Major M&A news last week in the Alberta Montney, as Ovintiv is set to acquire ~70,000 BOE/d of production from Paramount Resources for $3.325 billion. From its side, Paramount quoted these volumes as 67,600 BOE/d based on third quarter 2024 sales volumes.

See Ovintiv’s acquisition press release here, and the company’s updated corporate presentation here.

See Paramount’s disposition press release here.

In a separate transaction with an unnamed buyer, Ovintiv announced a disposition of its Uinta assets for USD$2 billion (CAD$2.815 billion). The Uinta assets had production of 29 mbbl/d in Q3, suggesting a flowing barrel price of ~CAD$97,069/bbl/d for these assets.

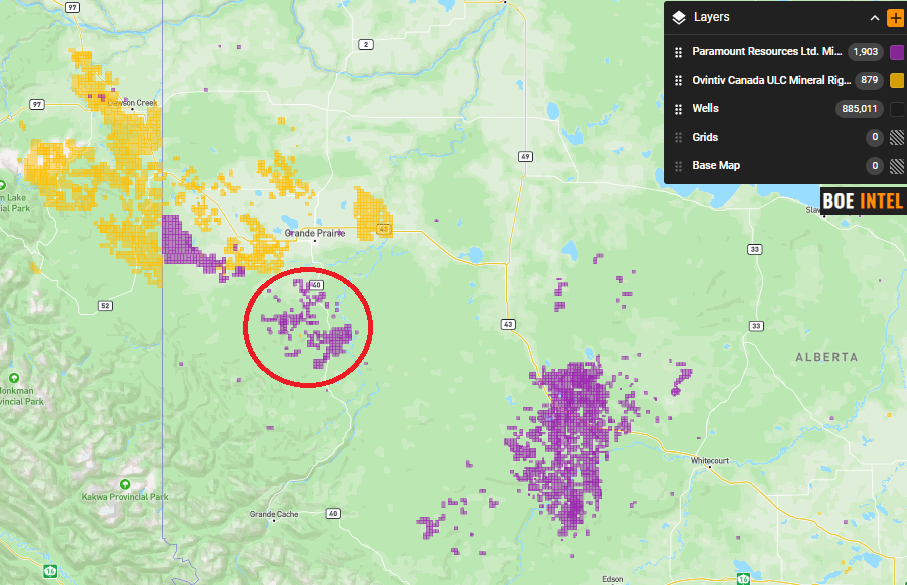

The Montney assets being acquired by Ovintiv are from Paramount’s Karr and Wapiti properties. From a public data point of view, we show the general area circled in red below. Figure 1 shows the crown mineral rights held by Paramount in purple and Ovintiv in yellow. These mineral rights reflect all zones and not exclusively Montney.

Also being acquired by Ovintiv are Paramount’s Zama properties in northwest Alberta, which were permanently shut-in by Paramount and do have some ARO (asset retirement obligations) associated with them (see p.28-29 of Paramount’s 2023 AIF for comments on the ARO of these properties).

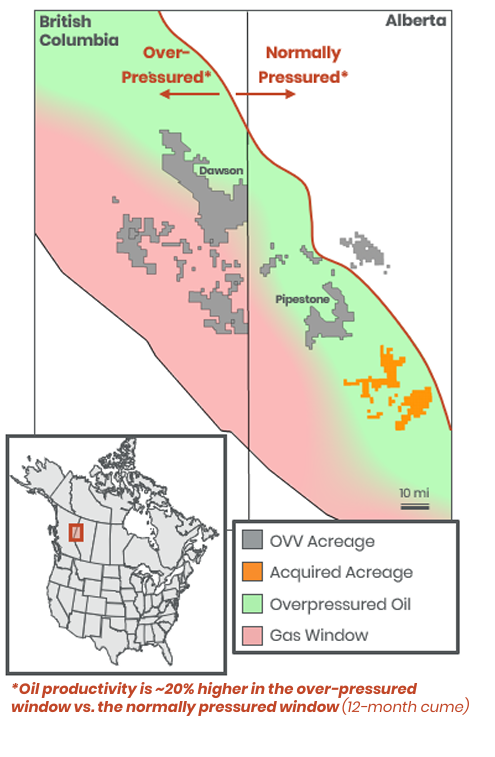

Figure 2 shows the asset map from the updated Ovintiv corporate presentation.

