Canada’s oil patch has been the victim of bad PR for the past several years. Canadian crude has been labelled dirty, heavy, sour, and environmentally unfriendly. Canada hasn’t been able to make any progress on new pipelines, and the United States remains the only viable export market. Energy executives are openly wondering whether it makes sense to invest in this country. In addition to that negative sentiment, Canadian crude sells for about 60 per cent less than its American counterpart, West [Read more]

Column: The importance and opportunity for Canadian oil

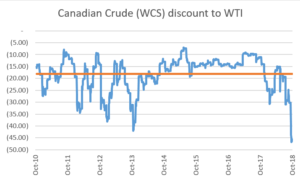

In this article, I will attempt to de-mystify the difference between Canadian Crude and WTI (West Texas Intermediate) as we at Auspice Capital Advisors believe global investors may find a more clear way to gain crude oil exposure with an edge beyond WTI. Historically, this opportunity was only available to wholesale energy traders. As a result, the Canadian Crude market is something that is not well understood. However, given this is the largest foreign supply to the US (greater than Saudi [Read more]

Canadian Crude is outperforming

While globally Crude Oil has been in a tight range the last couple months, the price of crude has risen since the election of Donald Trump last November. However, the top performer in both the period between the election and December 30th and in the first 60 days of 2017 is the Canadian Crude Index (CCI). Term WTI (prompt) WTI (basket) USO ETF CCI Reference Price CCI ER (Investable) CCX ETF Nov 8 – Dec 30/16 18% 19% 16% 26% 22% 22% First 60 days [Read more]