast

GLJ’s recently released July forecast has WTI and Brent long-term forecasts as 68.00 USD/bbl and 72.20 USD/bbl, respectively (in real 2019 dollars). GLJ’s gas price forecasts have been adjusted with Henry Hub and AECO long-term forecasts at 3.00 USD/MMBtu and 2.60 CAD/MMBtu, respectively (in real 2019 dollars).