Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

At the end of November, we profiled Alberta’s Inactive Well List, looking at a six-month snapshot of activity in the list. Tracking the list can be a helpful indicator of the health of the industry, help drive liability decision-making, and identify priority wellsite retirement opportunities.

In that article, our research revealed that 1,905 licenses had been removed from the Inactive Well List in the six-month time frame, with 5,492 well licenses added. Digging into the licenses removed from list, we revealed that a third of them had been reactivated, with the other two-thirds abandoned.

This week, we’re taking a closer look at the profile of licenses added to the list. If we’re to assume a similar pattern to the previous six months, it’s possible that thousands will soon be removed due to reactivation or abandonment. Those with potential for re-activation suggest many A&D opportunities reside throughout Alberta’s Inactive Well List. Others will be properly abandoned, which represents opportunity for service and supply companies.

To that end, we’ve poured through the data available in our AssetBook software to look at the Inactive Well List additions from the same six-month time frame as our last article. Some key stats for those 5492 licenses include:

- Wells removed from list since Nov 24 article: 235 licenses

- Average depth of production zone: 801.1 m

- Average years since drilled: 22.6

- Operators of inactive wells: 221

- Med/High risk well licenses: 55

- Working interest owners (op & non-op): 379

- Estimated total abandonment cost: $355.6 million (note: this estimate was produced using XI’s ARO Manager software)

Below are some data tables to give more depth of information, by region, on the wells added to the Inactive Well List. Note: in addition to these static images, we have produced interactive dashboards that you can access and work within through this link.

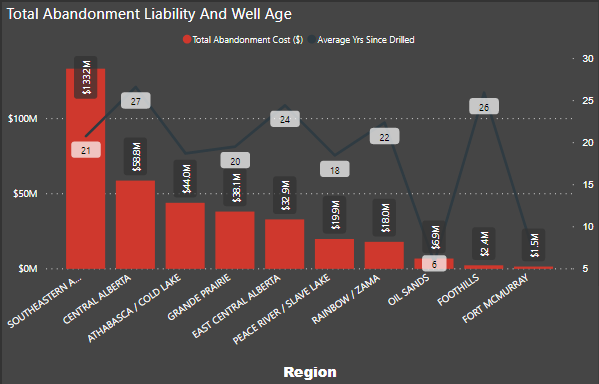

Total Cost and Average Well Age by Area

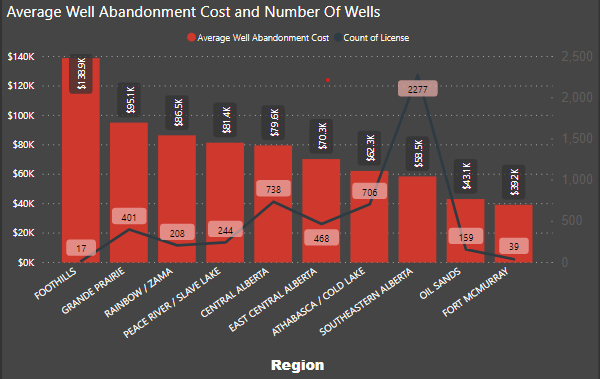

Number of Wells and Average Abandonment Cost by Area

Click here to dig into this information with an interactive dashboard view.

This information was compiled from the data available in XI’s AssetBook ARO module, which allows you to monitor and optimize liabilities from initial deal right through to abandonment and reclamation. For those who don’t require the full capabilities of AssetSuite, we’ve created a new report purpose-built for service companies. Click here to learn more about our new InactiveLiability Report. To learn how these products can help you navigate inactive wells and liabilities, contact us for a demo.