Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like Wednesday Word to the Wise delivered directly to your inbox, subscribe here.

We last wrote about Industry consolidation in 2018, covering the period from December 2014 to December 2018. This time, we’re looking at consolidation since that report up until the end of May 2020, which covers the period of economic distress due to the COVID-19 pandemic and international price wars.

Industry consolidation is a natural occurrence in any downturn and has been a pattern for us for at least the past 5 years. Junior and mid-size companies merge to combine their strengths, solidify balance sheets, and grow. Majors acquire companies of all sizes that are accretive to their economic position in preparation for the market rebound. Now could be an opportune time to purchase assets in the WCSB if you have resources to do so.

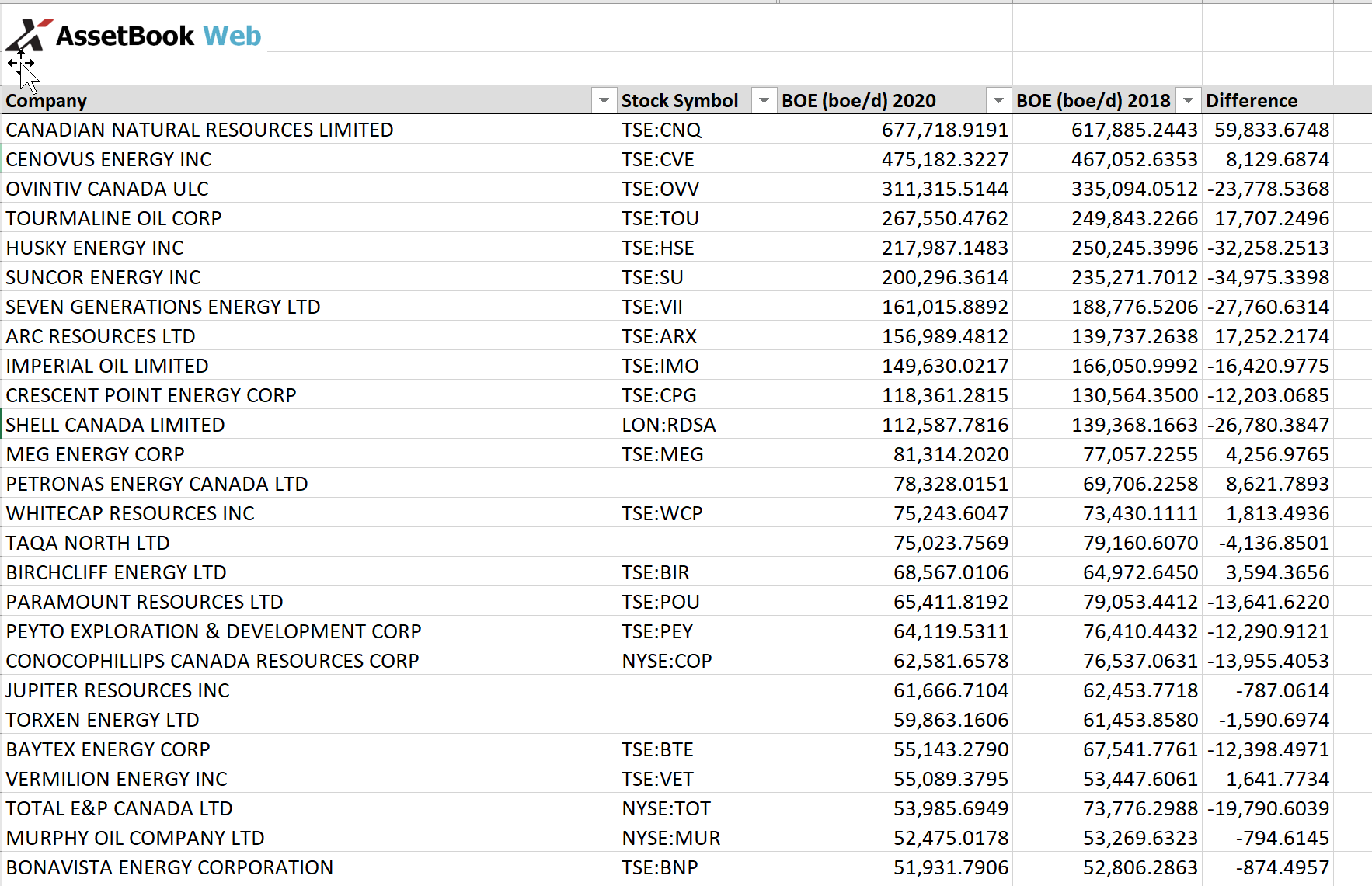

According to the enhanced public data in XI’s AssetBook, between December 2018 and March 2020, the number of active companies with reported production in the WCSB shrunk by 8.6 percent. Active company count (greater than 0 BOE/Day) went from 1,334 in December 2018 to 1,219 at the end of March 2020.

There has been a slight consolidation in the top group: in 2018, there were 47 companies making up 80% of the WCSB production; this number has declined to 45. As well, 64 companies were purchased by the top 10 producing companies during this period.

Some other interesting information from this report includes:

- The trend away from public companies has continued, with 5 publicly traded companies dropping from the list.

- The number of companies that are greater than 50% oil has decreased by 5%, but the bigger hit was gas weighted companies — dropping 12% in this period.

- Overall production is down approximately 6% in this period.

Given the significant reduction in activity in the basin, the downward production trend will likely accelerate over the next few years. This should mean that companies are going to be looking at acquisition to grow their business until activity ramps back up. While there are bargains out there, companies seem to be more interested in acquiring healthy assets. As this trend continues, the use of sophisticated tools to find these healthy options will be critical to success.

XI has the data required to independently evaluate opportunities that become publicly available as well as hidden opportunities that may never hit the public market. To learn how XI’s AssetSuite can help you optimize your M&A process and uncover unadvertised assets, visit our website or contact us for a demo.