The other day, after a weekend in the Edmonton region, I found myself driving around southwest of the city on a backroad path in a deal the navigation system worked out for me on my behalf. I was involuntarily guided past the Leduc discovery well that heralded the oil boom.

A few miles later, driving past beautiful acreages on the edge of a valley, I pondered the serenity of the landscape, the beautiful views, and lives i’ll never know, for better (mansion on a hill) or worse (current citizen of Ukraine).

For those of you awaiting a customary tirade against the escalating insanity of the energy world, there’s nothing here but disappointment today. If one is involved with the energy world, i think this is a good time for some reflection, particularly if one is fortunate enough to live in North America, and in particular, western Canada.

Why pause for reflection? Because the steady stream of terrible news is starting to desensitize. It’s overwhelming. Take the most obvious example. At the start of Russia’s attack on Ukraine, every missile attack drew headlines.

That was a long month ago, and the tragedy has grown to levels that simply stun the senses. The other day, an EU diplomat leaving Mariupol noted that “Mariupol will become part of a list of cities that were completely destroyed by war… Guernica, Coventry, Aleppo, Grozny, Leningrad.” The details of the horror of Russian-inflicted pain are in danger of fading into the background, just as the tens our thousands of Syrians being killed every year by their government in a decade-long civil war now hardly make the news.

Every bomb is as bad as the first, we can’t let the sheer number of them diminish the impact.

What does make the news is a steady stream of mini-terrors that shake the west, where our luxurious stability is now under threat in ways that seemed unimaginable way back in, oh, say, 2019. Western governments, up to their eyeballs in debt incurred to keep the economic ship afloat, are now being forced to raise interest rates straight into the worst possible time – a time of mass uncertainty, skyrocketing inflation, supply chain meltdowns, and global conflict.

No one even wants to calculate the impact of much higher interest rates (some predict the US Fed will hike rates 6-8 times this year) on massive debt balances, and the negative consequences for the out-of-control housing market could be as bad as 2008.

The mighty Chinese economic engine is faltering due to a collapse of massive property developers such as Evergrande, leaving a mighty crater in that economy, and no one knows how that situation will unfold. It is hard to see a happy ending on that file.

Germany is on the brink of blackouts, because they’ve succumbed to activist pressure and are shutting down their nuclear facilities at the exact same time Europe is pledging to find alternate sources to all the oil and gas they’re currently getting from Russia. They’re not going to find it, because global oil/gas shortages are here for a while; production is constrained by a lack of capital and a lack of desire from oil/gas producers to plow money back into an industry that is being hounded out of existence.

A shocking and saddening energy story is unfolding around the world, with almost-unbelievable plot lines at both the macro and micro level. On the geopolitical macro scale, consider that a consortium of Japanese, European, and US banks are going to Kuwait to convince them to lift oil output, and the US is offering to lift sanctions on Venezuela if they will increase oil production; this at the same time that many European and US banks are yanking support for domestic hydrocarbon production, and after the Biden administration with great fanfare cancelled a pipeline on day one that could have brought the US the same quality of crude from Canada as it seeks from Venezuela. Politicians are caught in a conundrum of their own making, both disavowing hydrocarbon production in one room then scooting over and desperately seeking more of it in another.

A case study from the micro level brings home the reason for this conundrum with sickening clarity. Students of energy will know that the Northeastern US desperately needs more natural gas (this past winter the region was burning oil for power, more than it has done for years). The NE US also sits about 150-200 miles east of probably the largest natural gas field in the world, the Appalachian shale field. For years, infrastructure companies tried to build NG lines to the region, but various states, primarily NY, made that impossible.

Industry never gave up, however, and a company called New Fortress Energy came up with a scheme to generate LNG in Pennsylvania and ship it by truck or rail to gas-hungry NE states. The company originally intended to sell the gas for export, but it would no doubt have competed as a supply source in the region. Either way, the gas would be helping either a very needy world, or fellow countrymen.

But of course that didn’t happen. New Fortress recently had the $800 million project derailed indefinitely by the Sierra Club and a few minor league ENGOs. The litigants successfully had the project’s air emissions permit revoked. So, US natural gas cannot even serve other parts of the country – not by pipe, or rail, or truck, and the proposed LNG supply most definitely can’t help Europe.

