Greenfire Resources, a Canadian oil sands producer with assets in the Hangingstone region, announced its entry into a definitive business combination agreement with M3 Brigade Acquisition III Corp. in December 2022. The agreement, which specified a US $950 million valuation for Greenfire, was consummated on September 20 and the company’s shares began trading on the NYSE on September 21. With this process now finalized, we wanted to provide our readers with a quick overview of the latest information available on Greenfire and its operations. All data and figures in this article are sourced from Greenfire Resources and M3 Brigade Acquisition III Corp.’s publicly available corporate material, Petro Ninja and BOE Intel.

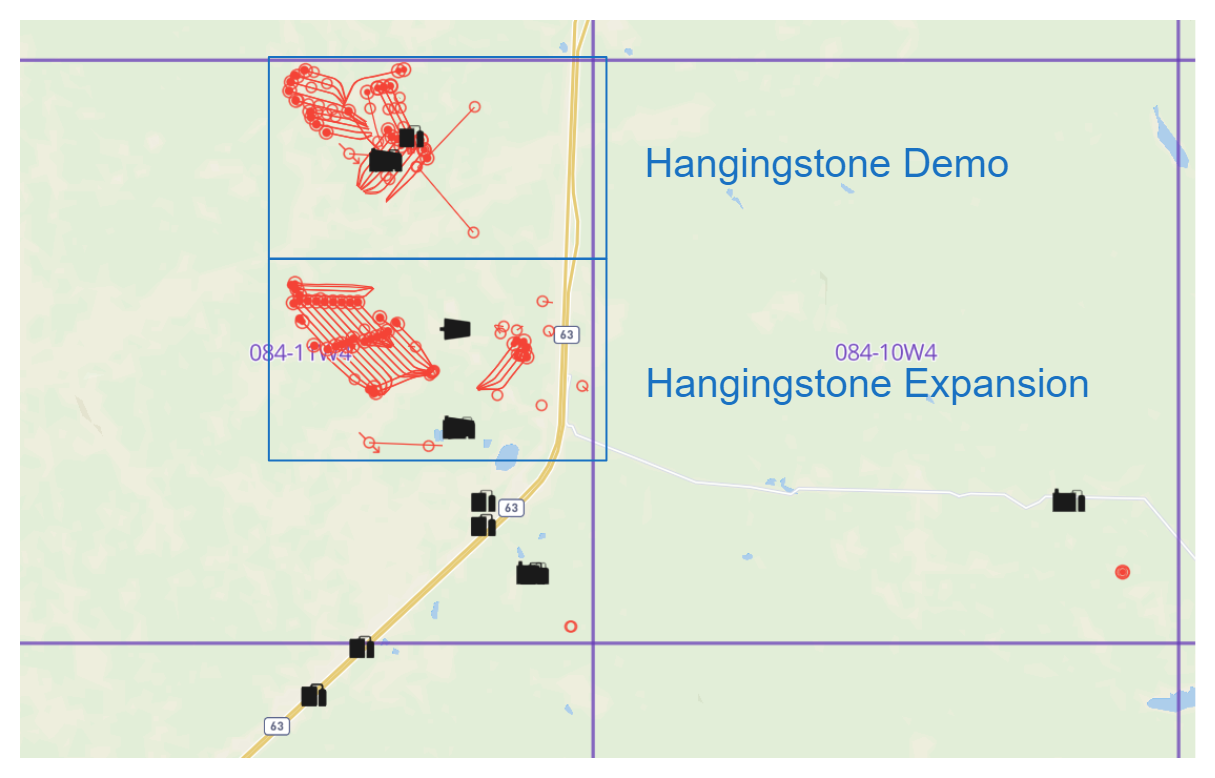

Greenfire Active/Location Wells and Proximal Facilities (Wells in red, Facilities in black)

Greenfire Resources’ operations are centred around 2 SAGD facilities, “Hangingstone Demo” and “Hangingstone Expansion”. After implementing a capital budget of $40 million in 2022 and initially planning for $39 million in 2023, the company recently cut and reallocated its spending plans for this year. As of June 16, the company’s capital budget is $34 million with 70.5% allocated to Hangingstone Expansion and 29.5% allocated to Hangingstone Demo. This represents a shift from the company’s original 2023 capital budget, which allocated 46.2% of spending to Hangingstone Expansion and 53.8% to Hangingstone Demo. With respect to drilling, the company intends to drill 5 redevelopment infill wells, at least one of which has a target horizontal length of 1,600m, at Hangingstone Expansion as well as 1 water disposal well at Hangingstone Demo. The company appears to be maximizing output from its existing wells and facilities as opposed to breaking entirely new ground, although this may change as the company makes progress towards its debt targets. It’s worth noting that Greenfire owns a large pool of mineral rights that are not currently being exploited, which may provide a clue regarding potential future development opportunities for the company.

Greenfire Resources Crown Mineral Rights and Active/Location Wells (Mineral Rights in yellow, Wells in Red)

In the company’s most recent corporate presentation, Greenfire Resources estimated its daily average production in 2023 will be 20,400 BBL/d of net bitumen with a 2023 exit production of 25,100 BBL/d. Greenfire also indicated its potential “debottlenecked” production is 33,400 BBL/d, which we presume is a projection that is contingent upon the resolution of infrastructural frictions. With respect to comparable public companies, MEG Energy and Athabasca are often cited as comparable peers due to being predominantly pure play oil sands producers.