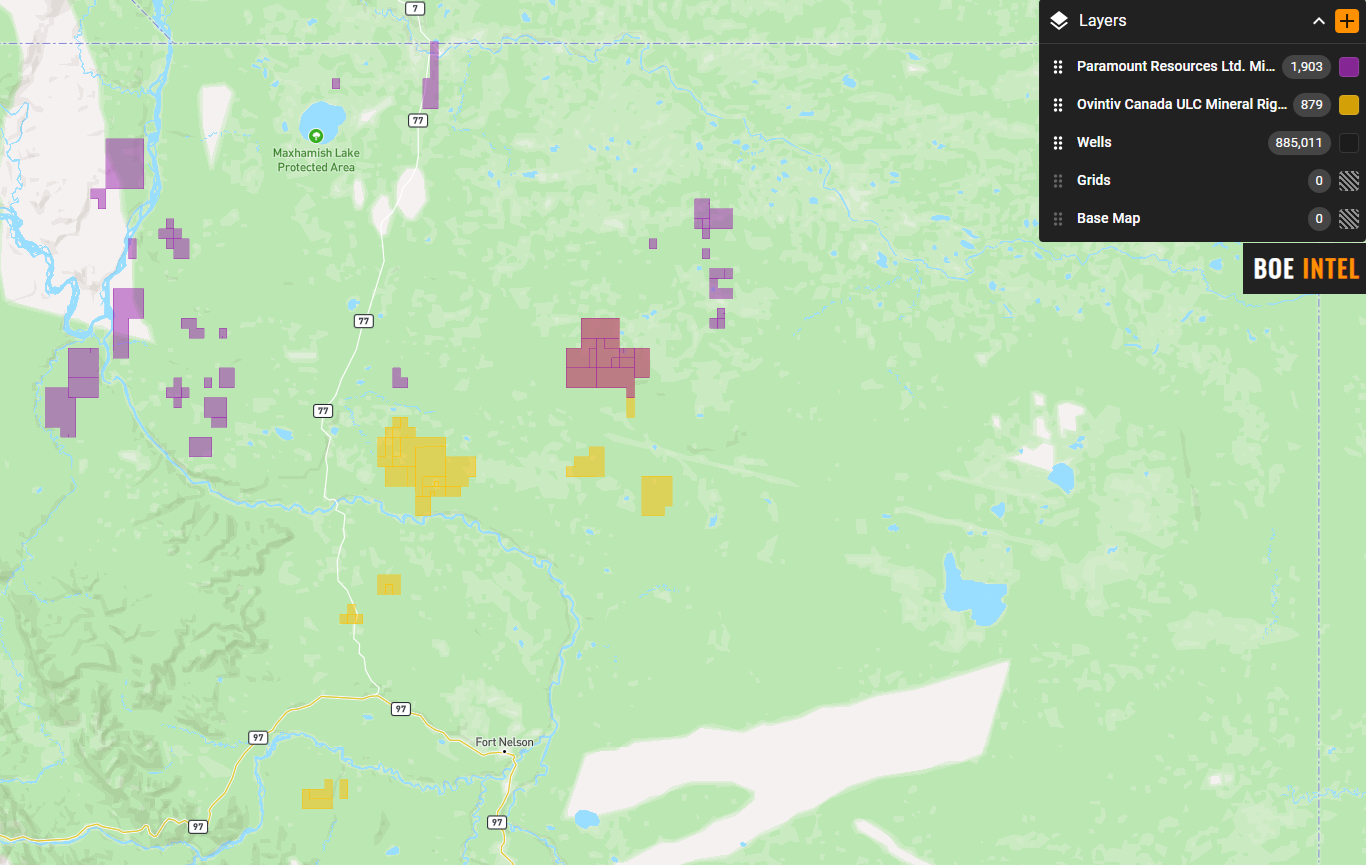

Paramount will also receive Horn River assets from Ovintiv (Figure 3). Paramount has put together quite a dominant position in the hyper-prolific Liard/Horn River area, as readers will recall that in early 2024 the company was also able to consolidate acreage from Chevron and complete a JV transaction with Woodside.

Figure 1 – Crown mineral rights (all zones) held by Paramount Resources and Ovintiv

Figure 2 – Montney acquisition map as per new Ovintiv corporate presentation

Source: Presentations and Events – Ovintiv

Figure 3 – Crown mineral rights held by Paramount Resources and Ovintiv – Horn River area

The Montney continues to be one of the premier plays in Canada and is often sought after in M&A. Figure 4 below shows some of the larger Montney M&A comparables from the last few years.

Figure 4 – M&A comparables – BOE Intel (turn sideways to view full table on mobile)

| Date | Type | Acquirer | Target | Value ($) | Region/Play | BOE/d | % liquids | $/BOE/d |

|---|---|---|---|---|---|---|---|---|

| 2024-11-14 | Asset | Ovintiv | Paramount Resources | 3,325,000,000 | AB Montney | 70,000 | 50 | 47,500 |

| 2024-08-12 | Corporate | Tourmaline Oil Corp. | Crew Energy | 1,300,000,000 | BC Montney | 29,500 | 44,068 | |

| 2023-11-06 | Corporate | Crescent Point | Hammerhead Energy | 2,550,000,000 | Alberta Montney | 56,000 | 48 | 45,536 |

| 2023-08-01 | Corporate | Strathcona Resources | Pipestone Energy Corp. | 920,000,000 | Montney | 33,143 | 41 | 27,759 |

| 2023-03-28 | Asset | Crescent Point | Spartan Delta Corp. | 1,700,000,000 | Alberta/Montney | 38,000 | 55 | 44,737 |

| 2022-06-28 | Corporate | Whitecap Resources | XTO Energy Canada | 1,700,000,000 | Montney/Duvernay | 32,000 | 30 | 53,125 |

| 2022-03-28 | Corporate | Vermilion Energy | Leucrotta Exploration | 477,000,000 | Montney | 13,000* | 36,692 | |

| 2021-11-10 | Corporate | Canadian Natural Resources Limited | Storm Resources | 960,000,000 | Montney | 28,267 | 19 | 33,962 |

| 2021-06-11 | Corporate | Tourmaline Oil Corp. | Black Swan Energy | 1,100,000,000 | North Montney | 50,000 | 22,000 |

*Press released acquisition volumes of 13,000 BOE/d were a forward looking number. Actual volumes at the time were likely significantly lower.

**BC Montney transactions highlighted in green