The Alberta Government brought in more than $59 million on its March 20, 2024 Crown land sale. This big result follows up on another equally interesting land sale from two weeks ago that fetched more than $52 million.

To view all of the results from yesterday’s land sale, click here.

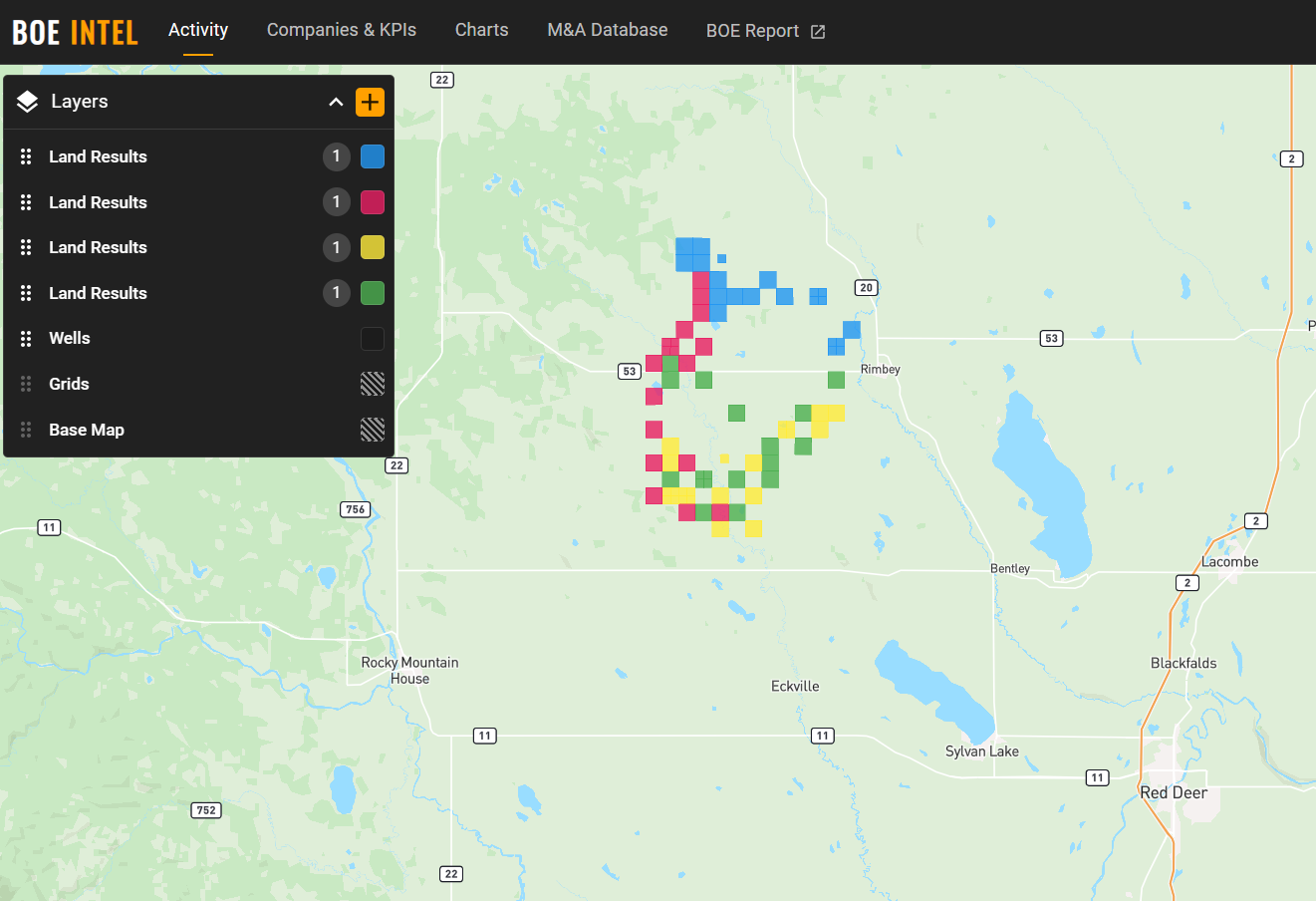

Perhaps the most fascinating part of yesterday’s land sale (and definitely the most expensive), was 57.5 sections (14,720 hectares) of mineral rights northwest of Red Deer and at the southeastern tip of the large Pembina field. These mineral rights were broken out into 4 parcels, which we have highlighted below in the table (Figure 1) and the BOE Intel map (Figure 2). In total, these parcels went for $46.8 MM, at an average price of $3,178/ha, or $813,656/section. Unsurprisingly, all parcels went to land brokers.

