Developing and executing business plans and strategies is some of the most complex, time-consuming work that any company can undertake. They are critical to understanding your competitive position in the marketplace and allowing companies to make timely decisions to time sensitive opportunities. Strategic business planning requires significant amounts of time and resources across your company from C-suite leaders to technical and operational experts and business and economic analysts. When it [Read more]

GLJ’s October Price Forecast

The last quarter was unusually volatile for Canadian and international gas and liquids prices and exchange rates. Overlapping factors ranged from maintenance on the NGTL gas system in Alberta, European war and energy crises, recession concerns, and economic uncertainty associated with rapidly rising short- and long-term interest rates and foreign exchange volatility. Oil and Liquids GLJ made no significant changes to the long-term nominal values. Near-term values were adjusted to reflect [Read more]

Opportunity Knocks: An Intro to Canadian Biofuel

Exploring potential within Canada’s energy transition In order for a greener future to be possible, we have to reduce our environmental footprint. Using biomass and biofuels can help us achieve this by diverting waste from landfills and overseas recycling facilities to produce electricity and transportable fuels to lessen our reliance on non-renewable energy sources. This session is scheduled for July 27th at 10:30 AM MST, and will be hosted by GLJ VP & CFO, Tim Freeborn. We will discuss [Read more]

GLJ’s July Pricing – Energy oversupply in a pandemic roiled world

As we continue to observe and experience the effects of the current pandemic, the energy industry, like the rest of the world, has begun what appears to be a slow recovery. In contrast to the governments that continue to spend to keep their economies afloat, energy producers are continually forced to cut spending to survive these downturns. With these cutbacks come production declines and shut-ins which are anticipated to slowly alleviate the global oversupply of both oil and natural gas; [Read more]

GLJ Petroleum Consultants Appoints New CEO

Calgary, AB, September 26, 2019 - GLJ Petroleum Consultants (GLJ) announced today that Jodi Anhorn, current GLJ executive vice president and COO, has been appointed as GLJ’s new president and CEO. In addition, GLJ vice president Chad Lemke has been appointed to executive vice president and COO, joining Caralyn Bennett, executive vice president and chief strategy officer, as part of the senior leadership team. The leadership changes are effective Oct. 1, and follow the retirements of Keith [Read more]

GLJ’s July Price Forecast: Glimmers of Light at the end of the tunnel

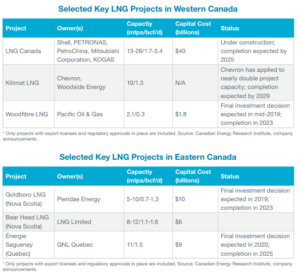

Despite current challenges that face the Canadian energy industry, there are continued plans for future development reinforcing the assumption that conditions will eventually improve. With a deep-rooted sense of determination, Canadian industry continues to work towards developing our resources and building out market access in a socially responsible way. Slow and Steady To a certain degree, it has been one step forward, and two steps back with the approval of the TMX pipeline and the [Read more]

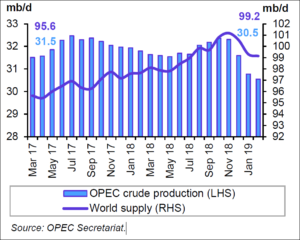

GLJ’s April Price Forecast: Rising oil prices and lower volatility – too good to last?

Enjoy the recovery for now, but brace for inevitable disruptions Despite the possibility of oversupply, trade disputes, and slowing economic growth, oil prices have steadily recovered in 2019 – both internationally and in Canada. The hope, as it should be, is that this welcome period of rising oil prices and lower volatility will continue as we move towards 2020. Unfortunately, that hope may be short lived, as the conditions that resulted in significant instability in broad equity markets [Read more]

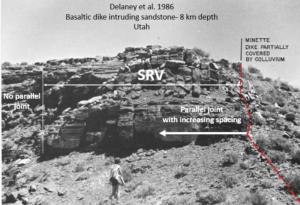

Helping Industry Model Complex HF in Shale and Tight Reservoirs

Part 1: What Are the Challenges Importance of hydraulic fracturing to industry The shale hydrocarbon reservoirs compromise a significant portion of the total unconventional resources in Canada. Duvernay and Montney are the principal western Canadian shale plays which have been estimated to have over 600 trillion cubic feet of natural gas and 5 billion barrels of oil of technically recoverable resources. Other major shale plays in Canada are the Horton Bluff Shale of New Brunswick and Nova [Read more]

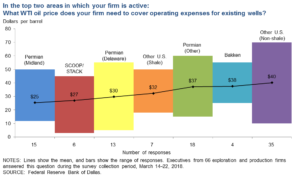

GLJ Petroleum Consultants: April 2018 Price Forecast

We work in an energy industry that, with each passing moment, is becoming more and more interesting. “Living in interesting times” is often eluded to as a traditional Chinese curse generally referring to existing with disorder and change. Changes are rampant throughout the energy industry, be it recent advances in technology, the global power struggle over market share, or newly emerging markets which may disrupt the industry as a whole. In 2018, we appear to be living in increasingly [Read more]

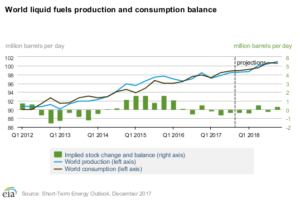

GLJ Petroleum Consultants’ January 1, 2018 Price Forecast

With a new year comes a new outlook for oil and gas prices. Though 2017 was a year of continued belt tightening for many producers in sight of lower for longer commodities prices, 2018 brings with it a glimmer of hope for a more stable pricing environment. Recent rate increases by the US federal reserve and expected continued rate hikes by the Bank of Canada appear to point toward what can be expected to be a more stable era in the North American economy. Though volatility is always present due [Read more]