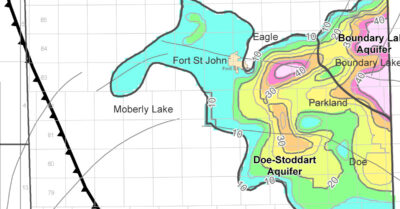

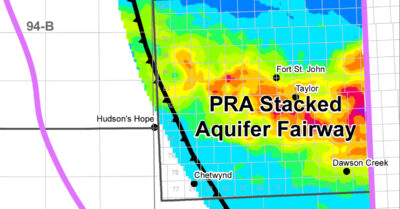

A previous Canadian Discovery (CDL) article presented a high-level view of the recently published Northeast BC Geological Carbon Capture and Storage Atlas. The atlas provides a high-level analysis of CO2 geological storage potential in saline aquifers and depleted gas pools in NEBC; it found that there are multiple opportunities for geological carbon storage within both saline aquifers and depleted gas pools in a number of formations — on all scales from small to large. Twelve formations are [Read more]

Northeast BC Has “Gigatonnes” of Room to Grow Carbon Storage

Carbon capture and storage (CCS) is a hot topic in the 2023 Western Canada energy landscape…and with good reason! Western Canada has both the geology and the geological and engineering know-how to sequester CO2 in a big way. This article focuses on results from the recently published Northeast BC Geological Carbon Capture and Storage Atlas. The atlas provides a high-level analysis of CO2 geological storage potential in saline aquifers and depleted gas pools in NEBC; it found that there are [Read more]

Canadian Discovery can provide area-specific subsurface expertise for your deep saline aquifer CO2 sequestration proposal

CALGARY, AB, CANADA – March 8, 2022 – On March 3, 2022, the Government of Alberta put out its Request for Full Project Proposals for Carbon Sequestration Hubs. Timelines are tight with Full Project Proposals due by May 2, 2022. Canadian Discovery Ltd. (CDL) can provide area-specific subsurface expertise in support of companies’ deep saline aquifer CO2 sequestration Full Project Proposals. CDL has developed a fully integrated subsurface workflow to help clients characterize the suitability of [Read more]

CO2 storage in deep saline aquifers: something old, something new

The Government of Alberta Carbon Sequestration Tenure Management plan currently focuses on the permanent disposal of carbon dioxide into zones deeper than 1,000m that have no associated hydrocarbon recovery. Many deeper zones that were tested in the ‘50s and ‘60s for hydrocarbons are water-bearing and have morphed into potential CO2 sequestration targets. These deep zones avoid some of the risks associated with CO2-EOR and depleted oil and gas pools, including the presence of legacy wellbores [Read more]

CO2 storage in deep saline aquifers: something old, something new

The Government of Alberta Carbon Sequestration Tenure Management plan currently focuses on the permanent disposal of carbon dioxide into zones deeper than 1,000m that have no associated hydrocarbon recovery. Many deeper zones that were tested in the ‘50s and ‘60s for hydrocarbons are water-bearing and have morphed into potential CO2 sequestration targets. These deep zones avoid some of the risks associated with CO2-EOR and depleted oil and gas pools, including the presence of legacy wellbores or [Read more]

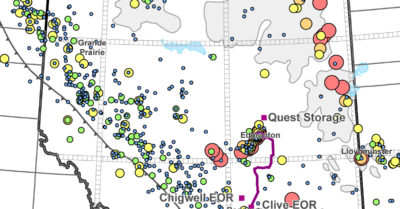

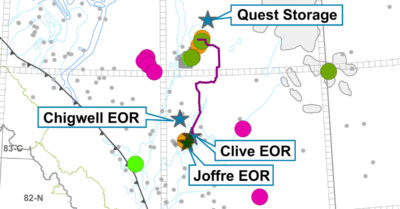

Alberta Has “Tonnes” of Room to Grow Carbon Storage

Carbon capture, utilization and storage (CCUS) is one of the hot topics du jour in the 2021 Western Canada energy landscape…and with good reason! This article focuses on Alberta, which has industrial carbon dioxide emissions that would be good to capture, and a number of viable targets that could store said emissions. Storage targets include depleted gas reservoirs, deep saline aquifers, and enhanced oil recovery (EOR) schemes in oil reservoirs. In 2018, AB produced 144.9 MM tonnes (Mt) of [Read more]

