Whitecap Resources highlighted its Viking tuck-in acquisition in its new corporate presentation just recently released. We first spotted Whitecap as the buyer of the Baytex assets using BOE Intel on December 20th.

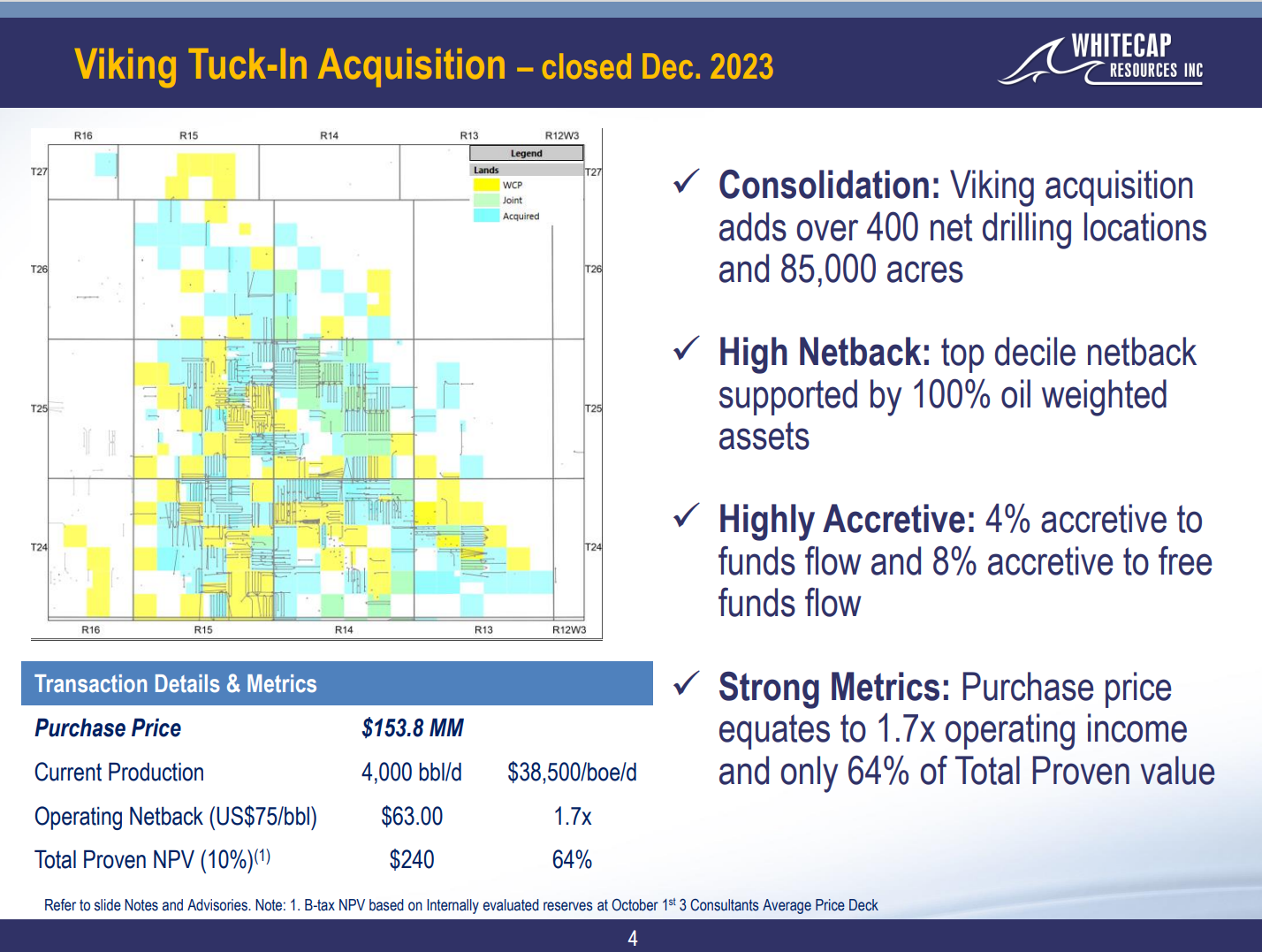

Below we show the new slide in Whitecap’s presentation highlighting the acquisition.

