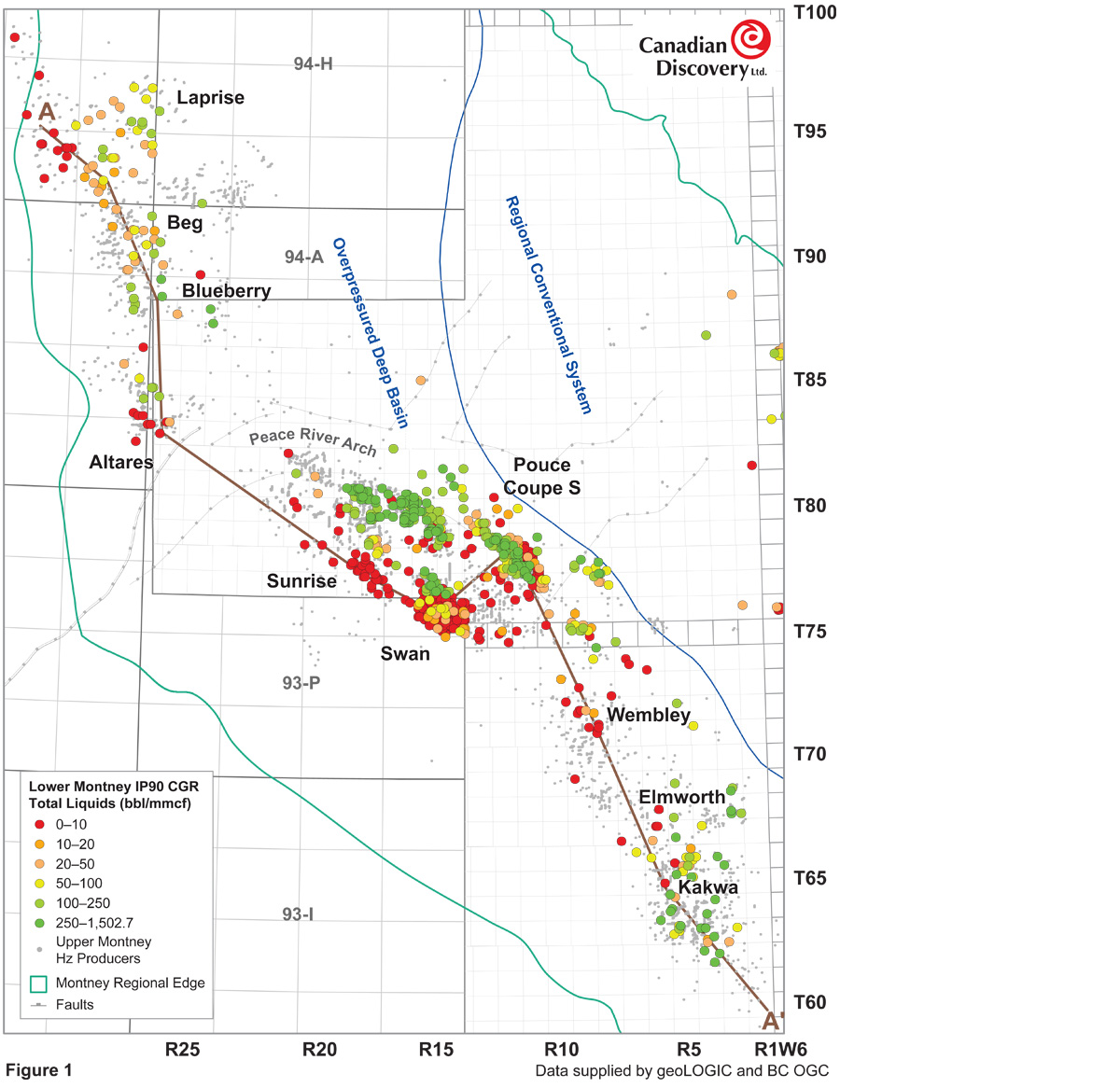

Lower Montney zones have been extensively developed along the formation’s subcrop edge and in the southern conventional reservoirs at Kaybob, Kaybob South, Placid and Ante Creek North. But, in the unconventional siltstone reservoirs that make up the bulk of recent horizontal drilling, development of the lower zones lags that of the upper zones. Operators are beginning to add significantly to their reserves by going lower on their existing pads. Figure 1 shows the IP90 condensate-gas ratio (CGR) incorporating all liquids (including oil) for horizontals completed in the lower Montney zones. Upper zone completions are shown in grey. This map includes reporting of sales volumes from the BC External Reports website and enables a better understanding of condensate production in areas with poor liquids reporting. As a result, areas with greater liquids potential in the lower zones can be more easily observed.

