CALGARY, AB, April 23, 2024 /CNW/ - Western Energy Services Corp. ("Western" or the "Company") (TSX: WRG) announces the release of its first quarter 2024 financial and operating results. Additional information relating to the Company, including the Company's financial statements and management's discussion and analysis ("MD&A") as at March 31, 2024 and for the three months ended March 31, 2024 and 2023 will be available on SEDAR+ at www.sedarplus.ca. Non-International Financial Reporting [Read more]

Headlines

Freeland says $5 billion just a start for Indigenous loan guarantee program

TORONTO - The $5-billion announced for an Indigenous loan guarantee program in last week's budget is just a start, said Deputy Prime Minister Chrystia Freeland. "Nothing would make me happier than seeing that $5-billion oversubscribed and needing to put in place even more," she said, speaking to media at the First Nations Major Projects Coalition conference in Toronto on Tuesday. The program is designed to help Indigenous communities buy equity in natural resource and energy projects by [Read more]

AI boom to fuel natural gas demand in coming years, report says

A spike in power usage from artificial intelligence (AI) data centers could significantly boost natural gas demand in the second half of the decade, analysts at investment banker Tudor Pickering Holt & Co said in a report on Tuesday. As much as 8.5 billion cubic feet per day of natural gas could be required additionally to match the rise in demand, the report added. WHY IT'S IMPORTANT U.S. power and technology companies have expressed concerns that the country's electrical systems [Read more]

APEGA registrar and CEO to retire spring 2025, search for new RCEO begins

Edmonton, April 23, 2024 (GLOBE NEWSWIRE) -- Jay Nagendran, P.Eng., FCAE, ICD.D, FEC, FGC (Hon.), registrar and chief executive officer of the Association of Professional Engineers and Geoscientists of Alberta (APEGA), announced he will retire and resign his position on April 30, 2025. Mr. Nagendran has spent the past seven years dedicated to upholding the mission of protecting the interests of all Albertans through leading the regulation of professional engineers and geoscientists in [Read more]

Goldman expects geopolitical risk premium to moderate, maintains $90/bbl Brent ceiling

Goldman Sachs on Tuesday said it expects further moderation in the still-elevated geopolitical risk premium of $5-10 per barrel for crude oil in the coming months, and maintained its range-bound view, with a $90 per barrel ceiling on Brent. Oil prices slipped on Tuesday, a day after touching their lowest levels in more than three weeks following a perceived de-escalation in the Israel-Iran conflict as Iran played down a reported Israeli attack on its soil. The moderately bearish [Read more]

Alberta Innovates and Emissions Reduction Alberta announce new hydrogen funding

$57 million in projects announced at the Canadian Hydrogen Convention EDMONTON, Alberta, April 23, 2024 (GLOBE NEWSWIRE) -- The Government of Alberta, through Alberta Innovates and Emissions Reduction Alberta (ERA) is announcing $57 million, worth $280 million, in innovation funding for 28 projects to advance a hydrogen economy, reduce emissions, and create jobs in Alberta. Alberta Innovates, in partnership with Natural Resources Canada, is committing $22.5 million for 20 early-stage [Read more]

Venezuela to accelerate cryptocurrency shift as oil sanctions return

Venezuela's state-run oil company PDVSA plans to increase digital currency usage in its crude and fuel exports as the U.S. reimposes oil sanctions on the country, three people familiar with the plan said. The U.S. Treasury Department last week gave PDVSA's customers and providers until May 31 to wind down transactions under a general license it did not renew due to a lack of electoral reforms. The move will make it more difficult for the country to increase oil output and exports as companies [Read more]

US oil and gas M&A hits quarterly record after blockbuster 2023

U.S. oil and gas deals hit a record $51 billion in the first quarter, a continuation of last year's fierce merger pace centered in the top U.S. shale field, data provider Enverus said on Tuesday. Energy companies have rushed to expand oil and gas drilling inventories, especially in the Permian Basin of West Texas and New Mexico, where producer break-even costs are about $64 a barrel. Oil prices averaged about $77 a barrel last quarter and this week traded near $83 per barrel. Most of the [Read more]

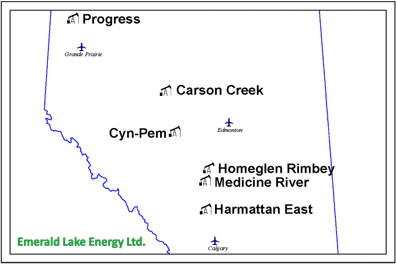

Emerald Lake Energy Ltd. – Corporate Divestiture

Emerald Lake Energy Ltd. (“Emerald Lake” or the “Company”) has engaged Sayer Energy Advisors to assist it with a corporate sale process. Emerald Lake is a private junior oil and natural gas company with long life working interests in located in the Cyn-Pem, Carson Creek North, Harmattan East, Homeglen Rimbey, Medicine River and Progress areas of Alberta (the “Properties”). The Properties consist primarily of non-operated working interests in several units. In addition, the Company holds [Read more]

New to Market Surplus Bakken Oil and Gas Equipment – Including (19x) Lufkin 640-365-168 Pumping Units for USD $25,000 Each and Transloading Equipment

CALGARY, AB, April 16, 2024 - Fuelled Family of Companies ("Fuelled" or "the Company" or "we" or "our"), a technology-based company that uses platforms to manage, sell and disrupt, is pleased to share some newly added equipment to Fuelled.com. Bakken Surplus Equipment Newly posted equipment located in Manitoba and Saskatchewan, ideally situated, and suited for the Bakken. Transloading Packages (truck offload) Tanks Separators Free Water Knockouts (heated and non-heated) [Read more]

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- …

- 2782

- Next Page »