VANCOUVER - The latest round of applications is now open under a $100-million fund aimed at cleaning dormant oil and gas wells in British Columbia. B.C. Energy Minister Bruce Ralston says the second half of the funding is set to be dispersed in the coming months after the first $50 million supported about 1,000 jobs and reclamation activities at nearly 1,900 sites. He says the first round included $15 million worth of work on sites in B.C.'s agricultural land reserve and dormant well sites [Read more]

Headlines

Hemisphere Energy provides corporate and operations update

Vancouver, British Columbia - Hemisphere Energy Corporation (TSXV: HME) ("Hemisphere" or the "Company") is pleased to provide an update on corporate activities and its Southern Alberta oil assets. Although 2020 had considerable challenges, Hemisphere made several important achievements throughout the year. Focus remained on debt reduction through limiting capital expenditures, minimizing costs, and maximizing profitability even when that included shutting in production. Capital spending [Read more]

O’Toole pushes U.S. envoy to Canada to preserve Line 5, Keystone XL pipelines

OTTAWA - Conservative Leader Erin O'Toole urged the acting American ambassador to Canada to tell Washington to preserve the Line 5 pipeline to the United States. O'Toole told Katherine Brucker that he was disappointed by President Joe Biden's decision to cancel Keystone XL pipeline on his first day in office last month. O'Toole also said if the governor of Michigan follows through on plans to shut down Line 5 by May it would have a negative economic impact on both countries. About 87 [Read more]

ARC Resources to merge with Seven Generations in all-stock deal

ARC Resources Ltd and Seven Generations Energy Ltd have entered a $8.1 billion all-stock merger agreement that will create Canada's sixth-largest energy company. The combined company will become the biggest operator in Western Canada's premier Montney shale play, producing more than 340,000 barrels of oil equivalent per day (boepd). It will be Canada's largest condensate producer and third-largest producer of natural gas, operating under the name of ARC Resources Ltd and remaining [Read more]

Inter Pipeline provides statement on Brookfield Infrastructure Partners’ intention to make unsolicited bid

Advises shareholders to take no action CALGARY, AB - Inter Pipeline Ltd. ("Inter Pipeline" or the "Company") (TSX: IPL) is responding to the news release by Brookfield Infrastructure Partners L.P. ("Brookfield") regarding Brookfield's intention to make an unsolicited offer to acquire all of the outstanding common shares of the Company not already owned by Brookfield. The Company confirms that it previously received unsolicited, non-binding and conditional proposals from Brookfield in the [Read more]

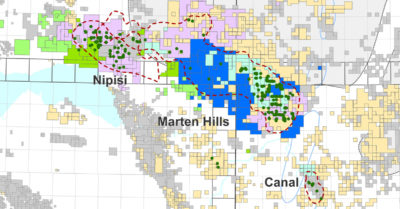

The Shine is Back on the Clearwater!

Mergers and acquisitions in the Nipisi-Marten Hills-Jarvie Clearwater heavy oil plays shifted into overdrive during the last two months of 2020. In November, newcomer Headwater Exploration (dark blue on the map) (figure 1) acquired Cenovus’ Marten Hills assets (approximately 3,000 bopd and 270 net sections), and in December, Tamarack Valley acquired Woodcote Oil’s Nipisi assets (light green) and Highwood Oil’s Nipisi and Jarvie assets (dark green) (combined, 2,000 bopd and 167 net sections). In [Read more]

Environmental law group to challenge Alberta oil inquiry in court

CALGARY - An environmental law charity is to ask a judge today to shut down Alberta's inquiry into the purported foreign funding of anti-oil campaigns. Ecojustice argues in its written submissions that the inquiry was formed for an improper purpose, which the law charity says was to intimidate those concerned about the environmental effects of oil and gas development. The group also contends there's a reasonable apprehension of bias and that the inquiry is dealing with matters outside of [Read more]

ARC Resources and Seven Generations Energy announce strategic Montney combination

CALGARY, Alberta - (ARX - TSX, VII - TSX) ARC Resources Ltd. ("ARC") and Seven Generations Energy Ltd. ("Seven Generations") today announce a strategic combination of the two premier Montney producers. The combined company will continue to focus on significant free funds flow(1) generation through a responsible and disciplined approach to development while creating superior and enduring value for all shareholders. The combination is consistent with ARC’s and Seven Generations’ long-term [Read more]

Pine Cliff Energy Ltd. provides operations update and announces 2020 year-end reserves and 2021 guidance

Calgary, Alberta - Pine Cliff Energy Ltd. (TSX: PNE) ("Pine Cliff" or the "Company") is pleased to provide an operations update and to announce its 2020 year-end reserves and 2021 guidance. Operations Update Pine Cliff's fourth quarter 2020 production averaged 19,130 Boe per day, weighted 91% to natural gas. This resulted in the average production for the year being 19,005 Boe per day, exceeding the Company's 18,500 to 19,000 annual 2020 guidance range. This production was achieved with [Read more]

ARC Resources Ltd. reports fourth quarter and year-end 2020 financial and operational results and year-end 2020 reserves results

CALGARY, AB - (TSX: ARX) ARC Resources Ltd. ("ARC" or the "Company") today reported its fourth quarter and year-end 2020 financial and operational results as well as its year-end 2020 reserves results. ARC's audited consolidated financial statements and notes ("financial statements") and ARC's Management's Discussion and Analysis ("MD&A") as at and for the year ended December 31, 2020, are available on ARC's website at www.arcresources.com and SEDAR at www.sedar.com. On February 10, 2021, [Read more]