Bitcoin bounces back big, and competing with booming AI demand for every shred of energy available

The energy world, particularly here in North America, started off 2024 as if it were a movie scene, the sort where people go silent as they feel the ground vibrating, and the vibration grows to a tremor, and the sound picks up, and before you know it they’ve been overrun by a tornado or a herd of buffalo or a military invasion or something, pick your genre. The earth-shaking event was of course the meteoric rise of AI (as Jerry Seinfeld put it, “Aren’t you sick of hearing about AI a thousand times a day?”), and the corresponding jolt to the energy sector.

Companies shrieked at the fear of being left out, and rushed to jump on the AI bandwagon. That aspect wasn’t surprising; no one can even see where the ultimate potential is, and every business is different.

The fur really started flying though when AI-crazed companies started looking around and asking, “Hey, where can I plug this thing in?” Then the power race was on. Multiple tech giants raced to secure energy sources including nuclear power (and it didn’t take long for grid operators to cotton on to what would happen if all the emissions-free baseload power was scooped up by filthy rich tech companies, and that strategy is now on the rocks).

The AI race is just beginning. It is hard to put an actual number on forecast AI power demand, because it is changing so rapidly. Energy infrastructure companies have continuously upgraded AI power demand forecasts, and are giddy at the forecasts (in a recent conference call Kinder Morgan’s chairman said: “ In my decades of experience in the mid-term arena, I’ve never seen a macro environment so rich with opportunities for incremental build-out of natural gas infrastructure.”)

Of perhaps equal significance, or close, is the reawakening of an energy-swilling beast we have nearly forgotten about for 2-3 years – Bitcoin mining.

Four years ago, as Bitcoin prices passed $50,000 per imaginary coin, with the whole world getting into the crypto-mining game, Bitcoin’s power consumption rose to massive levels. In late 2020, Bitcoin data mining was consuming at a rate of 90 TeraWatt-hours (TWh) per year. If Bitcoin mining was a country, that amount would have ranked it the 35th largest power consuming nation on earth. Considering Bitcoin had about zero consumption a decade earlier, this leap was not insignificant.

But that was peanuts. Today, annualized consumption is up 84 percent from those levels to about 166 TWh per year at an annualized rate. That rate bumps Bitcoin up to the equivalent of number 25 on the list of global electricity consumption nations, just ahead of Poland and just behind Egypt.

But hold on, we’re just getting started. Two significant events are about to propel Bitcoin mining into the energy-consumption stratosphere.

First, in April of this year, there occurred what is known in the Bitcoin world as a “halving” – which I think should have been called “the halvening” because well the whole thing is just kind of goofy anyways so why not Hollywood-ize the event. But regardless, at certain intervals, the rate of Bitcoin issuance slows down so as to prolong the party so to speak, because as students of the realm know there will only ever be 21 million BTC coins issued in total, so can’t have them flying out the virtual doors too fast.

How the rate of issuance slows down is the interesting part, particularly with respect to energy consumption. It now requires twice as much computational effort to earn a single Bitcoin. That is by design; Bitcoin is issued as “proof of work”, meaning that actual energy must be expended to earn the stuff. There’s no way around it.

More work is not a problem for industrious miners, if the price is right. And wow is it right. Bitcoin prices have soared past $90,000 US, up a third from the record of just a few months ago. There are a few factors that might be causing that (or, rather, because it is all imaginary, there may be infinite reasons, but we don’t have all day do we), one of which is the halving which is making new Bitcoin harder to come by, and the other is the growing acceptance of crypto by some very big players, including the US government. Trump was not a crypto fan a few years ago, but now wants to make the US, in typically immodest language that will shock no one, “the crypto capital of the planet.” He also speculated about the creation of a national strategic reserve of Bitcoin. Pennsylvania announced plans to do so as well. As of now, the plan is not to buy Bitcoin in the open market, but to keep what is confiscated from criminals or whomever the government goes after. But as more nations and institutions get on the bandwagon, just imagine what will happen. There will be countries and institutions that will pile in through sheer FOMO.

When major governments decide they want to buy up something of which only 21 million will ever be created – let the bidding commence.

The more valuable Bitcoin gets, the more people enter the business to mine it, like a gold rush. So Bitcoin’s ‘managers’ (no one has any idea who they are) make it even harder to generate Bitcoin – meaning, consume more energy – and because Bitcoin is only generated by computer processing, the energy demand can only increase. Imagine Bitcoin hitting $250,000, and see how many Bitcoin miners set up shop in any nook and cranny where they can access power. The limitation will be mining machines (computers), and if miners get their hands on those, they will find power, somewhere, somehow, from whatever source is available. Green is great but whatever. A buck’s a buck.

The more successful Bitcoin gets, the higher the price will go, which will accelerate the hunt for Bitcoin, which will increase power consumption, which will rise until Bitcoins are being issued too quickly, which will result in another halving, which will drive up power consumption. This appears to be a one way street, right to the moon.

