Enerplus, once a major producer in the WCSB, has all but exited the Canadian oil patch after a number of large asset sales in 2022. While the company is still the licensee for 124 wells classified as “active” or “location” per data from Petro Ninja, these wells are producing petroleum volumes that are effectively immaterial for a company of this size; Enerplus, which produced nearly 98,000 BOE/d in Q1 2023, only produced around 180 BOE/d from its remaining licensed wells in Canada last month. It’s also possible that these wells are actually owned and operated by a different producer, and that the licences simply have not been transferred officially yet. Either way, Enerplus is now a US producer for all intents and purposes. One big question still remains: what assets did the company sell and how are they performing?

The Sales

Enerplus Mineral Rights Transferred since July 2021

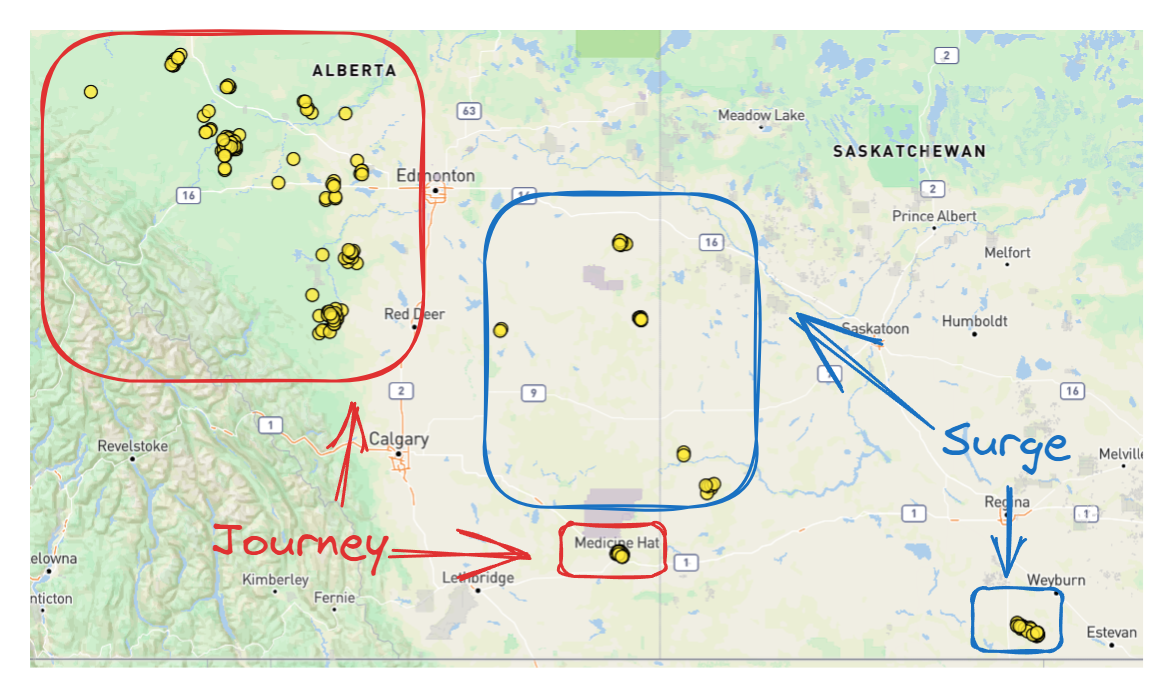

While Enerplus has been continuously divesting its Canadian assets since 2016, its most consquential sales in the past 5 years occurred in 2022. Firstly, Journey announced its $140 million acquisition of Enerplus’ Ante Creek and Medicine Hat assets in July 2022. This transaction has so far resulted in the transfer of 81.82 net sections, 25 facilities, 109 pipeline assets and 812 well licences. As demonstrated below, production from these assets has been fairly consistent since January 2022; as of May 2023, the transferred wells were producing just over 4,000 BOE/d. Interestingly, many of the assets acquired per AER data do not appear to be close to Journey’s mineral rights holdings. This may indicate that a substantial portion of the company’s mineral rights in these areas are held by land brokers, or perhaps that these assets are not a part of Journey’s core strategy going forward.

