Snappy Payouts and Returns

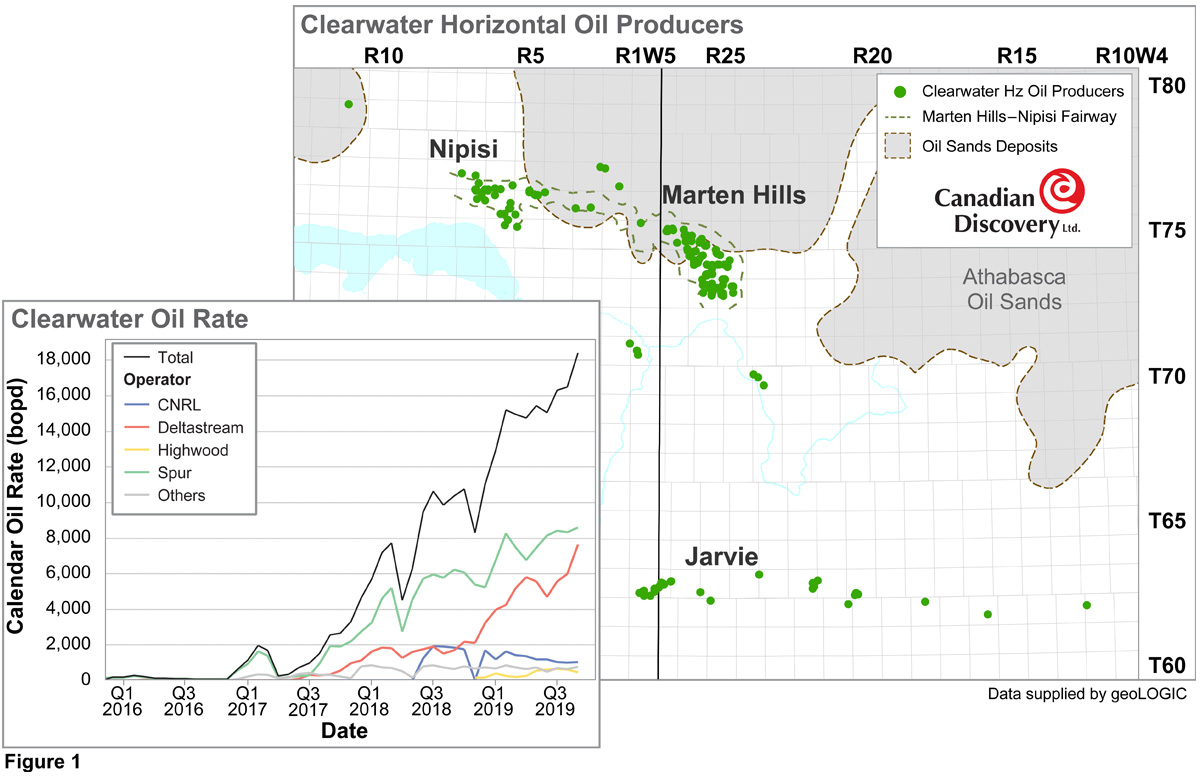

In its short four-year life, the Clearwater cold flow heavy oil play at Marten Hills, Nipisi and Jarvie has gone from interesting land sales to producing 18,400 bopd (as of Sep 2019) (figure 1). Over 8 mmbo have been produced to September 2019. The main players are Spur and Deltastream, with Highwood, Cenovus and CNRL also active.

