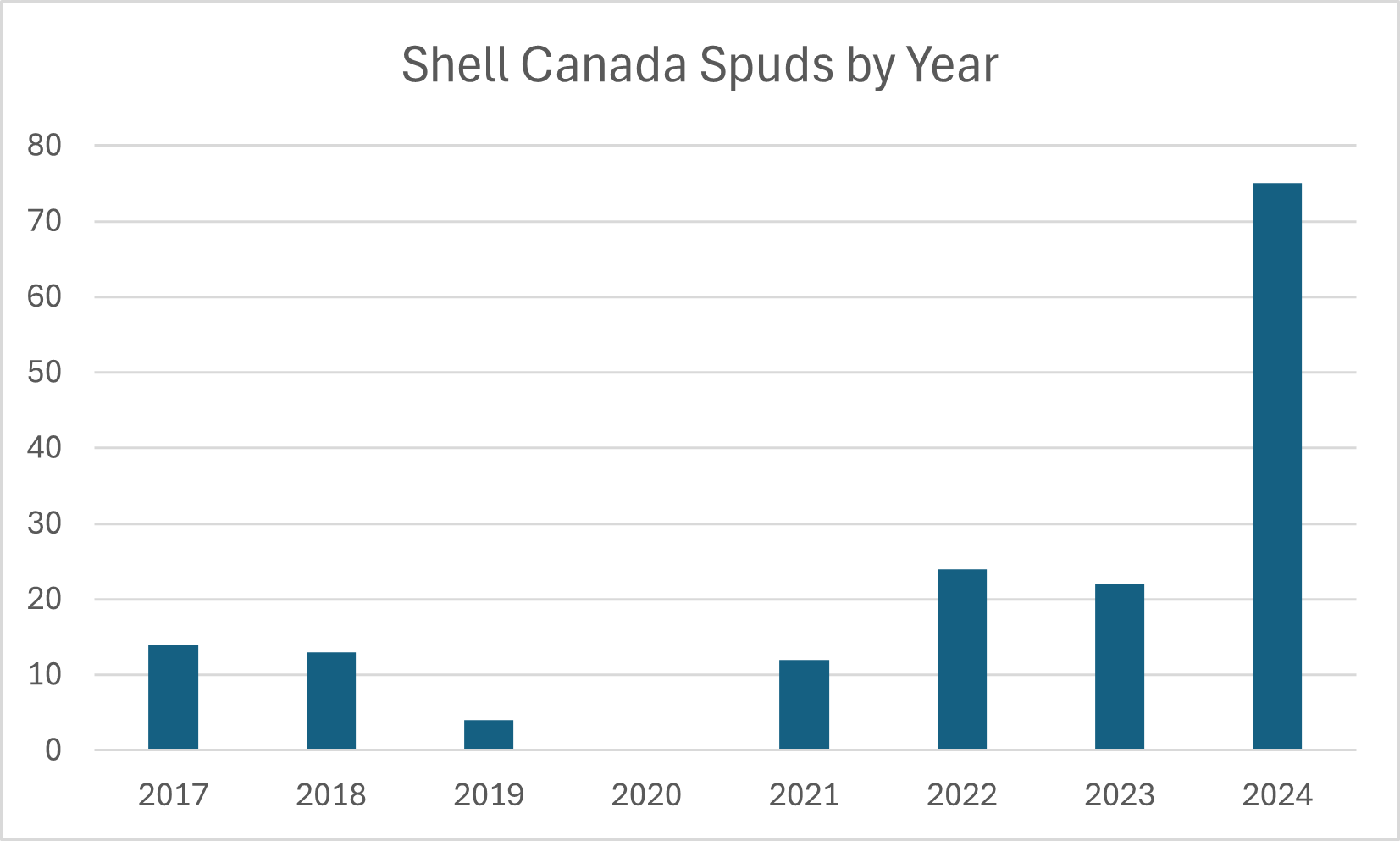

Shell Canada has been rather quiet in Canada for a number of years. Yes, the company has been steadily building out LNG Canada for several years (recall that Shell is the lead partner in the LNG Canada partnership), but its upstream activity has generally been fairly modest over the last number of years. Recently, that has changed. The timing of this surge in activity and the imminent startup of LNG Canada (expected in mid-2025) is likely no coincidence.

To date in 2024, Shell Canada has spud 75 wells, with 73 of those coming in British Columbia. This matches the number of wells spud by Shell over the prior 6 years….combined.

BOE Intel subscribers can click here to head directly to Shell’s company page on BOE Intel.

Figure 1 – Shell Canada spuds by year

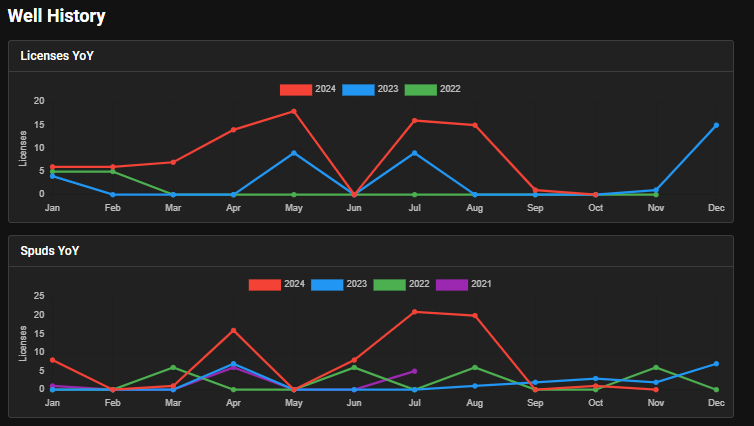

Figure 2 – YoY history for Shell Canada licences and spuds

To date in 2024 Shell has brought 27 wells on production according to BOE Intel public data. With a number of wells from 2024 yet to be placed on production, it appears that the company is planning for some stronger production levels for the startup of LNG Canada.

Monthly gross licensed production (all wells licensed to Shell Canada at 100% working interest) from Shell Canada has bounced around between 90-114 MBOE/d in 2024. While these are gross volumes, it’s worthwhile to recall that Shell does have a JV with PetroChina at Groundbirch. Figure 3 below shows the monthly gross licensed production figures. The drop-off in production in mid-2021 was due to the transfer of well licences from Shell to Crescent Point (now Veren) as a result of this transaction, but since then the company’s production has been reasonably flat.

Figure 3 – Shell Canada gross licensed production

The startup of LNG Canada is a closely watched event for Canadian natural gas producers, many who have struggled through sub $1 natural gas prices in Canada for much of this year. Whether it will result in a boost to prices depends, in part, on the response from the major gas producers in Canada. Use BOE Intel to stay informed on changes in activity levels and the impact that will have on the 2025 outlook.