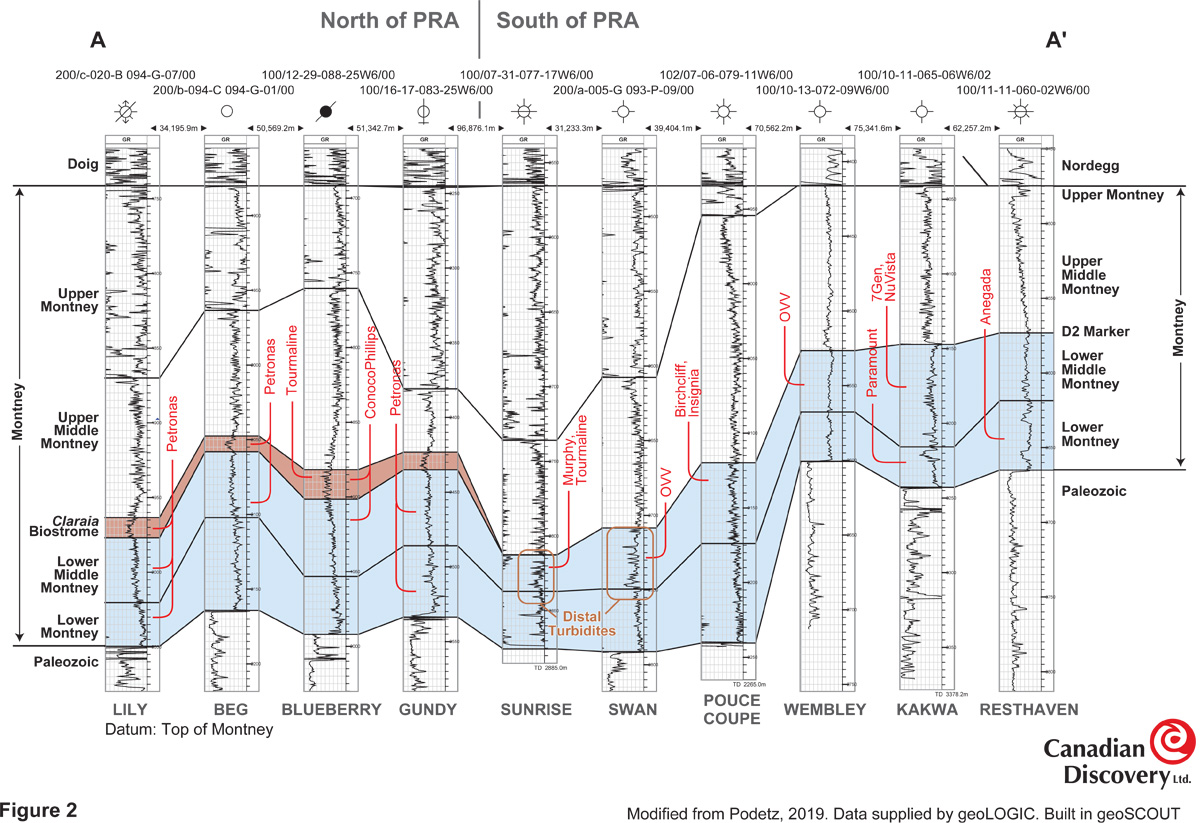

South of the Peace River Arch (PRA), operators have pursued liquids in the lower zones around Tower/Sunrise (Ovintiv, Tourmaline), Dawson (Tourmaline and ARC), Wembley (Ovintiv), Karr and Kakwa (7Gen, Paramount), and Placid/Bigstone (Delphi and Athabasca). Between those areas, there are vast stretches of upper development with little lower zone development. Figure 2 is a regional cross-section from Lily to Resthaven showing CDL’s interpretation of where lower zones are being completed. South of the PRA at Tower/Sunrise, Doe Creek and Swan, operators have targeted the distal turbidites near the top of the lower zone (Podetz, 2019).

