LNG Canada is expected to be only months away from first export of liquified natural gas. A recent update suggested that first shipment would be in July 2025, while just yesterday LNG Canada announced that it took delivery of its first import cargo as a step towards getting the plant ready for export in the middle of 2025.

It’s a massive step forward for LNG Canada and Canadians broadly as for the first time ever our country’s natural gas will find a market other than Canada or the United States.

It’s an accomplishment that should be celebrated coast to coast.

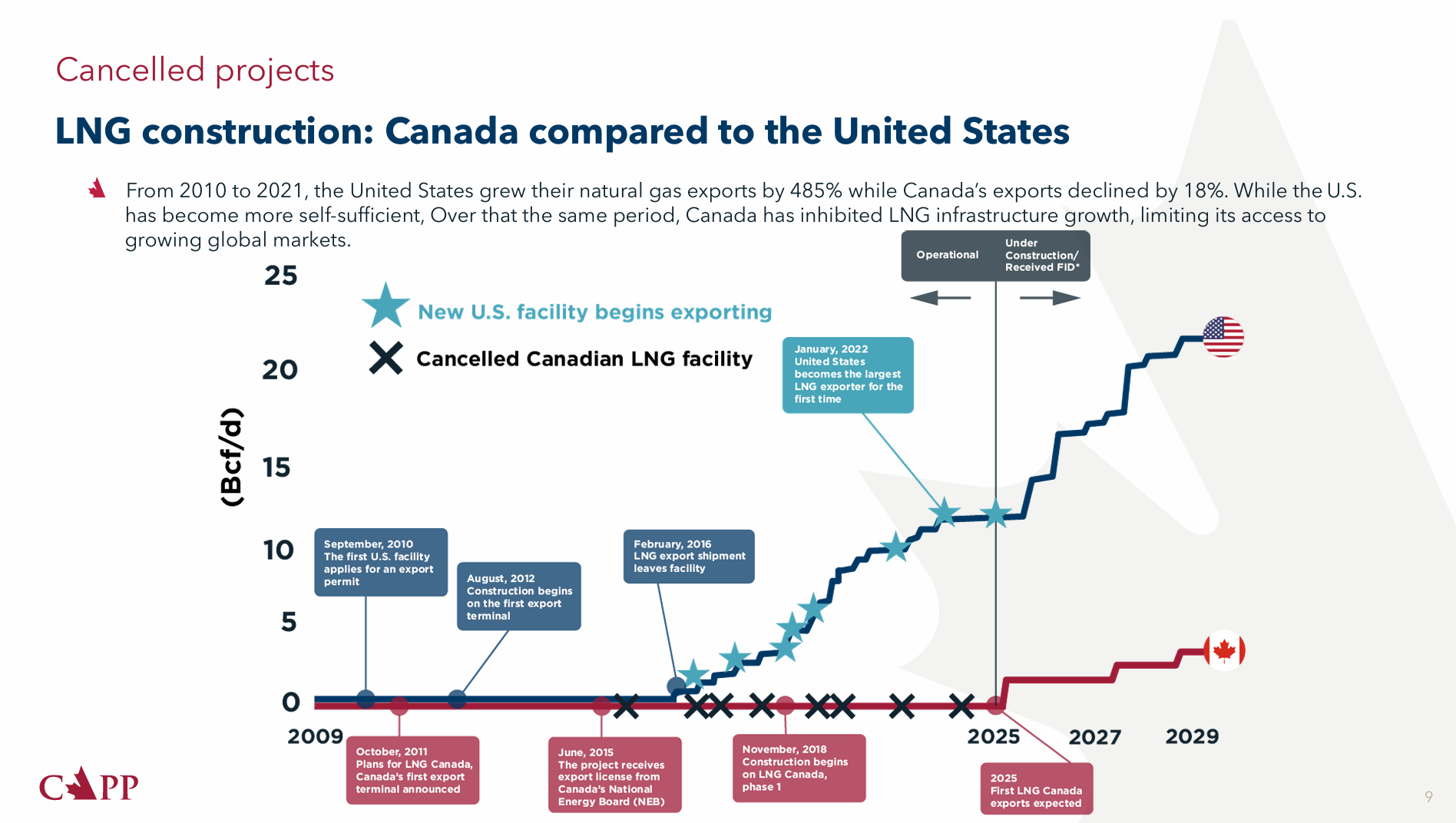

Still – there is much more to do. Consider the chart below from the recent CAPP report and wonder about what could have been.

Canada and the United States both began proposing LNG export facilities at roughly the same time in the early 2010’s. In typical ‘let’s not wait around fashion’, the United States seized the moment and has become the world’s largest LNG exporter in the world since then. Canada has exported zero. Nothing.

One recent study by S&P Global suggested that the US LNG industry has contributed $408 billion to US GDP since 2016, supporting an average of 273,000 direct, indirect, and induced US jobs. That type of GDP contribution and job creation sure would’ve been nice for Canada as it ranks near dead last compared to its peers in per capita GDP growth over the last decade. File that under ‘what could have been’ I guess.

Source: Building Canada’s Future – CAPP

Still, all hope is not lost. LNG Canada Phase 1 start up is happening, and that will come with initial capacity of 1.8 BCF/d, roughly 10% of Canadian natural gas production. Other projects are in the works to build on that success. See the table below for some potential Canadian LNG projects working their way through the regulatory and construction process.

The Canadian election will no doubt play a role in how many of these projects end up going ahead, and at what speed they are able to go. For now, in words at least, LNG seems to have bipartisan support from Liberals and Conservatives. Whether that continues post-election remains to be seen, but it appears that Canada for the moment is united behind LNG development.

The opportunity is there for Canada to become a major player in worldwide LNG markets. Will we seize the opportunity?

|

Project Name

|

Location

|

Status

|

Timeline (First Export)

|

Capacity (MTPA)

|

Capacity (Bcf/d)

|

Key Details

|

|---|---|---|---|---|---|---|

|

LNG Canada (Phase 1)

|

Kitimat, BC

|

Near complete

|

Mid-2025

|

14

|

~1.8

|

First large-scale export facility; Shell-led with international partners.

|

|

Woodfibre LNG

|

Squamish, BC

|

Under construction

|

2027

|

2.1

|

~0.3

|

Smaller project, electrified with BC Hydro power; Enbridge-backed.

|

|

Cedar LNG

|

Kitimat, BC

|

Construction started (FID June 2024)

|

2028

|

3

|

~0.4

|

Floating LNG, Haisla Nation-led with Pembina; fully electrified.

|

|

LNG Canada (Phase 2)

|

Kitimat, BC

|

Proposed (no FID)

|

Early 2030s (if approved)

|

14

|

~1.8

|

Expansion of Phase 1.

|

|

Ksi Lisims LNG

|

Pearse Island, BC

|

In regulatory process

|

Early 2030s (if approved)

|

12

|

~1.7–2

|

Nisga’a Nation and Rockies LNG-backed; environmental review due spring 2025.

|

|

Tilbury LNG (Phase 2)

|

Delta, BC

|

Proposed (assessment submitted)

|

2028 (if approved)

|

2.5

|

~0.3

|

FortisBC expansion; adds to existing capacity for export and local use.

|

|

Kitimat LNG

|

Bish Cove, near Kitimat, BC

|

Proposed (no FID)

|

Uncertain

|

10

|

~1.3

|

Chevron and Woodside partnership; delayed but still viable.

|