Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

Last week we discussed the pros and cons on drilling vs acquiring in order to capitalize on the current elevated resource prices in our article Best Growth Strategies: Drilling vs Acquisition. Now let’s look at a specific instance of strategic acquisition mentioned in that article, the recent purchase of Storm Resources Ltd (Storm) by Canadian Natural Resource Ltd (CNQ), using data from our premier tool for scoping and evaluating corporate and asset A&D opportunities.

What do we know about each company’s assets and core areas? What are the liabilities that shape this deal? We’ve looked at both companies through a few different lenses to allow you to compare the companies and gain some insight of your own.

Core Areas

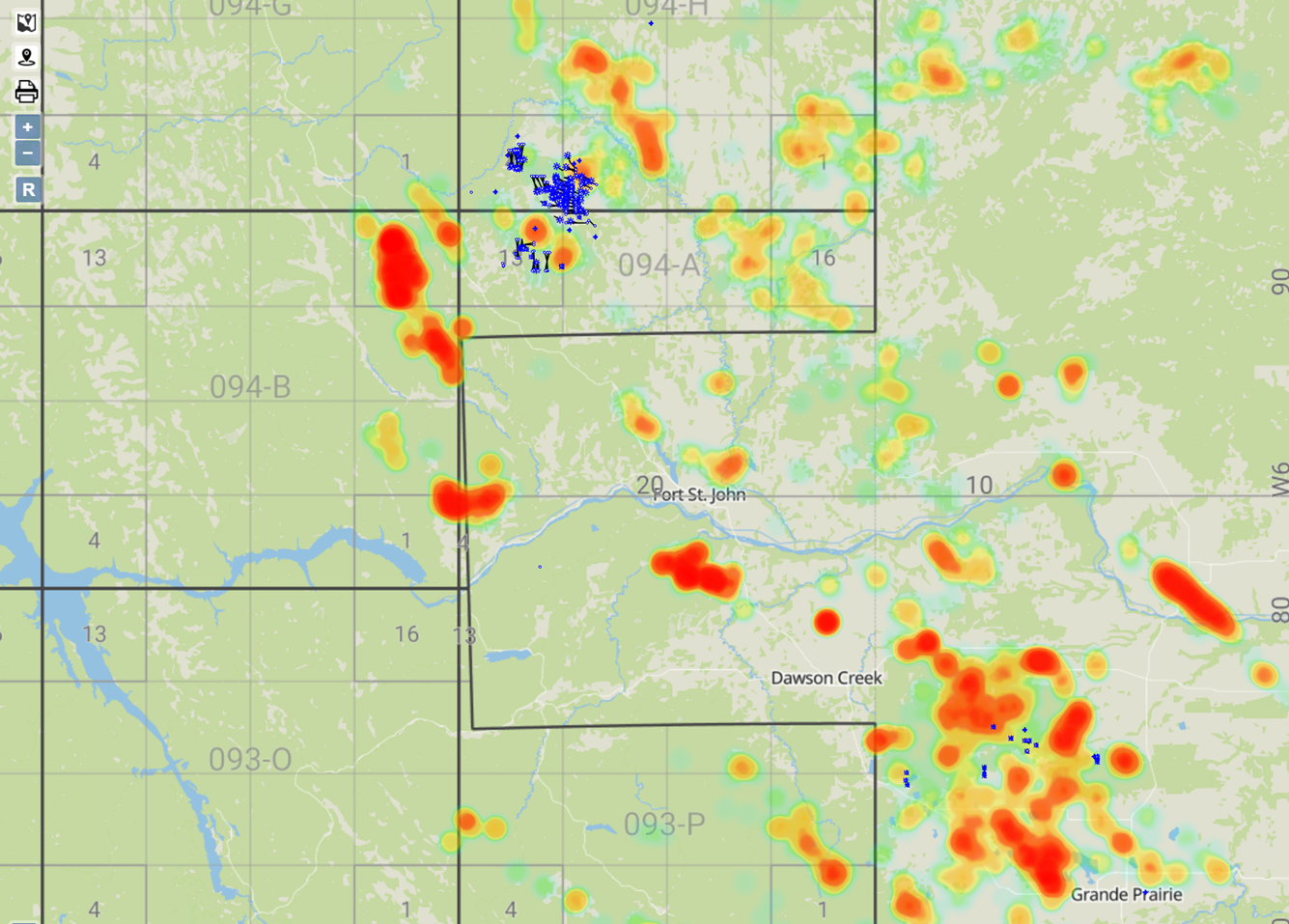

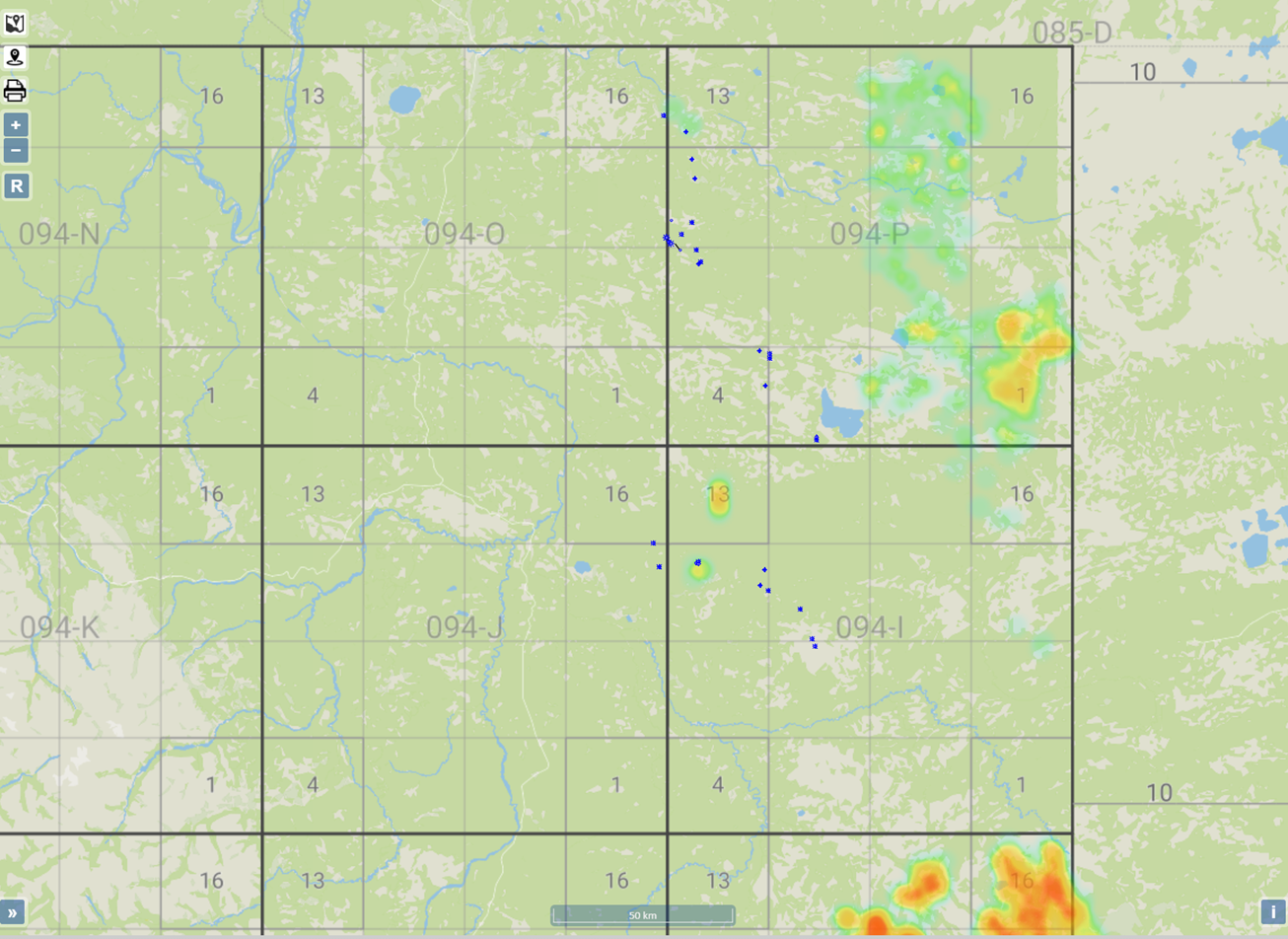

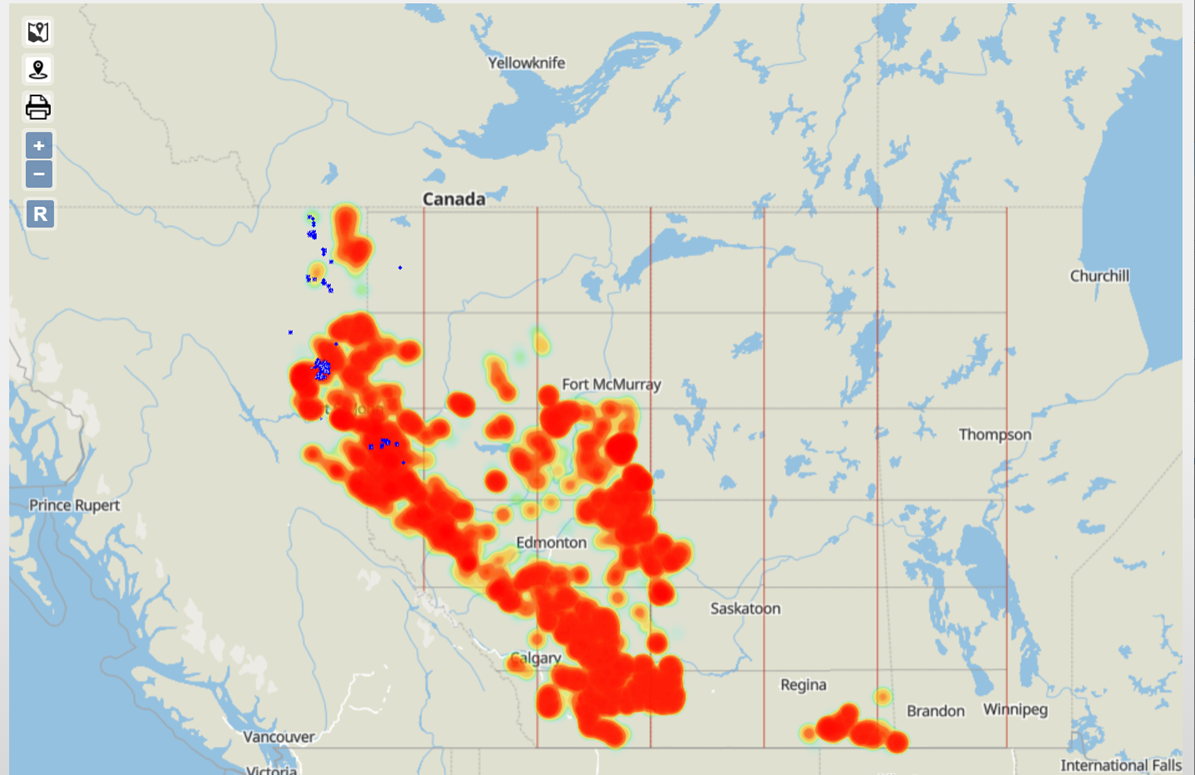

