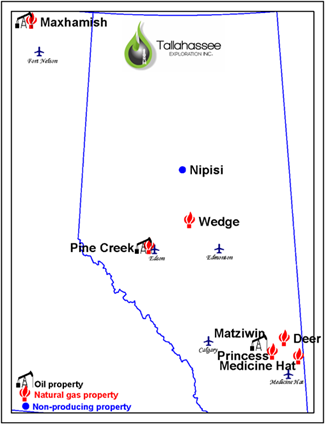

Tallahassee Exploration Inc. (“Tallahassee” or the “Company”) has engaged Sayer Energy Advisors to assist it with the sale of certain non-core operated and non-operated oil and natural gas assets located in the Deer, Medicine Hat, Matziwin, Nipisi, Pine Creek, Princess and Wedge areas of Alberta and the Maxhamish area of British Columbia (the “Properties”). Tallahassee is selling the Properties in order to focus on its core assets.

Recent average daily production net to Tallahassee from the Properties was approximately 458 boe/d, consisting of 2.3 MMcf/d of natural gas and 70 barrels of oil and natural gas liquids per day.

Tallahassee’s forecasted annualized net operating income from the Properties is approximately $490,000 per month, or $5.9 million on an annualized basis.

As of May 7, 2022, Tallahassee’s net deemed asset value for the Properties was ($936,487) (deemed assets of $6.0 million and deemed liabilities of $6.9 million), with an LMR ratio of 0.87.

The Company prepared an internal reserves evaluation of the Properties specifically for this divestiture (the “Reserve Report”). The Reserve Report is effective April 1, 2022 using an average of GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule Associates Limited’s April 1, 2022 forecast pricing. Tallahassee estimates that, as of April 1, 2022, the Properties contained remaining proved plus probable reserves of 534,000 barrels of oil and natural gas liquids and 11.0 Bcf of natural gas (2.4 million boe), with an estimated net present value of $20.7 million using forecast pricing at a 10% discount.

Summary information relating to this divestiture is attached to this correspondence. More specific information is available at www.sayeradvisors.com. A package of more detailed confidential information will be sent to any party executing a Confidentiality Agreement (copy attached).

Cash offers relating to this divestiture will be accepted until 12:00 pm on Thursday, July 7, 2022.

For further information please feel free to contact: Ben Rye, Grazina Palmer, or Tom Pavic at 403.266.6133.