Source: PowerPoint Presentation (wcap.ca)

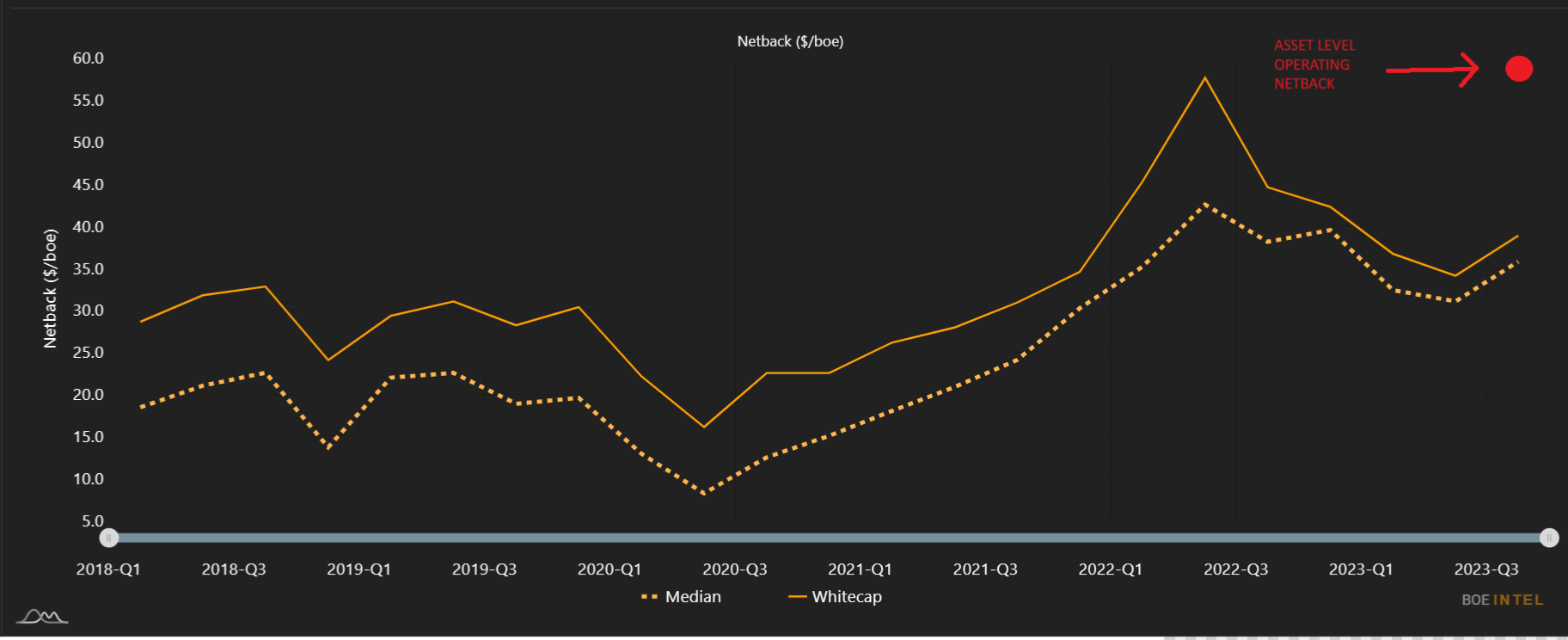

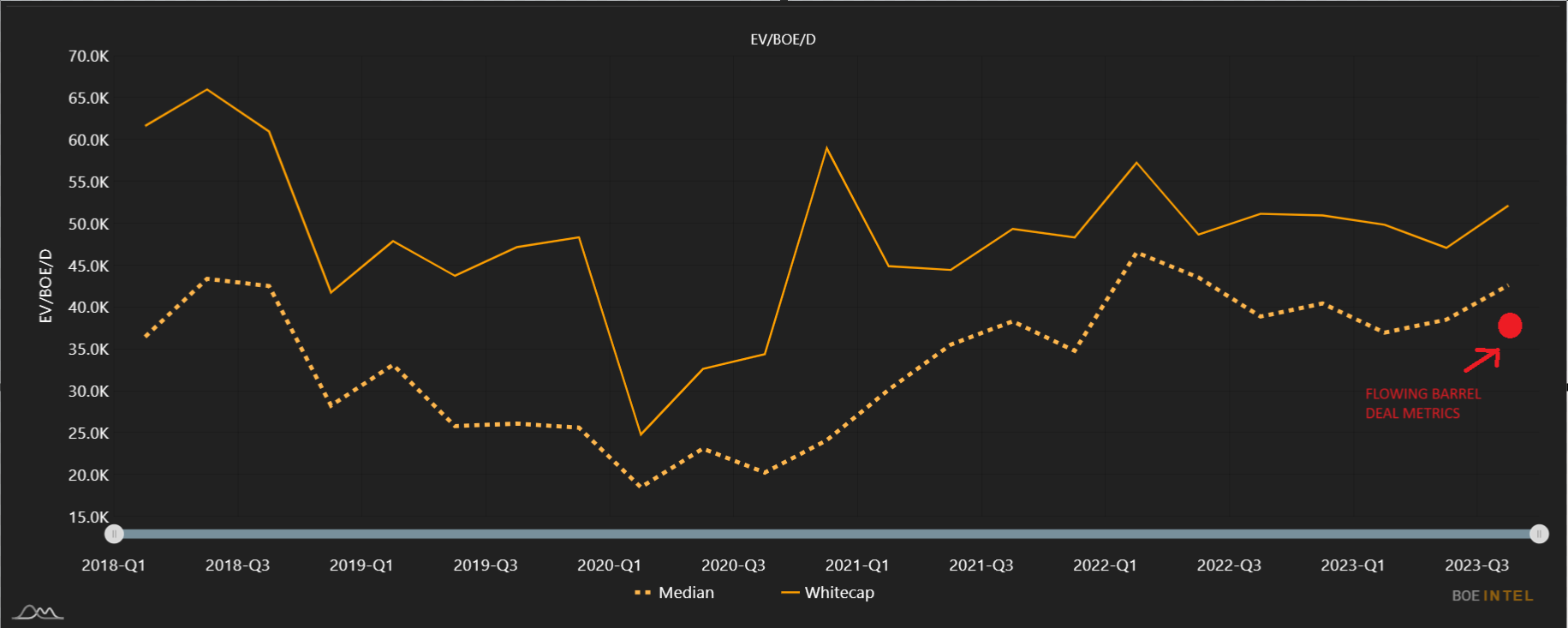

In its presentation, Whitecap highlights a few interesting tidbits on the acquisition, particularly the addition of 400 net drilling locations, 85,000 acres, and that the purchase price reflected 1.7x operating income. Whitecap also mentions an operating netback for the assets of $63/BOE, compared to Whitecap’s Q3 corporate operating netback of $38.83/BOE (Figure 1). The assets were purchased at a flowing barrel price of $38,500/BOE/d, compared to Whitecap’s EV/BOE/d of ~$52,100 BOE/d and the median company which trades around $42,600/BOE/d (Figure 2).

Figure 1 – Operating netback after hedging

Figure 2 – Flowing barrel metrics – EV/BOE/d

Whitecap has increased its 2024 guidance by ~2,500 BOE/d (new range 165-170 MBOE/d) and simultaneously reduced its 2024 capital spending guidance by $100 MM (new range $900 MM-$1.1 billion). Whitecap’s “West” Division (containing the Montney/Duvernay assets) is the future for the company, but this acquisition shows that the “East” Division remains an important part of the business. The West Division will see ~55% of the new capital budget in 2024, with 80% of the West Division’s spending allocated to Whitecap’s Montney and Duvernay assets.