The zones listed cover a wide swath of mineral rights, including the Duvernay, which may be the targeted zone here.

Figure 1

| Colour on map | Bonus ($) | Area (hectares) | $/ha | Area (sections) | $/section |

|---|---|---|---|---|---|

| Green | 15,616,013 | 3840 | 4067 | 15 | 1,041,068 |

| Yellow | 13,794,145 | 3392 | 4067 | 13.25 | 1,041,068 |

| Pink | 9,987,840 | 3840 | 2601 | 15 | 665,856 |

| Blue | 7,387,200 | 3648 | 2025 | 14.25 | 518,400 |

| Total | 46,785,198 | 14,720 | 3,178 | 57.5 | 813,656 |

Figure 2

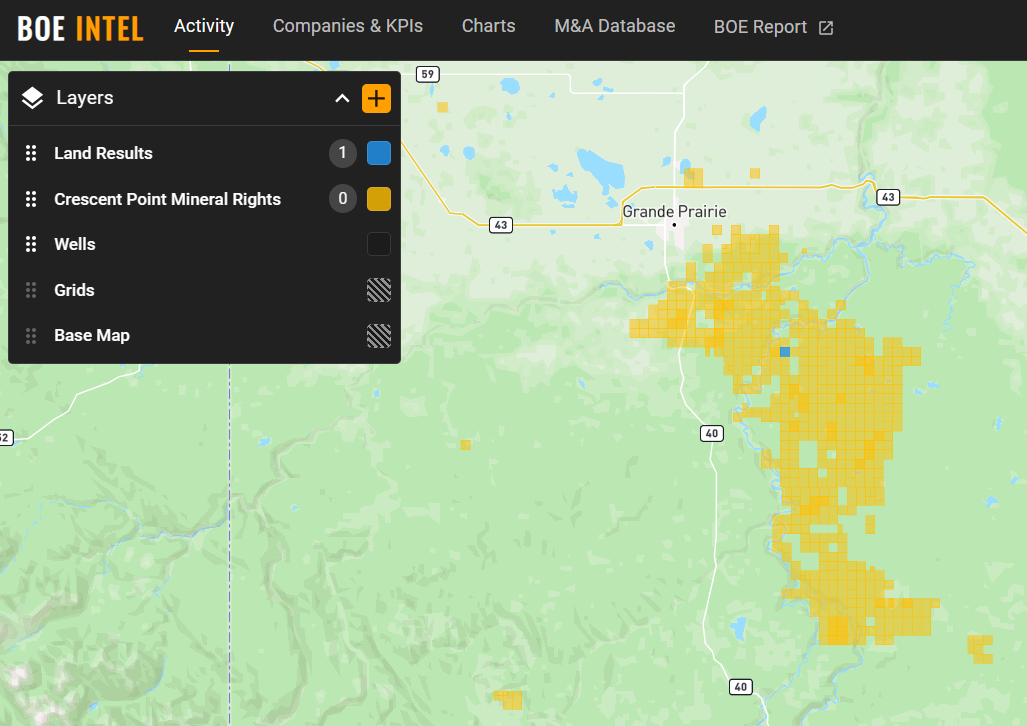

While those 4 parcels represented more than three quarters of the total spend in the March 20, 2024 land sale, they did not represent the most expensive pieces of land based on a $/area basis. That honour belongs to this one section of prime Montney acreage (Figure 3) surrounded by Crescent Point’s (Veren’s?) acreage. The zones cover surface to basement mineral rights. That piece of land went for $5.325 million/section, or $20,801/ha. The buyer was a land broker by the name of Lacadena Land Company.

Figure 3