This is happening at the same time that the US president is popping in on every global oil/LNG producer and asking them to produce more. In his own backyard, a tiny sliver of activists is counteracting the work of a Democrat president. They are indirectly helping Russia, because Europe needs to find another source of LNG to sever energy ties with Russia.

Think of the power wielded by these unchecked institutions, the power to deny the world of fuel it desperately needs, with no fear whatsoever of blowback or consequence. Every molecule of NG these groups block from world markets is a molecule purchased from Russia, which funds more bombs to annihilate hospitals, shelters, and whatever else Putin has in mind.

Such is the world we live in. Or most people do anyway. It’s time to step away from global madness and peer around our own back yard.

Driving home from west of Edmonton, I drove past pumpjacks and natural gas pipeline risers, which gave a blasphemous level of comfort like most regions of the world will not ever have the comfort of knowing. I drove past herds of cattle, and gave a silent tip of the hat to the blase-looking bovines that I know will provide us with meat and dairy products indefinitely thanks to the efforts of ranchers and farmers and, of course, the currently-if-not-permanently comfortable animals themselves.

I drove past endless fields that will soon be filled with bursting-with-life crops. I drove through the very heart of the oil patch, right past Leduc Discovery #1 in fact, and witnessed the surrounding landscape as a mixed farming/wooded landscape that exuded both productive capability and mixed wilderness in a way that no urban anti-hydrocarbon activist can even imagine.

I drove past mile after mile of nearly uninhabited terrain, and thought that this endless bounty was no doubt similar to what many Ukrainians have been familiar with when on a drive in the countryside, until very recently. I thought how many people this landscape can support, both those that are of the land from a historical perspective and those that can benefit from the resources it provides from both above and below the surface.

People can choose to hear it or not, but if they are wise, they will: big problems are coming. US president Biden has openly stated that food shortages are “going to be real”. The cause is a global shortage of various fertilizers, many of which are either sourced from Russia or produced from natural gas or both. And he’s referring to the dazzlingly pampered west, not the billions and billions in Asia and Africa that may well face hardships we can’t imagine. Our foods will be subject to severe inflation; theirs may not show up at all.

The same goes for hydrocarbons. The US has pledged to bring more natural gas to Europe, but in a world where there isn’t enough LNG, that means only one thing – a bidding war. The wealth of the west will keep the home fires burning, no matter how many “fossil fuel subsidies” western governments implement (California, in a move of breath-taking but boringly normal hypocrisy, just introduced $10 billion worth; European countries are incurring tens of billions of subsidies also, a number surely to rise).

Shielded by governments, western countries will pay what it takes to get its fuel. Left by the side of the road will be cruelly less successful bidders, such as Pakistan, countries which are labelled in the media simply as “countries unable to procure LNG cargoes”. Imagine the outcry if next winter Europe was simply deemed a region “unable to procure LNG cargoes”.

Here in Canada and the US, we owe an indeterminate but massive debt of gratitude that we live in a place where we do not need to fret about our ability to procure LNG cargoes. We have plenty, as we do of oil, and food, and minerals, and space, and safety nets. We may pay a lot more for it, but we can get it.

For those of us that have been predicting hydrocarbon shortages for years – an event accelerated by Russia’s war, but one that was coming nevertheless as a result of long-term under-investment due to divest-fossil-fuel/ESG campaigners – there is scant celebration in seeing predictions come true. There is only a sickening feeling.

As North Americans blessed with countless resources, food, and space, let’s hope we are able to exercise our legs and help supply the world with what it needs to keep from imploding. We don’t need subsidies or help, we just need people to get out of the way.

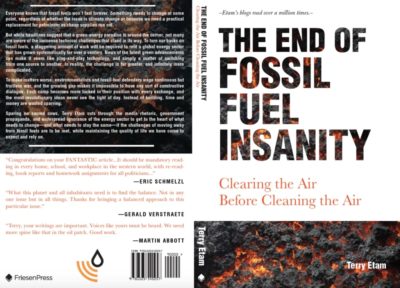

Slava Ukraini! Find out how the world got into such a calamitous energy state, and how to get out – pick up “The End of Fossil Fuel Insanity” at Amazon.ca, Indigo.ca, or Amazon.com. Thanks for the support.

Read more insightful analysis from Terry Etam here, or email Terry here. PS: Dear email correspondents, the email flow is wonderful and welcome, but am having trouble keeping up. Apologies if comments/questions go unanswered; they are not ignored.