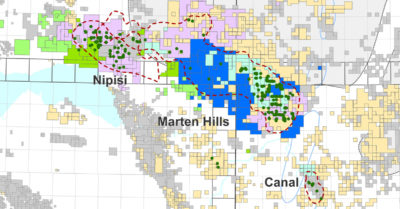

The Shine is Back on the Clearwater!

Mergers and acquisitions in the Nipisi-Marten Hills-Jarvie Clearwater heavy oil plays shifted into overdrive during the last two months of 2020. In November, newcomer Headwater Exploration (dark blue on the map) (figure 1) acquired Cenovus’ Marten Hills assets (approximately 3,000 bopd and 270 net sections), and in December, Tamarack Valley acquired Woodcote Oil’s Nipisi assets (light green) and Highwood Oil’s Nipisi and Jarvie assets (dark green) (combined, 2,000 bopd and 167 net sections). In [Read more]

Unlocking the lower Montney

Lower Montney zones have been extensively developed along the formation’s subcrop edge and in the southern conventional reservoirs at Kaybob, Kaybob South, Placid and Ante Creek North. But, in the unconventional siltstone reservoirs that make up the bulk of recent horizontal drilling, development of the lower zones lags that of the upper zones. Operators are beginning to add significantly to their reserves by going lower on their existing pads. Figure 1 shows the IP90 condensate-gas ratio (CGR) [Read more]

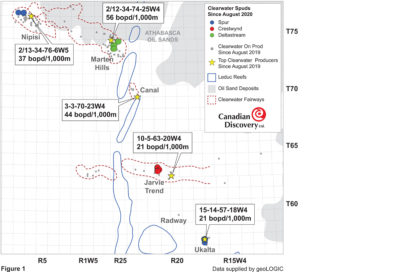

The Clearwater’s Comeback

As industry continues to endure the chaos of the last six months (not that the last six years have been much of a picnic…), activity is slowly returning to key plays like the Clearwater. Outside of thermal development wells at Cold Lake, the Clearwater went undrilled from early March to mid-August 2020. However, new wells have since been spudded at Nipisi, Marten Hills, Meanook (on the Jarvie trend) and Ukalta (figure 1). Since multi-lateral Clearwater production volumes and rates account [Read more]

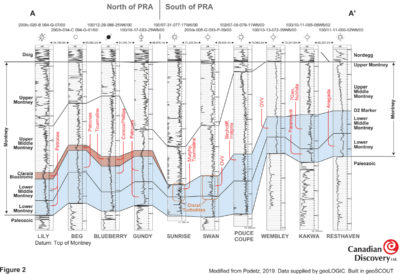

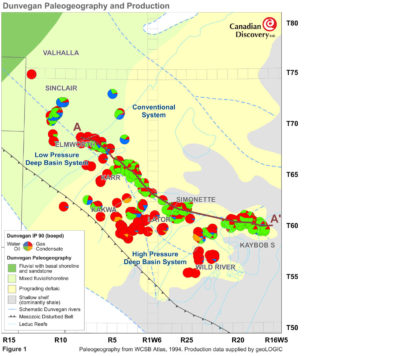

The Dunvegan: Uphole Potential?

As operators look to maximize returns on their existing properties, or to invest in new opportunities, they often look “uphole” to shallower productive zones. The Upper Cretaceous Dunvegan Formation fits that bill in the Deep Basin of west-central Alberta. The Dunvegan was deposited in a fluvial-deltaic environment (figure 1) on the scale of the present day Mississippi Delta. Figure 2 is a cross-section that traverses one of the Dunvegan delta’s larger distributary channels and shows the facies [Read more]