The announcement release mentioned that Storm’s assets were all in CNQ’s core areas. Looking at a heat map of CNQ’s assets with Storm’s assets below, we can see that the bulk of Storm’s assets nestle right in amongst CNQ’s large swaths of production (see figure 1). In fact, when we look deeper, we can see that the bulk of the assets are in an area that complements CNQ’s BC Northern Montney production, as opposed to fully augmenting production, with another block falling into Valhalla to again complement CNQ’s production in the area.

Figure 1 – Heat map of CNQ assets with Storm’s assets (no heat map). Storm assets are labeled in blue

What is particularly interesting is the approximately 200 BOE/day of production that seems to sit outside of CNQ’s core in far Northwest Horn River area.

This may be production that is less appealing to CNQ and could be open for another sale. If you’d like to see a list of all of Storm’s assets at the time of the deal, click here to download a report from AssetBook.

Liabilities

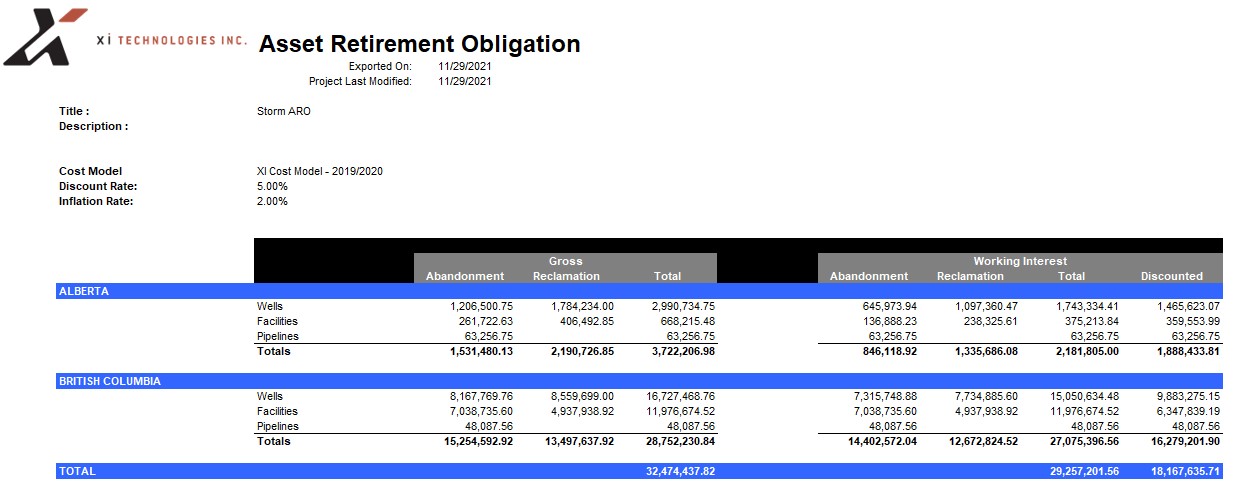

Once high-level scoping identifies assets of interest, it’s prudent to dig into the next level of evaluation and examine things like associated liabilities and emissions scoping. AssetSuite provides users the tools they need for this analysis with ARO Manager, which provides a true over the fence look at any grouping of assets to assess the potential end of life liability, and our upcoming Emissions module, which allows for A&D evaluations of Scope 1 Emissions for facilities in AB, SK, and BC.

Here’s the ARO for Storm’s licenses at the time of the acquisition. Click here to download a pdf.

Click here to download an LLR listing of Storm’s Licenses.

If you’d like to learn more about how XI’s AssetSuite software can analyze potential mergers and acquisitions, contact XI Technologies.