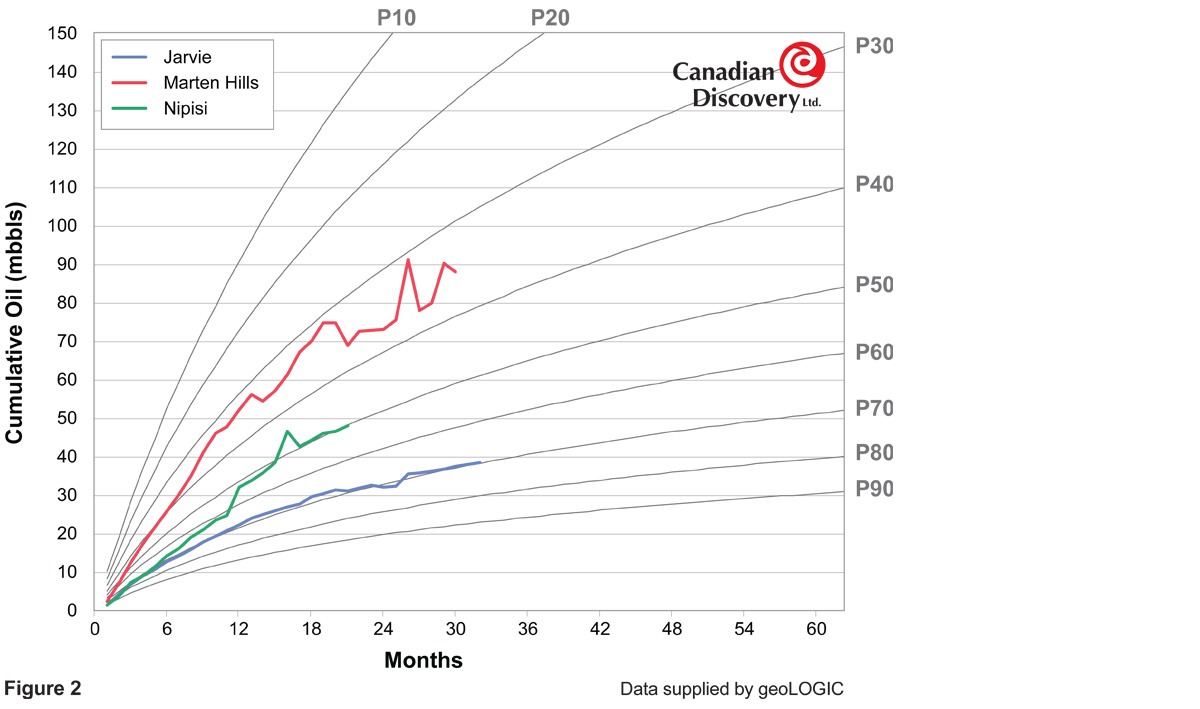

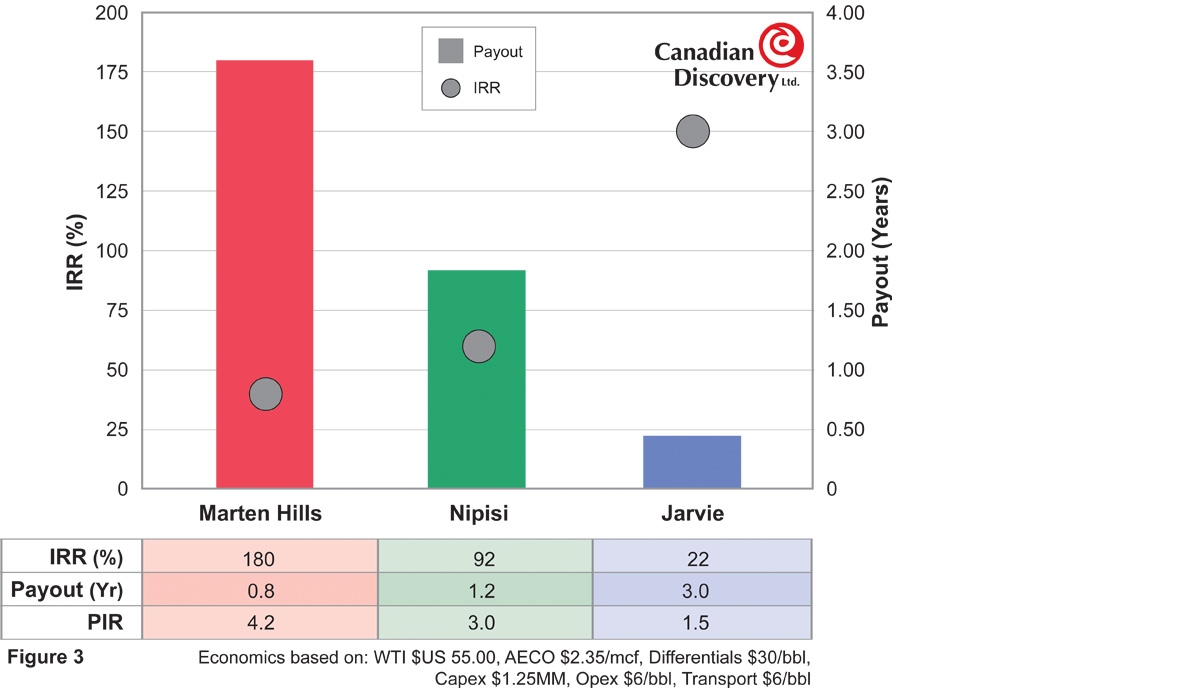

The strong economics of each of the three main areas are key to the success of this play, though there are definite differences between the areas. Figure 2 shows the average production profiles for the three areas in relation to the probabilistic type curves for the entire play. Figure 3 shows the Internal Rate of Return (IRR), Payout in years and Profit Investment Ratio (PIR) by area. All areas have favourable economics, but especially so at Marten Hills and Nipisi, which offer incredible returns with wells paying out in a year or less. Net pay is thickest at Marten Hills and thinnest at Jarvie.

Economics were run on half-cycle costs (drilling and operating only) using the overall P40 type curve for Marten Hills, P50 for Nipisi and P70 for Jarvie. Input parameters were: WTI oil price of $55US; gas price of $2.35/mcf at AECO; a differential of $30/bbl; capital cost of $1.25MM; operating cost of $6/bbl; transportation cost of $6/bbl (CIBC, 2019; Highwood, 2019); and Crown royalties. The economics were run before taxes.

Drilling techniques were the key to unlocking the Clearwater play. Operators are able to access large reservoir volumes using closely spaced open hole multi-laterals (currently four to eight) produced through one production string without having to use costly hydraulic fracturing technologies or thermal technologies (SAGD, CSS, etc.). With multiple legs, the relatively high permeability (1–900 mD) Clearwater reservoir is capable of producing economic volumes of 14–24° API gravity oil on primary production (CDL, 2019).

To learn more about the Clearwater play, contact Canadian Discovery at 403.269.3644 or info@canadiandiscovery.com.

References

Canadian Discovery. 2019. Clearwater Oil Play Information Package.

CIBC. 2019. From Ripple to Wave, The Emerging Clearwater Play. CIBC Industry Update. September 23, 2019.

Highwood Oil. 2019. July 2019 Corporate Presentation. https://highwoodoil.com/. Accessed August 2019.