The discount on Western Canada Select to the North American benchmark West Texas Intermediate futures widened on Friday. WCS for August delivery in Hardisty, Alberta, settled at $10.20 a barrel under the U.S. benchmark WTI, according to brokerage CalRock, compared with $10 a barrel on Thursday. * The differential between Canadian heavy crude and the U.S. benchmark has been wider in July than it was last month, when concerns about wildfires in Canada's oil-producing regions led to a temporary [Read more]

European Commission proposes Russian oil price cap 15% below global price

The European Commission proposed on Friday a floating price cap on Russian oil of 15% below the average market price of crude in the previous three months, EU diplomats said. The European Union and Britain have been pushing the Group of Seven nations to lower the cap for the last two months after a fall in oil futures made the current $60 a barrel level largely irrelevant. Brent crude has since rebounded somewhat, and settled on Friday at $70.36 per barrel. The G7 price cap, aimed at curbing [Read more]

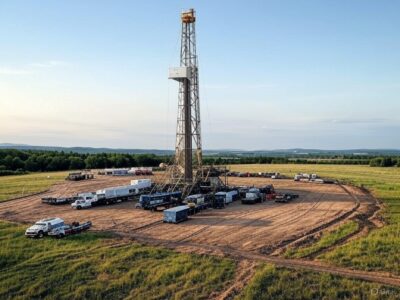

US oil/gas rig count down for 11th week to lowest since 2021, Baker Hughes says

U.S. energy firms this week cut the number of oil and natural gas rigs operating for an 11th week in a row for the first time since July 2020 when the COVID-19 pandemic cut demand for the fuel, energy services firm Baker Hughes said in its closely followed report on Friday. The oil and gas rig count, an early indicator of future output, fell by two to 537 in the week to July 11, the lowest since October 2021. Baker Hughes said this week's decline puts the total rig count down 47 rigs, or 8% [Read more]

Taiwan’s CPC Corp eyes US shale gas assets, sources say

Taiwan's state-owned energy company CPC Corp is in early stage discussions to buy shale-gas producing assets in the United States, three sources familiar with the matter said, in a bid to secure natural gas supplies to fuel Taiwan's economy. If a deal is struck, CPC would join a growing list of Asian companies taking ownership of U.S. natural gas assets, gaining exposure to the commodity at a time that the United States is expanding its export capacity by building more liquefied natural gas [Read more]

Saudi Arabia complying fully with voluntary OPEC+ target, energy ministry says

Saudi Arabia's energy ministry said on Friday the kingdom had been fully compliant with its voluntary OPEC+ output target, adding that Saudi marketed crude supply in June was 9.352 million barrels per day, in line with the agreed quota. The statement follows a report this month by the International Energy Agency (IEA), which said that Saudi Arabia exceeded its oil output target for June by 430,000 barrels to reach 9.8 million barrels, compared to the kingdom's implied OPEC+ target of 9.37 [Read more]

US natgas end-of-season storage seen at three-year low in October

U.S. natural gas storage is on track to end the April-October summer injection season at a three-year low of 3.797 trillion cubic feet (tcf) on October 31, 2025, according to analysts' estimates. That compares with an eight-year high of around 3.938 tcf at the end of the summer injection season in 2024 and a five-year (2020-2024) average of 3.782 tcf. Looking ahead, analysts esimtate stockpiles were on track to end the November 2025-March 2026 winter withdrawal season at a four-year low of [Read more]

US natgas prices steady as rising LNG exports offset less hot forecasts

U.S. natural gas futures held steady on Friday as rising flows to liquefied natural gas (LNG) export plants offset forecasts for less hot weather and lower demand next week than previously expected. Front-month gas futures for August delivery on the New York Mercantile Exchange rose 1.4 cents, or 0.4%, to $3.351 per million British thermal units at 9:14 a.m. EDT (1314 GMT). For the week, the contract was down about 2% after falling about 9% last week and 3% two weeks ago. Meteorologists [Read more]

Stocks fall, gold rises after Trump sets tariff sights on Canada

Global stocks fell on Friday after U.S. President Donald Trump intensified his tariff war against Canada, leaving Europe squarely in the firing line, sparking a modest investor push into safe havens such as gold. The Canadian dollar fell after Trump issued a letter late on Thursday that said a 35% tariff rate on all imports from Canada would apply from August 1. The European Union was set to receive a letter by Friday. The U.S. president, whose global wave of tariffs has upended businesses [Read more]

Canada back in tariff crosshairs

What matters in U.S. and global markets today By Mike Dolan, Editor-At-Large, Finance and Markets Although markets are trying to shrug off the week's U.S. tariff threats as yet another negotiation tactic, there's growing unease at the daily barrage, the latest being a 35% tariff on Canadian goods and higher levies on other countries. It's Friday, so today I'll provide a quick overview of what's happening in global markets and then offer you some weekend reading suggestions away from the [Read more]

Oil climbs on potential Russia sanctions; OPEC+ output, tariffs weigh

Oil prices rose on Friday after U.S. President Donald Trump said he would make an announcement regarding Russia, raising the prospect of more sanctions on the major oil producer, while tariff concern and rising OPEC+ output capped gains. Brent crude futures were up 19 cents, or 0.28%, at $68.83 a barrel as of 0408 GMT. U.S. West Texas Intermediate crude ticked up 24 cents, or 0.36%, to $66.81 a barrel. So far this week, Brent has added 0.8% and WTI has dipped 0.2%. Both contracts lost [Read more]