Enerplus’ Alberta Energy Regulator (AER) Transfers to Journey (includes pipelines, facilities and wells) and all of Journey’s Mineral Rights (Transfers in red, mineral rights in green)

The company’s other major asset sale was to Surge Energy. In a $245 million transaction that was announced in November 2022, Enerplus divested a majority of its positions in SE Saskatchewan and eastern Alberta. In total, we’ve identified the transfer of 1055 well licences, 60 facilities, 45 pipeline assets, and 48.51 net sections of land. While liquids production is declining gradually from the transferred wells, natural gas production has actually increased since the transaction closed; this may suggest that the wells’ gas/oil ratios (GORs) are increasing as they mature, or perhaps that Surge is attaining increased production efficiency as the assets are integrated.

Enerplus’ Alberta Energy Regulator (AER) Transfers to Surge (includes pipelines, facilities and wells) and all of Surge’s Mineral Rights (Transfers in red, rights in blue)

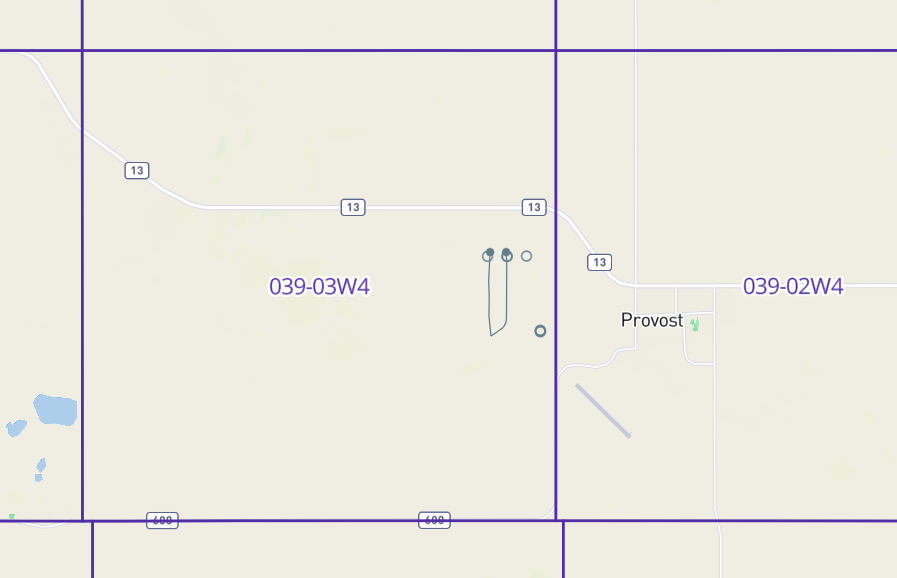

It’s also important to account for licensing activity that has taken place in Enerplus’ divested assets, as this may reveal the longer-run value of the positions. As of July 6, Journey had not obtained any licences in mineral rights acquired from Enerplus. Surge, on the other hand, has obtained 9 licences in township 039-03W4 that are connected to mineral rights formerly owned by Enerplus. As it stands, two of these wells (UWIs: 103052403903W400 & 102062403903W400) are on production and produced a combined total of 309.7 BOE/d in May 2023.

Surge Licences Connected to Mineral Agreements Acquired from Enerplus

We’ve also prepared a summary of the top divested wells by recent production. Journey Energy’s Montney assets are leading the way with top well 100092506624W500 accounting for 214 BOE/d of licensed production.

Top 10 Wells Acquired from Enerplus (by recent production)

| UWI | Licensee | Producing Formation | Recent Oil (BBL/d) | Recent Gas (mcf/d) | Recent Equivalent (BOE/d) |

| 100092506624W500 | Journey Energy Inc. | Montney | 195 | 213.6 | 214 |

| 100162506624W500 | Journey Energy Inc. | Montney | 116 | 124.5 | 125 |

| 100053506624W500 | Journey Energy Inc. | Montney | 84 | 119.9 | 120 |

| 100053606624W500 | Journey Energy Inc. | Montney | 79 | 92.5 | 92 |

| 100100601305W400 | Journey Energy Inc. | Glauconitic | 89 | 90.8 | 91 |

| 103152604705W400 | Surge Energy Inc. | Lloydminster | 80 | 81.7 | 82 |

| 100143108614W500 | Journey Energy Inc. | Slave Point | 81 | 81.5 | 82 |

| 191123000418W200 | Surge Energy Inc. | Ratcliffe | 74 | 76.2 | 76 |

| 102160801305W400 | Journey Energy Inc. | Glauconitic | 73 | 74.5 | 75 |

| 191010200417W200 | Surge Energy Inc. | Ratcliffe | 70 | 72.3 | 72 |

Check out BOE Intel for more data and analytical tools.