Chair Resources Inc. and Chair Holdings Limited (collectively “Chair” or the “Company”) has engaged Sayer Energy Advisors (“Sayer”) to assist it with the sale of all of the assets of the Company which are located throughout western Canada.

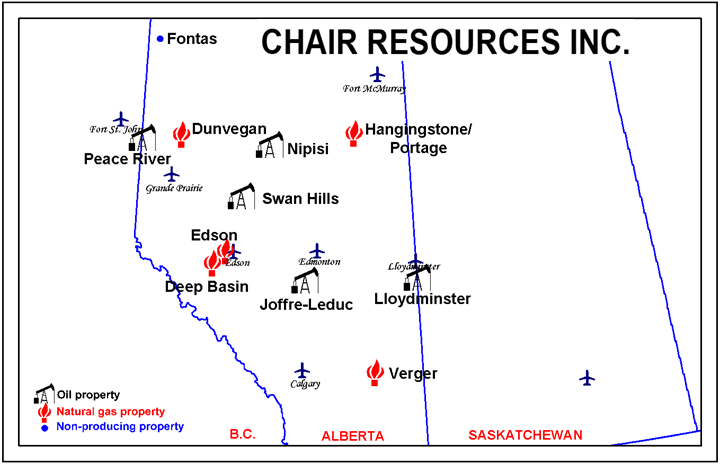

The Company’s oil and natural gas assets consist of long-life, low-decline, non-operated oil and natural gas working interests and royalty interests in the Deep Basin, Joffre-Leduc, Dunvegan, Edson, Swan Hills, Verger, Nipisi, Hangingstone/Portage and Fontas areas of Alberta, as well as the Lloydminster area of Alberta and Saskatchewan and the Peace River area of Alberta and British Columbia (the “Properties”).

The Company share of production from the Properties was approximately 1,432 barrels of oil equivalent per day (7.1 MMcf/d of natural gas and 253 barrels of oil and natural gas liquids per day) in June 2020.

| PROPERTY | COMPANY SHARE OF PRODUCTION | NOI | |||

| (June 2020) | June | ||||

| Oil | Ngl | Nat. Gas | Total | 2020 | |

| bbl/d | bbl/d | Mcf/d | boe/d | Monthly | |

| Deep Basin | 39 | 74 | 3,611 | 715 | $132,400 |

| Joffre-Leduc (1) | 27 | 4 | 46 | 39 | $24,100 |

| Dunvegan | 3 | 18 | 1,157 | 213 | $55,100 |

| Edson | 0 | 14 | 748 | 139 | $59,000 |

| Swan Hills | 37 | 22 | 21 | 62 | $62,800 |

| Verger | 0 | 0 | 1,198 | 200 | ($1,000) |

| Nipisi | 13 | 1 | 6 | 15 | ($7,100) |

| Lloydminster | 0 | 0 | 0 | 0 | ($800) |

| Peace River | 1 | 0 | 0 | 1 | ($700) |

| Hangingstone/Portage | 0 | 0 | 291 | 48 | ($8,000) |

| Fontas | 0 | 0 | 0 | 0 | ($4,700) |

| TOTAL | 120 | 133 | 7,078 | 1,432 | $311,100 |

(1).The Leduc D2 and D3 Units were shut-in from mid-April to mid-August 2020 for a gas plant turnaround. The plant turnaround timing was accelerated due to the market disruptions brought on by the COVID-19 Pandemic and OPEC power struggles. Pre-shutdown production levels of 94 boe/d (74 barrels of oil and natural gas liquids per day and 121 Mcf/d of natural gas) are expected by mid-September, along with monthly net operating income returning to 2019 average levels of approximately $81,000.

Trimble Engineering Associates Ltd. (“Trimble”) prepared an independent reserves evaluation of Chair’s properties as part of the Company’s year-end reporting (the “Trimble Report”). The Trimble Report is effective December 31, 2019, using Trimble’s January 1, 2020 forecast pricing.

Trimble estimates that as of December 31, 2019 the Properties contained remaining proved plus probable reserves of 2.5 million barrels of oil and natural gas liquids and 49.2 Bcf of natural gas (10.7 million boe), with an estimated net present value of approximately $51.0 million using forecast pricing at a 10% discount.

Further details regarding the marketing process can be found on our website at www.sayeradvisors.com. Summary information relating to this divestiture is attached to this correspondence. A package of more detailed confidential information will be sent to any party executing a Confidentiality Agreement (copy attached).

Cash offers relating to this opportunity will be accepted until 12:00 pm on Thursday October 1, 2020.

For further information relating to this process please feel free to contact: Ben Rye, Grazina Palmer or Tom Pavic at 403.266.6133.