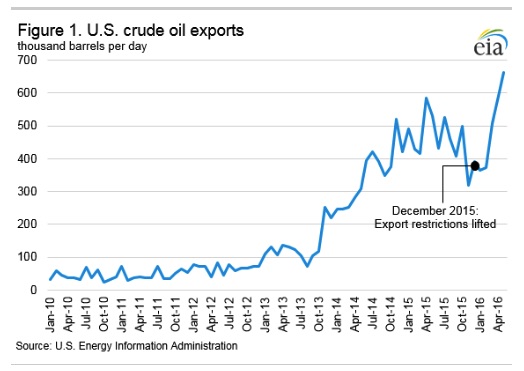

While Canada continues to struggle to get its crude oil to market, United States producers are seeing the value of its crude appreciate through the lifting of crude export restrictions in December of 2015. In April, following a 175,000 barrel shipment of light-sweet crude from North Dakota to the Netherlands, the President of the North Dakota petroleum council stated “once you get a barrel to sea, it will fetch a better price.” The shipment was one of many as producers continue to take advantage of Recently repealed legislation meant to maximize the value of exported products. Indeed, the same man also expressed how a producer can reap up to $14 more per barrel on the world market with the right government policy. Additionally, the Vice President of the American Petroleum Institute praised the ending of the restrictions, pointing to the fact exports are only a positive contribution to the United States economy.

While Canada continues to struggle to get its crude oil to market, United States producers are seeing the value of its crude appreciate through the lifting of crude export restrictions in December of 2015. In April, following a 175,000 barrel shipment of light-sweet crude from North Dakota to the Netherlands, the President of the North Dakota petroleum council stated “once you get a barrel to sea, it will fetch a better price.” The shipment was one of many as producers continue to take advantage of Recently repealed legislation meant to maximize the value of exported products. Indeed, the same man also expressed how a producer can reap up to $14 more per barrel on the world market with the right government policy. Additionally, the Vice President of the American Petroleum Institute praised the ending of the restrictions, pointing to the fact exports are only a positive contribution to the United States economy.

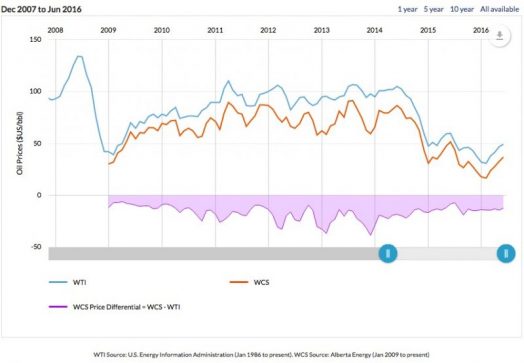

What’s more, Canada also stands to benefit from the lifting of the United States export ban due to reduced competition in what was already saturated American domestic market. This can be implied through a historically small WTI/WCS price differential. This benefit is small potatoes when compared to the benefit Canada would realize if we also had international exporting capacity. Increased capacity (through building more pipelines and LNG facilities) would likely be obtained through a Trump presidency. Trump has already expressed his support for Keystone XL, which would make port in Tidewater, for example. If a conservative Canadian government were to take office this, one could also expect an overturning of Prime Minister Trudeau’s ban on tanker traffic off British Columbia’s coast, the opening of Prince Rupert’s oil by rail terminal, and Enbridge’s Northern Gateway project. Energy East is the Canadian oil and gas industries’ only hope in the near future, which would mean opening up, among others, European markets to our oil.

Currently, the obstacle inhibiting Canada’s greatest potential for economic growth is essentially politics. To counter proposals for critical energy infrastructure to be built, Canada’s political establishment consistently utilizes environmental rhetoric which lacks any substance when viewed from the frame of rational economics. The Pembina Institute‘s claims that pipelines contribute to GHG emissions collapses when one considers the global perspective. Since crude oil is so inelastic, and that large price changes are required to only make small changes in quantity produced, crude buyers will simply substitute supply with invisible harm to their profit margins.

Political pressure on our oil and gas sector goes way beyond national pipeline politics. Multinational companies, who have traditionally valued Canada’s stable political environment, are finding better opportunities in developing nations. One needn’t look further than a recent case with ConocoPhillips. Conoco has traditionally been an established giant in Canadian oil and gas, yet lately, they have cut over 1000 jobs in Canada, replacing them in countries with more favourable policy in place to increase shareholder equity. Aside from the inability to get product to new markets, company spokesman Rob Evans said:

“Coupled with increased local cost pressures such as corporate taxes, regulatory compliance costs and property taxes, staying competitive in a global portfolio is a challenge for some parts of our Canadian business.”

Indeed, it appears our Provincial NDP government and our Federal Liberals are more connected to mainstream media rhetoric than policy makers in other nations. It appears that they seem to think our industry lives within its own bubble and they can manipulate it to appeal to a certain section of the voter base. The type of voter who drives to a pipeline protest location organized through the energy intensive communication infrastructure in clothing made of oil derived polyesters and shipped overseas in tankers fueled through crude oil. To me, this type of voter seems to get an oddly disproportionate amount of media coverage.

As Canadian producers and multinationals continue paying taxes to a regime which does nothing but hinder it; as the Liberal Government continues to put future generations further into debt through deficit spending despite revenue streams, such as crude oil terminals being easily available; as we continue to lose out on tax revenue which could be used to fund technological initiatives dedicated to actually making an impact on climate change; I wonder if there is there is truly any substance behind our stylish new government. Or have they paralyzed themselves trying to simply look good?