Advantage Energy announced on June 10th that it has acquired $450 MM of Charlie Lake / Montney assets from a private producer, including 14,100 BOE/d (53% oil/liquids) of production. While the press release did not mention who the seller was, and no asset transfers can be seen as of yet, the maps from the company’s acquisition slide deck line up with those of Longshore Resources (Longshore is also referenced in the fine print on a few slides). Not involved in this transaction are Longshore’s Central AB/West Saskatchewan Mannville assets.

See Advantage Energy’s acquisition presentation here.

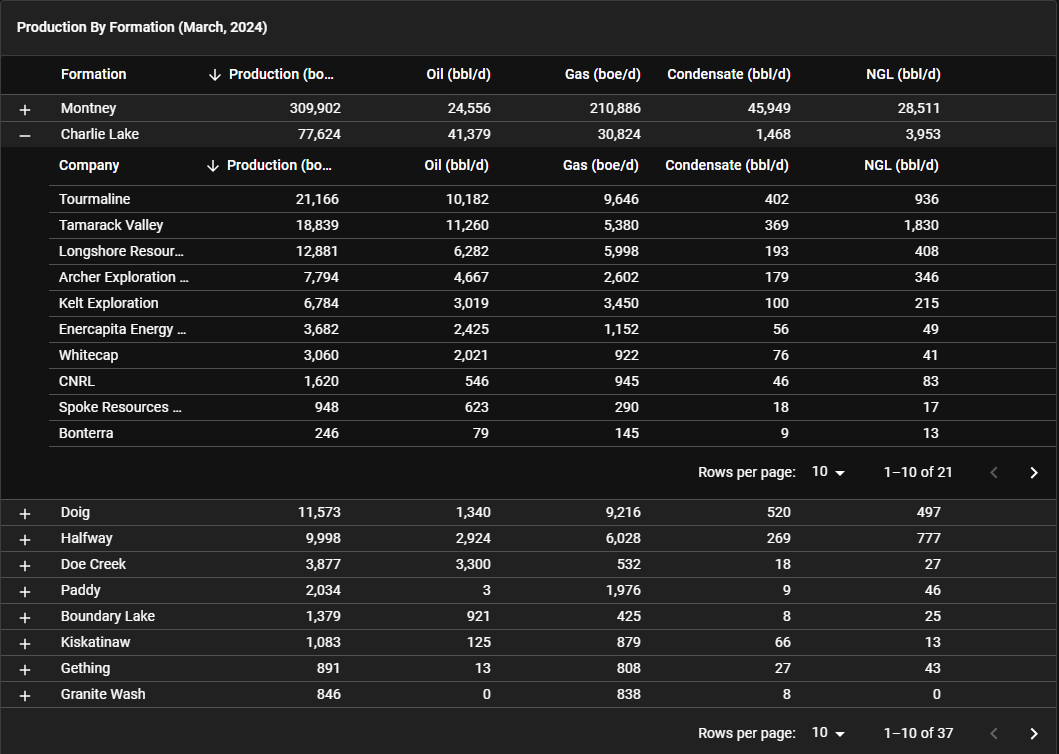

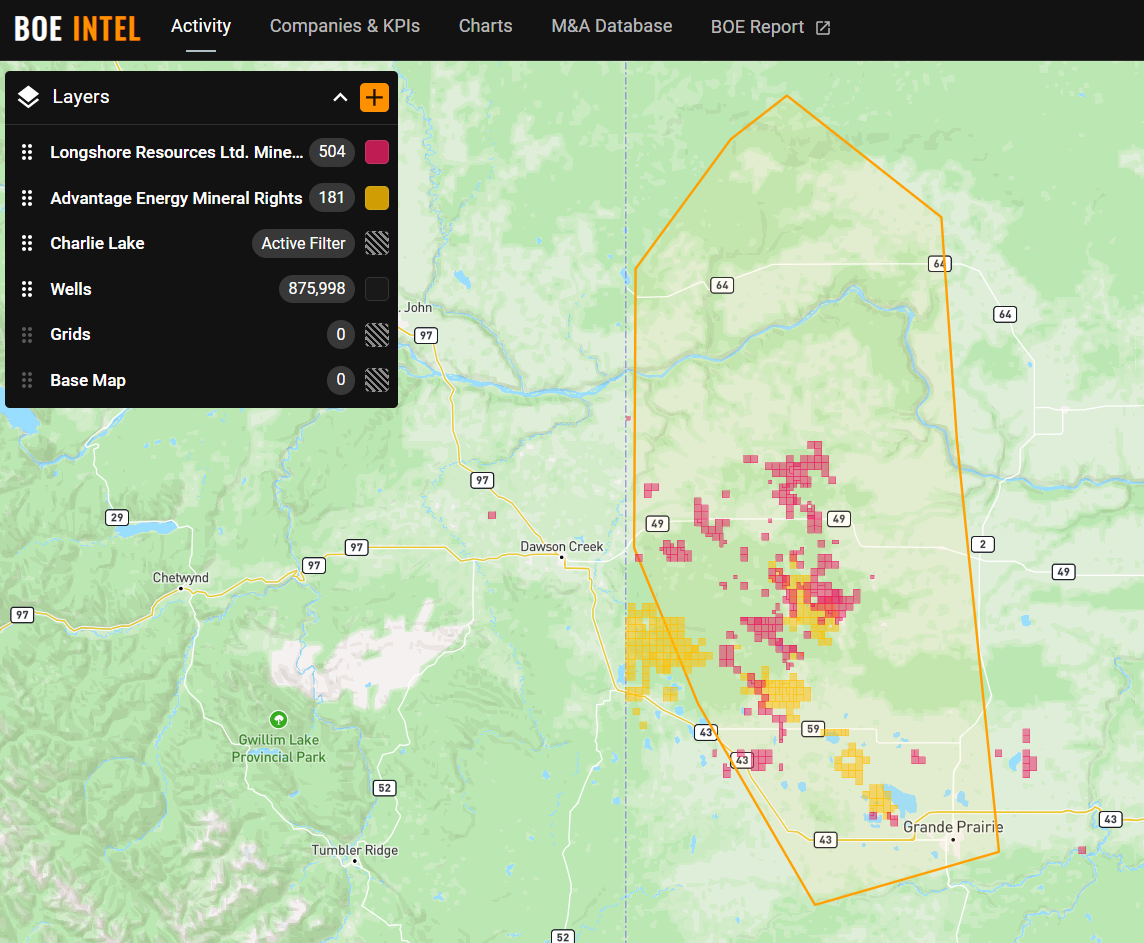

Pictured below are the mineral rights publicly held by Advantage in yellow, and by Longshore in red (Figure 1). See the referenced acquisition presentation for full maps provided by Advantage.

Figure 1

While this acquisition does come with some Montney potential in Alberta and British Columbia, the vast majority of the current production from the acquired Longshore assets comes from the Charlie Lake formation. In fact, Longshore had not spud a Montney well since 2019. Accordingly, we have shown a table for some Charlie Lake transactions from the last few years for comparison.

Figure 2 (turn phone sideways to view table on mobile)

| Date | Type | Acquirer | Target | Deal value | Play | BOE/d | $/BOE/d |

|---|---|---|---|---|---|---|---|

| 2024-06-10 | Asset | Advantage Energy | Longshore Resources | $450,000,000 | Charlie Lake | 14,100 | $31,915 |

| 2024-03-04 | Asset | Bonterra Energy | Archer Exploration | $24,100,000 | Charlie Lake | 330 | $73,030 |

| 2022-07-27 | Corporate | Tourmaline Oil Corp. | Rising Star Resources | $194,300,000 | Charlie Lake | 5,700 | $34,088 |

| 2021-04-12 | Corporate | Tamarack Valley Energy | Anegada Oil Corp | $494,000,000 | Charlie Lake | 12,500 | $39,520 |

