A couple weeks ago, we had profiled Shell Canada with the apparent indication that the company has picked up its spud activity in 2024, perhaps in anticipation of the startup of LNG Canada, which is expected by the middle of 2025.

It’s time to check in on another one of the LNG Canada partners: PETRONAS.

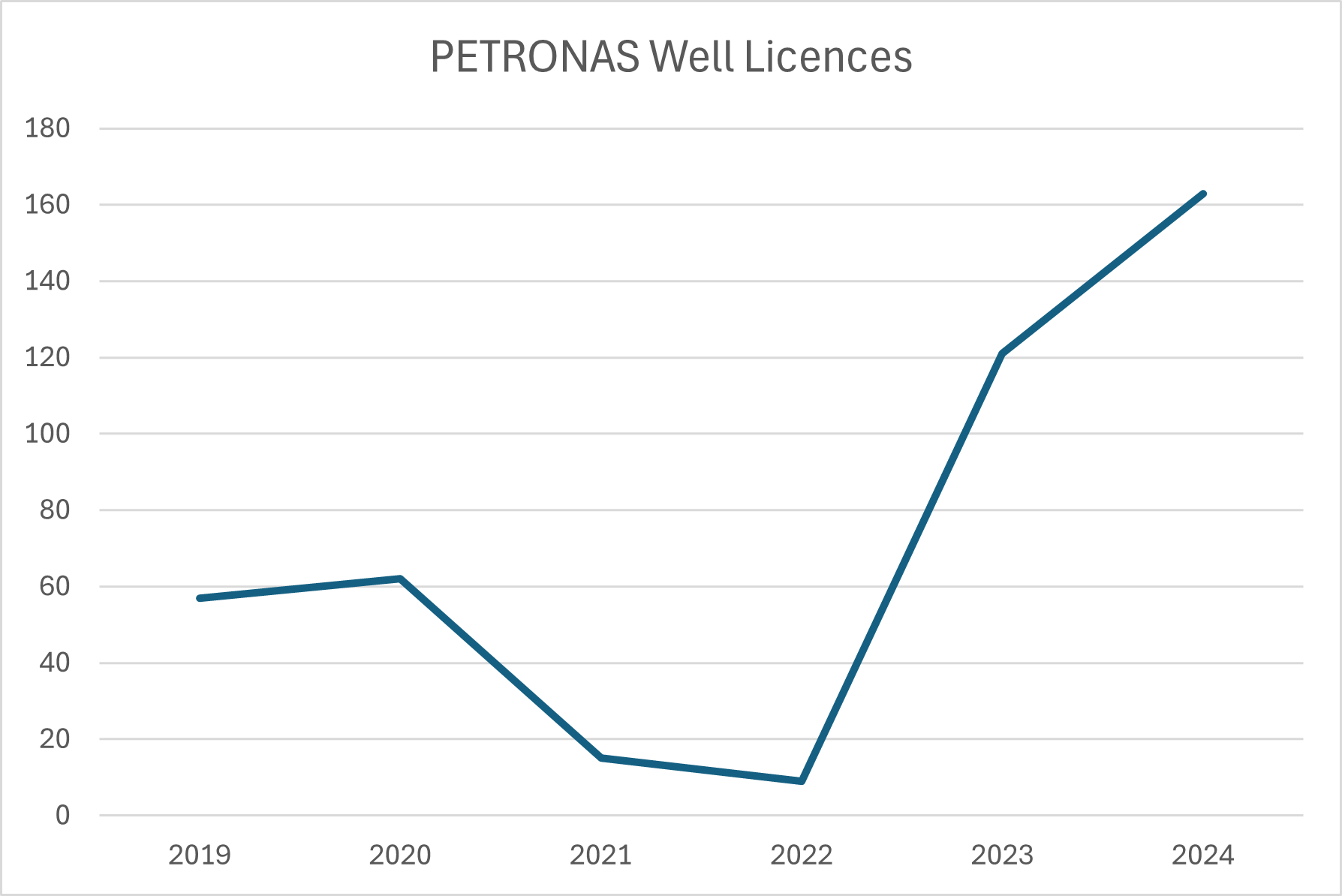

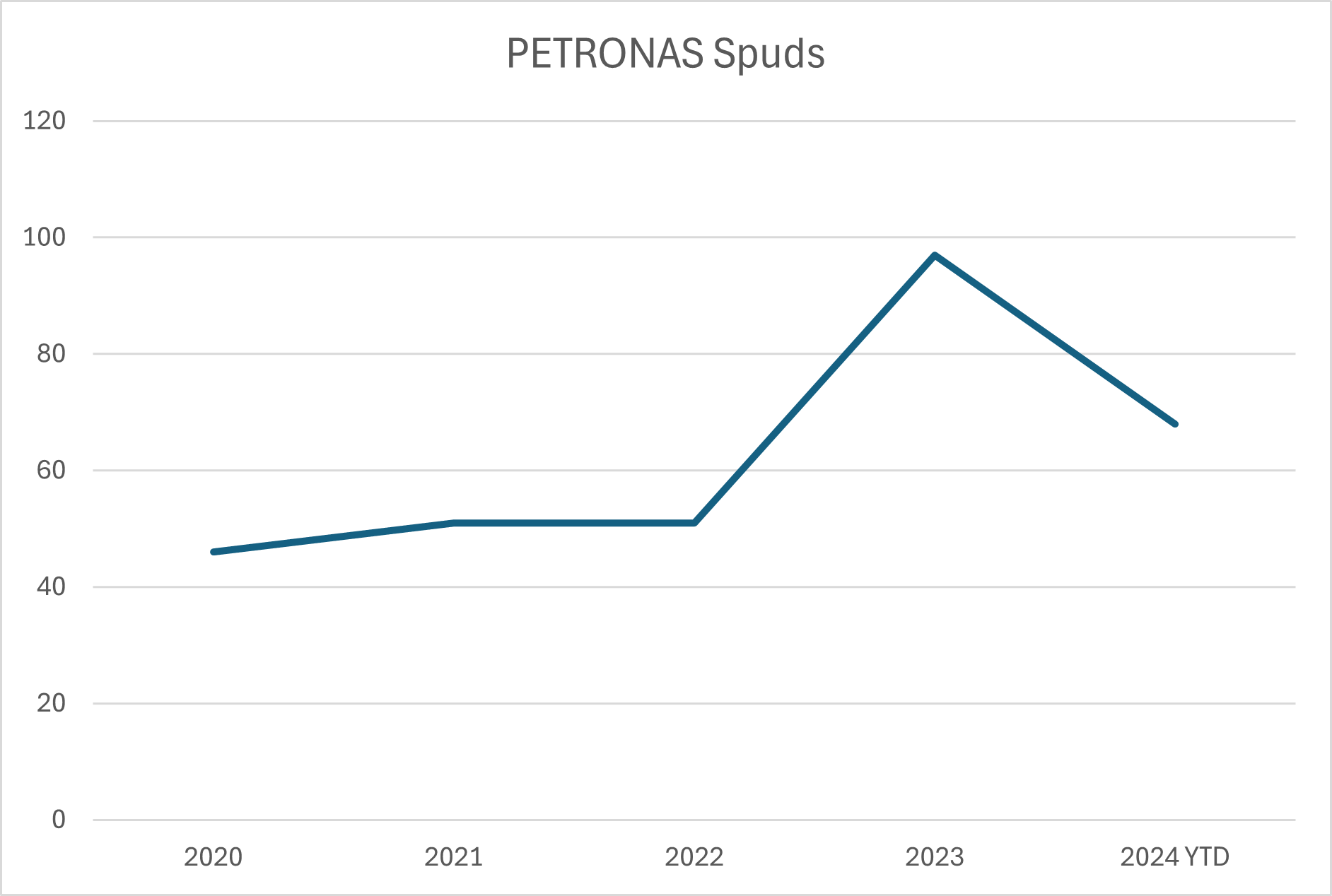

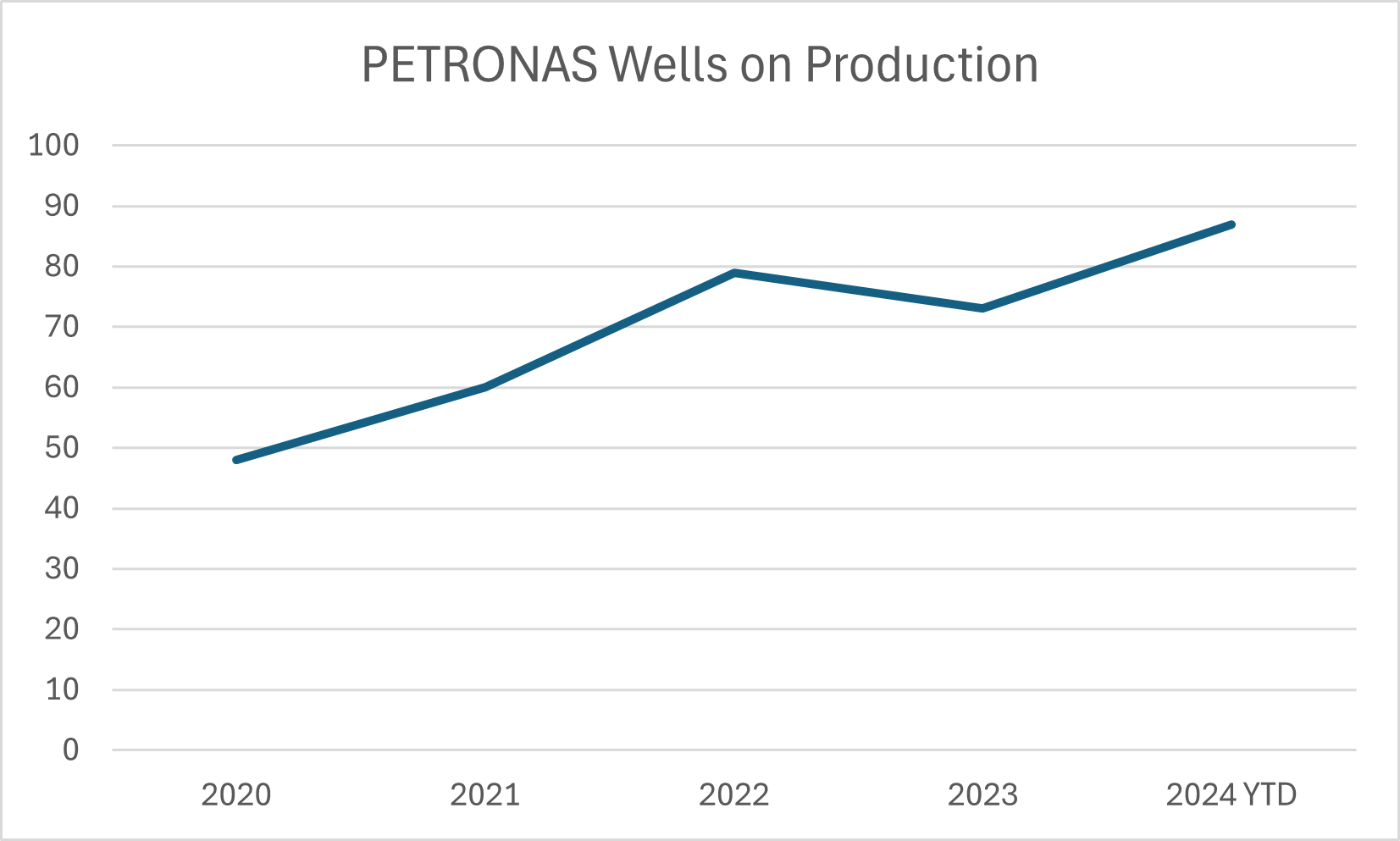

From an activity point of view, it really depends on exactly what part of the process you are looking at, as one can spot several different trends based on the public data. 2023 and 2024 were both years that