And keep in mind: This Bitcoin demand is in addition to the incredible amount of power new AI applications are about to consume, now that pretty much every industry is deciding they must use AI, and if you don’t pursue AI you risk getting left behind.

Over the next few years, there is no visible way to meet all this demand growth except by natural gas. Nuclear is best, but that will take a decade or two to become prevalent (if it can). Bitcoin can afford to run intermittently on renewables (AI can’t), but miners will burn anything necessary to get in on the feeding frenzy. And if the world’s governments begin hoarding Bitcoin, look out.

Belgian think tank envisions a completely bonkers strategy to wean off Russian natural gas: Let’s call it something else!

Bookmark this story for your future reference, for someday when you’re old and gray and want to look back at the depths us humans sunk to in our quest to rapidly revamp the global energy system. We read things now that are so crazy as to be, in normal times, not even worth considering as possible. But these days? No one bats an eye, no matter how insane.

I’m not kidding. Submitted for your consideration:

A recent report from a Belgian think tank considered Europe’s precarious natural gas supply situation, and what to do about it. The report pivots around the odd dance the EU must perform to explain to the world that it is not only weaning itself off Russian natural gas, in addition to claiming its disdain for the stuff in the first place (a carbon based fuel, don’t ya know).

The report was about the EU’s options to source gas after a supply agreement with Russia expires. As the report states, “The EU has a non-binding goal of stopping all Russian gas imports by 2027.” It starts off thoughtfully enough, but then makes a very odd move that is symptomatic of some very weird currents moving beneath the surface, currents that tell participants “Let’s give this a whirl and see if we can get away with it.”

The first proposed solution in the report is to replace Russian supplies with LNG. That makes sense; there are few other ways to access natural gas without pipelines (which are fiendishly difficult to build at scale in the modern world). The world’s LNG business is exploding in size. But that might not be sufficient to meet Europe’s needs for a number of reasons, including the LNG import/distribution infrastructure that would need to be created.

So the report thrusts a second option into the spotlight: Route the Russian gas through Azerbaijan, change its name, ship it to Europe, and act like nothing weird is going on. The EU would now simply be consuming “Azeri gas” and who could have a problem with that?

No really, they’re serious. And this idea is not the product of what you’d expect, it does not originate with a couple of Belgians solving the world’s problems after their 9th pint. The quasi-think tank that came up with this is called Bruegel. Their website claims: “Bruegel’s mission is to improve the quality of economic policy with open and fact-based research, analysis and debate. We are committed to impartiality, openness and excellence.” Bruegel’s membership includes EU Member State governments, international corporations and institutions. Their website lists 58 Research Fellows, 16 Research Assistants, 5 executives on the management team, and a bunch of other staff. So they’re a serious bunch.

And yet they throw out such a crazy idea and think we’ll all take it seriously. I guess that’s what sheer desperation will do. At first read, you might think you’re missing something, that this illustrious group surely knows better than you. But nope. Even the report itself sheepishly admits: “The involved parties might be able to live with such a ‘sneaky’ deal, but it would expose a massive degree of cynicism and by its very nature would encourage opacity and ultimately corruption.” A massive degree of cynicism – gee, ya think?

I hate to break it to them, but they aren’t the first to propose such a scheme: The Trailer Park Boys introduced a version of this a decade ago. Ricky had poor oaf Trevor go to random houses and move their patio furniture and barbecues to the roadside, whereby Ricky would saunter by and “pick up the garbage.”

Ricky, Bubbles and Julian – Canadian Research Fellows.

I guess it all fits. Azerbaijan is currently hosting COP 29, and a senior official from the host country’s COP29 team was apparently recorded helping put together “potential fossil fuel deals”. The same BBC report indicates that last year’s COP28 sported the same jaunty outfit when the UAE, host of COP28, allegedly used the conference to “strike oil and gas deals”.

Some days I really miss good old-fashioned goofy/slapstick shows like Trailer Park Boys. Some days I just turn on the news.

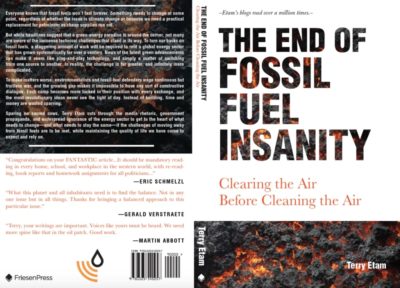

It’s all happening as foretold in…this. Gee, an energy transition isn’t quite so simple. Find out what readers knew years ago in The End of Fossil Fuel Insanity – the world of energy, in tolerable bites. Available at Amazon.ca, Indigo.ca, or Amazon.com.

Read more insightful analysis from Terry Etam here, or email Terry here.