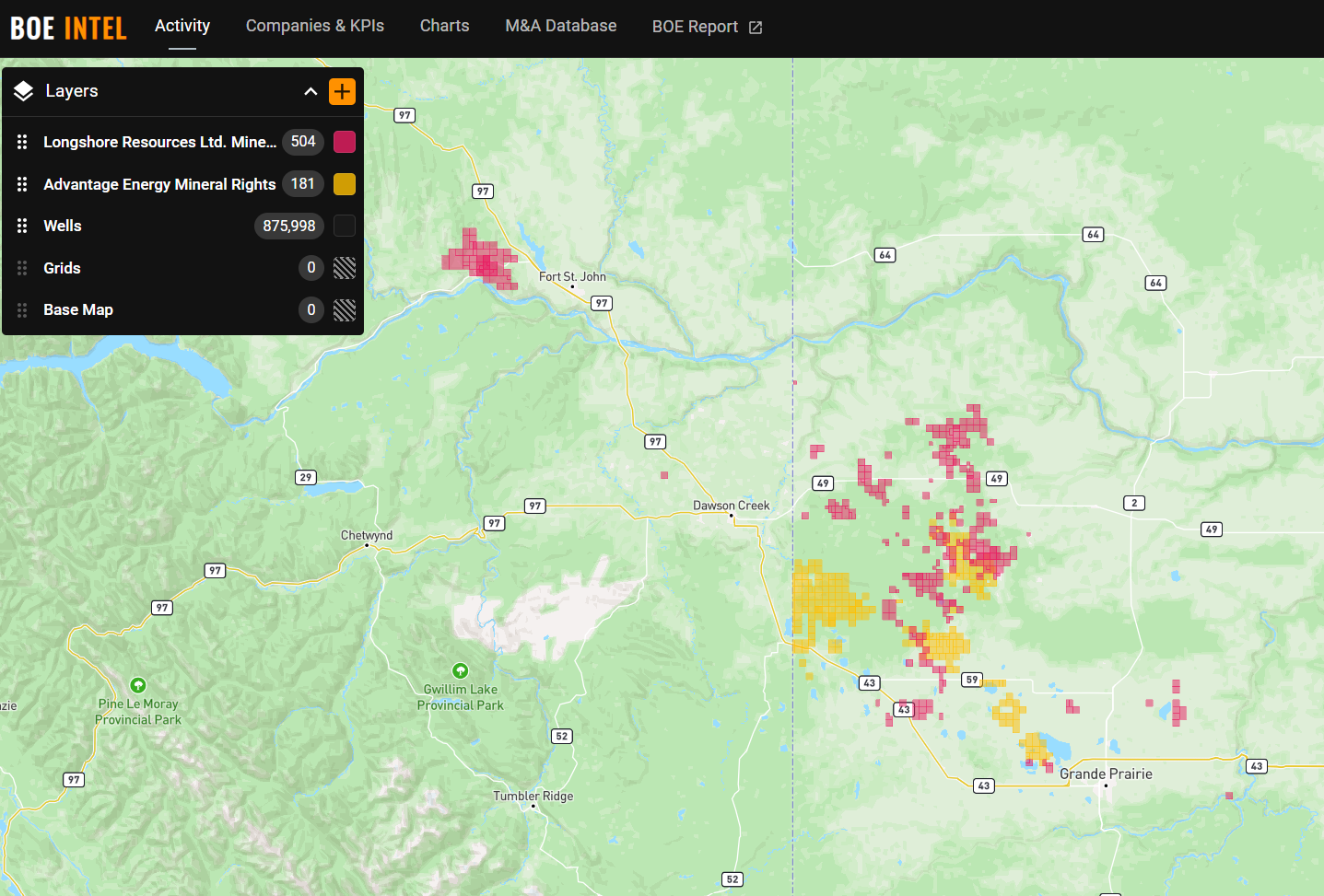

In Advantage’s new presentation, it cites the acquisition as including 37 net sections of Montney rights in Alberta and 33 net sections in BC. The Alberta Montney lands appear to be situated within the boundaries of recent industry Montney activity and nearby Advantage’s own Montney development. The BC lands meanwhile are in an area where there has not been as much Montney activity. The map below (Figure 3) shows Montney spuds over the last 2 years in BC relative to the acquired lands from Longshore.