PETRONAS Energy Canada was able to obtain a significant number of licences compared to its prior history (Figure 1), although spud activity tells a slightly different story as 2024 is shaping up to be a down year relative to 2023 from a new spud perspective (Figure 2). Just to further complicate matters, PETRONAS has brought more wells on production in 2024 compared to the prior year (Figure 3).

Figure 1 – PETRONAS Energy Canada well licences by year

Figure 2 – PETRONAS Energy Canada spuds by year

Figure 3 – PETRONAS Energy Canada wells on production by year

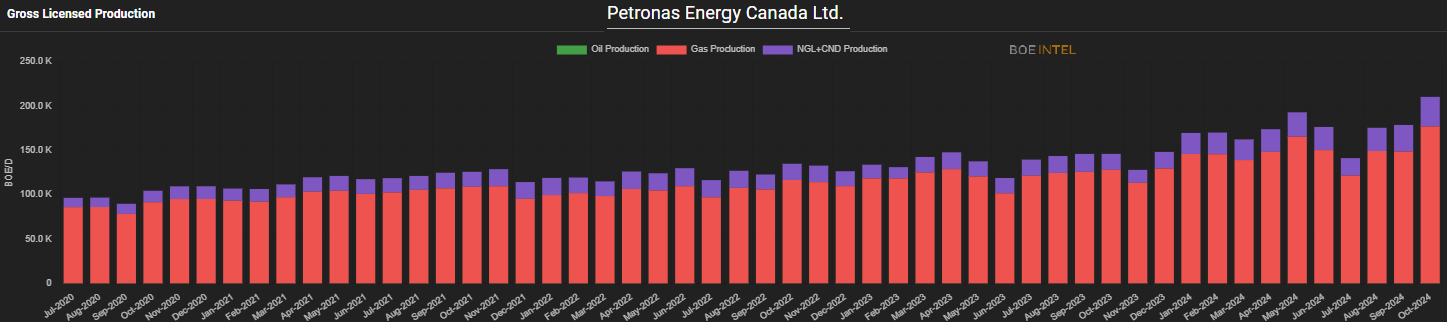

This has resulted in steady growth in production volumes for the company. October production data shows PETRONAS has exceeded 210 MBOE/d for its first time (on a gross licensed basis), with natural gas volumes exceeding 1 BCF/d for the first time as well in October (gross licensed natural gas volumes of 1.06 BCF/d in October 2024). These are gross volumes licensed to PETRONAS at a theoretical 100% working interest. Net volumes would be dependent on the company’s joint venture agreements within its North Montney Joint Venture (NMJV), or any other working interest sharing agreements.

Figure 3 – Gross Licensed Production for PETRONAS Energy Canada Ltd. – BOE Intel