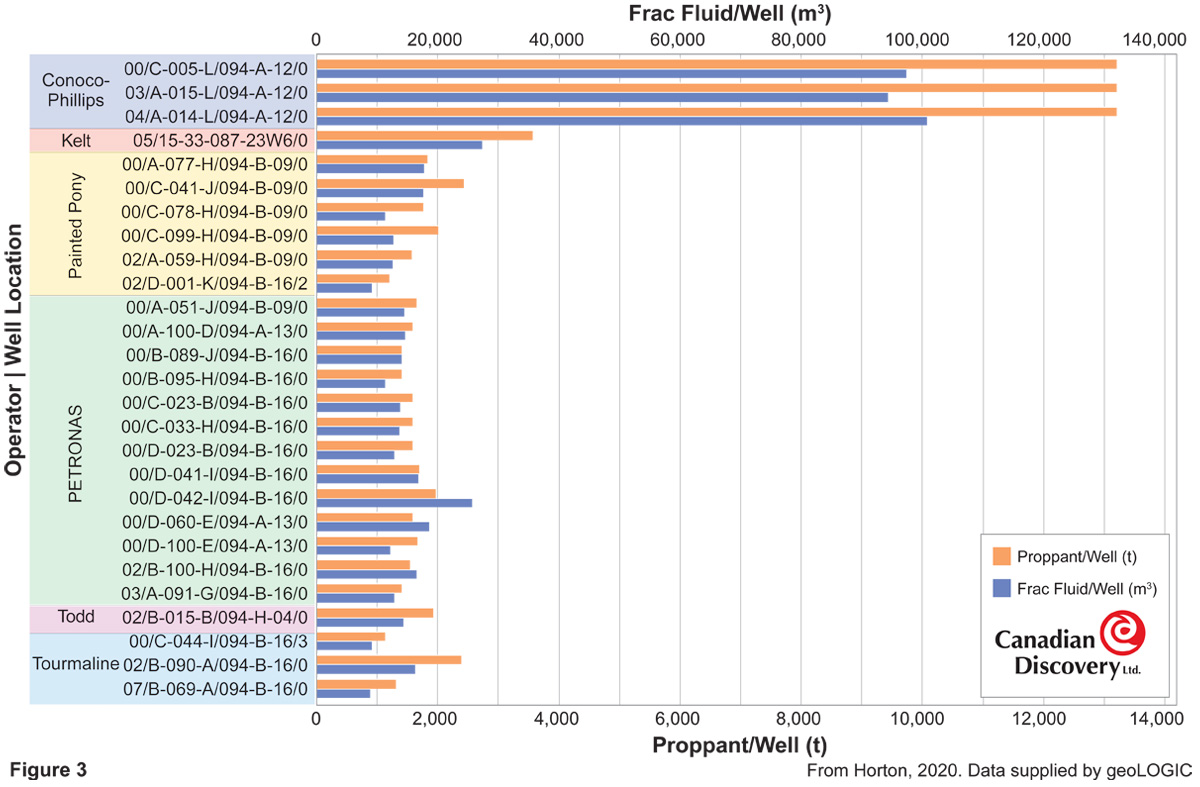

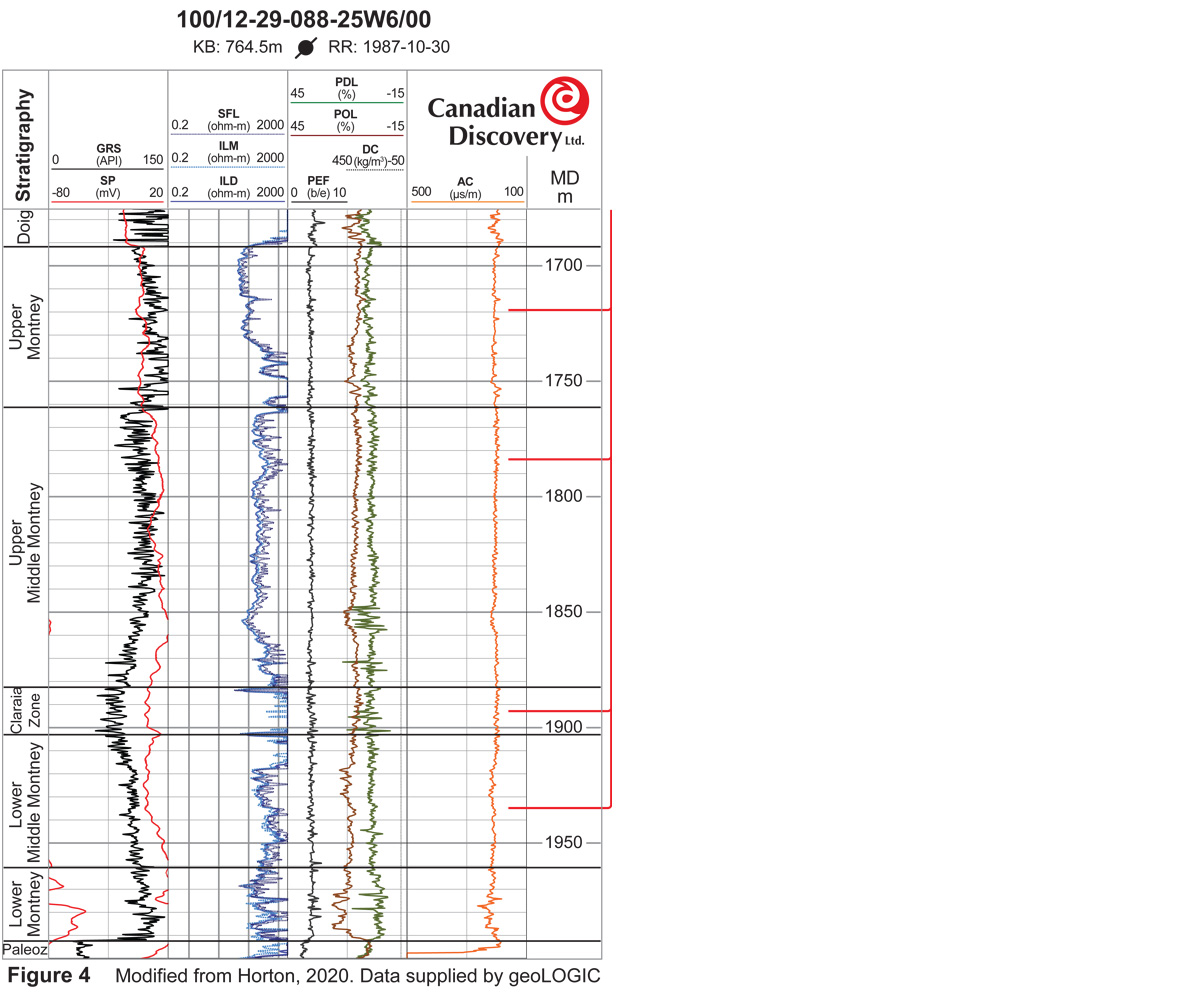

North of the PRA, the upper zones comprise most of the Montney section, and are the most intensely developed. Early on, operators applied the same completions design to both upper and lower zones, and lackluster production results may have discouraged continued lower zone development. ConocoPhillips hit the lower Montney zone hard with high intensity completions in three of its wells at Blueberry, pumping up to 10 times the proppant tonnage and fluid volumes per well vs its competitors’ wells (figure 3). The higher intensity completion design has yielded production results that are on par with the company’s upper zone completions from the same pad, and are amongst the best lower zone producers (with significant liquids) in the Northern Montney (Horton, 2020). The Claraia biostrome, which lies at the base of the upper zones, has been a popular completion target in the north for industry as well (figure 4).

Rock properties (porosity, permeability, clay mineralogy, rock fabric) and reservoir conditions (pressure, temperature and fluid chemistry) can have a profound effect on completions outcomes and production rates. CDL has observed that while the lower Montney is shallower at Blueberry than Tower, pressures and temperature regimes are similar due to higher pressure-depth and temperature gradients at Blueberry (Gibbs, 2020). CDL has work to do to determine if the rock at Blueberry is different than at Tower. Now that ConocoPhillips has proved the concept that the lower zones are productive, it may start to back off completions intensity to find the optimal design that yields the most production for the lowest amount of proppant.

Additional lower Montney reserves await development throughout the trend. However, operators will need a good understanding of an area’s rock properties and reservoir conditions to design completions that are optimal for that specific area.

To learn more, contact Canadian Discovery at info@canadiandiscovery.com and ask about our new Lower Montney Project.

References

British Columbia Oil and Gas Commission (BCOGC), 2020. BC OGC External Reports. https://reports.bcogc.ca/ogc/app001/r/ams_reports/bc_total_production?session=8122705498109. Accessed September 2020.

Gibbs, A. 2020. Liquids in the Lower Montney: Investigations using Fluids Dynamics Data. Presented at GeoConvention, Sep 2020.

Horton, J. 2020. ConocoPhillips Cracks the Lower Montney. https://digest.canadiandiscovery.com/article/8338

Podetz, C. 2020. 2019 Lower Montney Lowdown: The Likelihood of Liquids. https://digest.canadiandiscovery.com/article/7173