Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

With the announcement of the new Liability Management Framework, the Government of Alberta reinforced its commitment to ensure that producers meet their environmental liability responsibilities. The federal government demonstrated its understanding of the importance of liabilities with a $1.7 billion dollar commitment to the Western provinces to address abandonments and reclamations. With this increased attention and focus on environmental liabilities, we thought it would be useful to do a comparative analysis of provincial oil and gas liabilities for Alberta, Saskatchewan, British Columbia, and Manitoba.

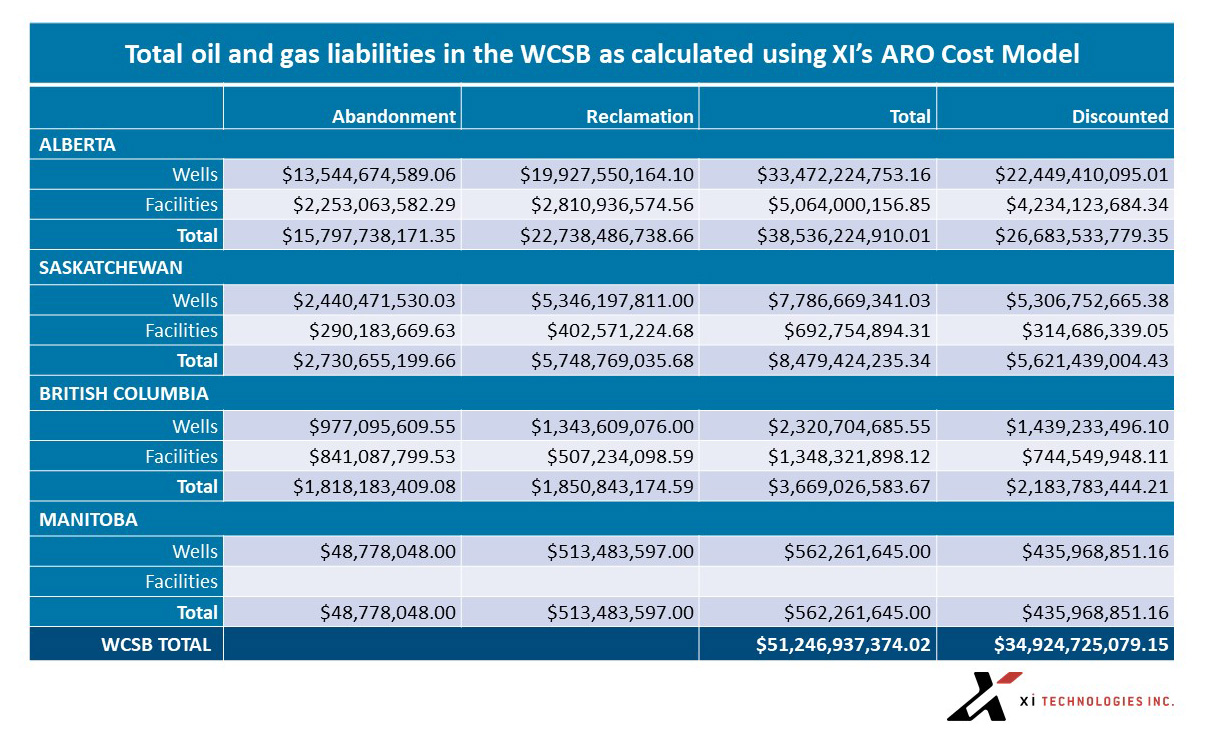

Note: The following figures do not include ARO data for mined oil sands, pipelines, or Oilfield Waste Liability (OWL) data. Here are the results:

According to our data and the standardized 2019 cost model in AssetBook ARO Manager, oil and gas asset retirement obligations (ARO) for WCSB wells and facilities now total $51,246,937,374 (not including mined oil sands, pipelines, or OWL). When taking discounted values into consideration, that number drops to $34,924,725,079.

The analysis was performed by XI’s data specialists using the enhanced public data and tools available in their AssetBook ARO Manager software. Liability costs in the estimate included all well and facility licenses in each province, except Alberta mined oilsands and Oilfield Waste Liability (OWL). Calculations were made using XI’s 2019 ARO Cost Model, which reflects the current reality of abandonment and reclamation costs in each of these provinces.

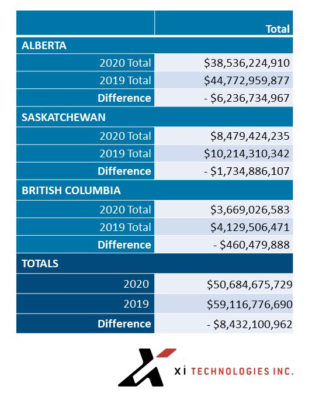

Comparing 2020 and 2019 numbers

We last did this analysis in January of 2019, excluding Manitoba. Alberta’s total liabilities decreased by just over $6 billion since that time. Saskatchewan’s total decreased by just over $1.7 billion, while B.C.’s total liabilities estimate decreased by just over $460 million.

We last did this analysis in January of 2019, excluding Manitoba. Alberta’s total liabilities decreased by just over $6 billion since that time. Saskatchewan’s total decreased by just over $1.7 billion, while B.C.’s total liabilities estimate decreased by just over $460 million.

The ARO cost model within AssetBook ARO Manager was developed through a culmination of government resources, expert opinion and industry data. ARO Manager uses this cost model to help clients estimate, analyze, and monitor ARO. To learn more about how our cost model is helping drive standardization in the ARO space, watch this recorded webinar. Additionally, XI Technologies has recently released a new product designed to help service and supply companies research potential opportunities in inactive liabilities. Visit our website to learn more about the InactiveLiability Report or contact us to learn how XI can help you navigate environmental liabilities.