Figure 3

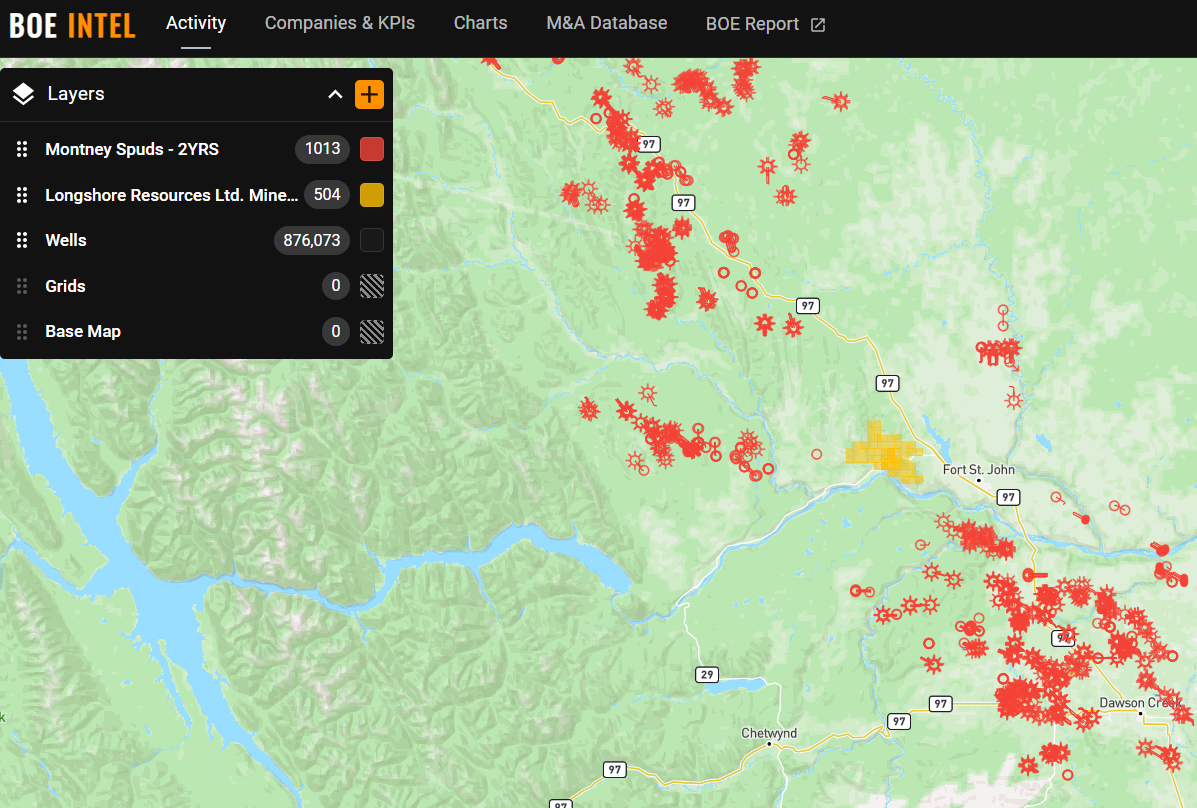

While Advantage had managed to grow its liquids business on a gross basis, and on a percentage of corporate production over the last number of years, this acquisition will further increase the liquids weighting for the company. According to the company’s presentation, the acquisition volumes have a 53% oil/liquids content, relative to Advantage’s Q1 2024 liquids weighting of ~10% (Figure 4).