Using data from BOE Intel, we’ve determined that the company holds 555 well licences. 4 of these licences were issued in the past 12 months, and Greenfire has spud 3 wells over the same period. We estimate that approximately 8.8% of the company’s licences are for wells that are currently producing, resulting in gross licensed production of approximately 19,168 BOE/d as of July 2023.

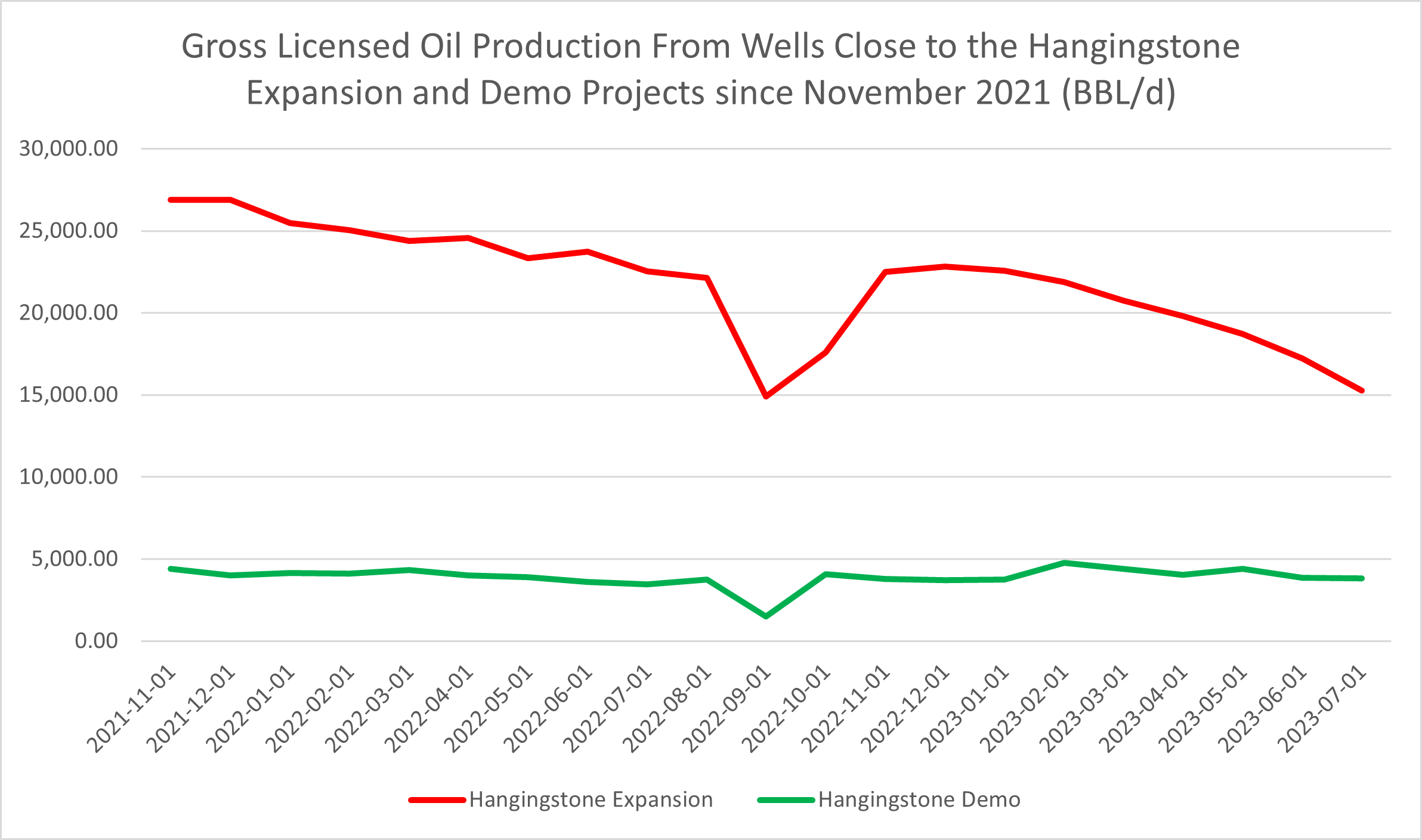

Greenfire’s decision to shift focus towards Hangingstone Expansion in 2023 appears to make sense given the relative production of the company’s two projects since 2022. Despite having a similar number of proximal active/location wells (71 wells at Demo, 96 at Expansion), there is a significant production difference between the projects; as demonstrated below, production from wells near Hangingstone Expansion was almost 18,000 BOE/d greater than production from wells near Hangingstone Demo. Please note that we made this distinction based off of wells’ geographic proximity to the two project zones, and the actual production from each project may differ from our estimates.

According to the company’s September 20 press release, Greenfire arranged a US $42 million equity private placement, a US $300 million senior note offering and a C $50 million Senior Credit Facility as part of the business combination agreement. This capital will help Greenfire deliver on its capital spending and debt reduction objectives. With this in mind, we will be keeping an eye on Greenfire Resources in the coming months. To get updates on the company’s production, licensing, and drilling activity on a continuous basis, visit Petro Ninja and BOE Intel.