Figure 4

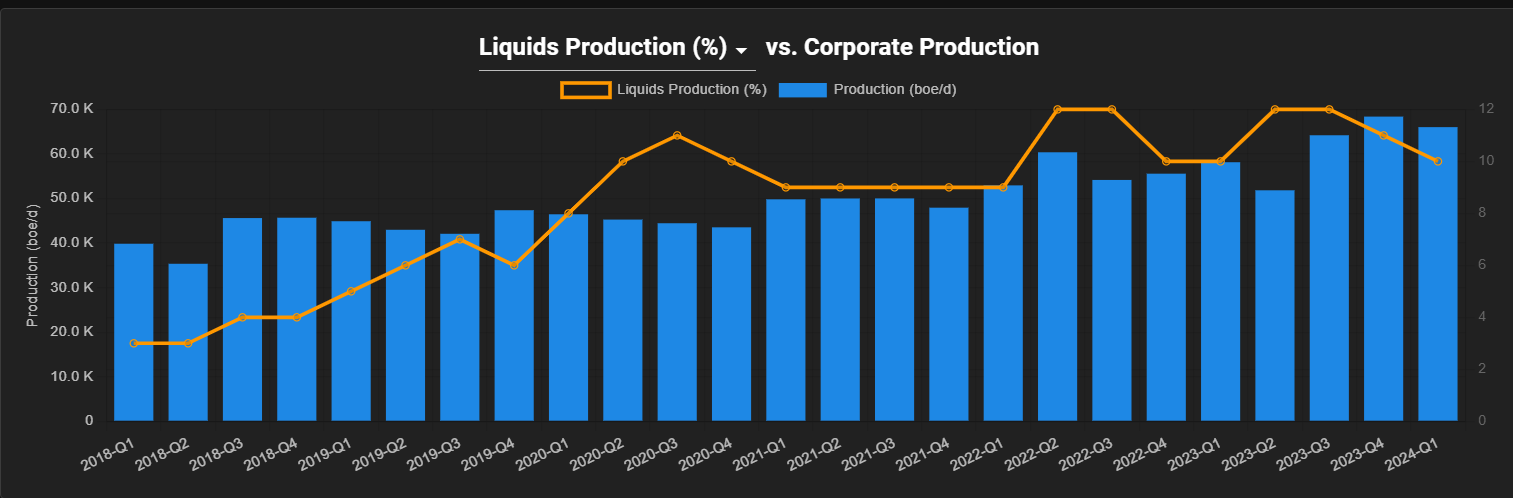

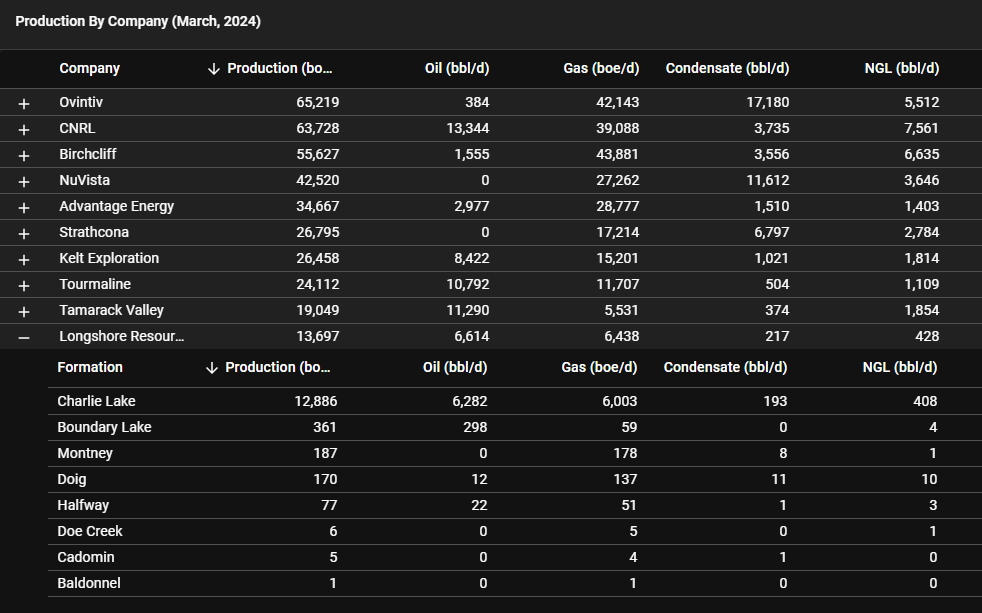

We used some new BOE Intel features to show a little bit more about the Charlie Lake fairway in the graphics below. First we drew an area that encompasses all of the Charlie Lake spud activity over the last 2 years (Figure 5). We were then able to filter the production from the area by formation and by company (Figures 6 and 7).

Within the boundaries of the area drawn, and using March 2024 public data production figures, we found that:

- Longshore’s gross production was ~13,700 BOE/d (almost the entire amount of the total acquisition volumes), including 6,614 bbl/d of oil and 217 bbl/d of condensate.

- Of that ~13,700 BOE/d, 94% of it came from the Charlie Lake formation.

- In terms of Charlie Lake producers in that area, Longshore was the 3rd largest behind only Tourmaline and Tamarack Valley.

If you want to see these new BOE Intel tools in action, reach out to us here for a demo.

Figure 5

Figure 6 – Gross volumes from area drawn

Figure 7 – Gross volumes from area drawn