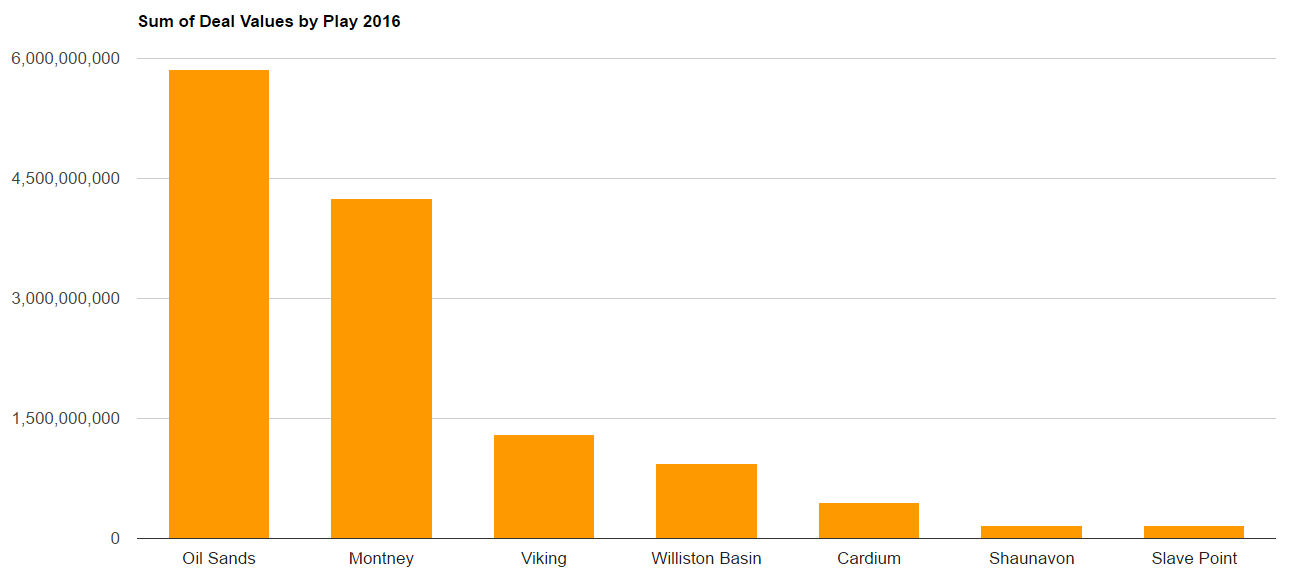

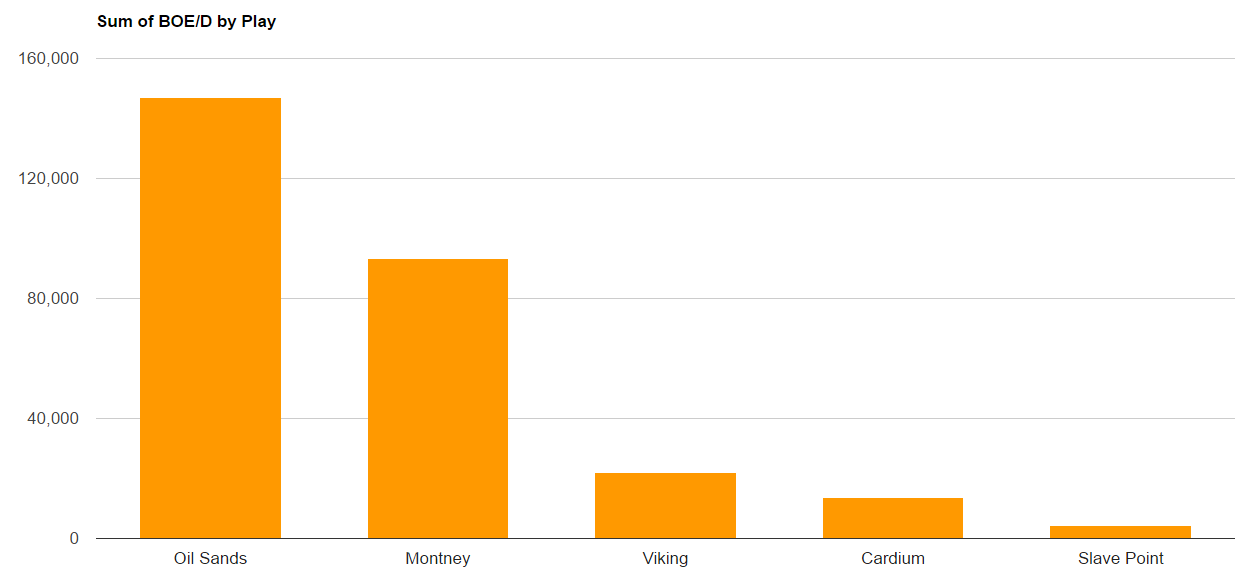

According to BOE Report M&A Database, over $14 billion of Western Canadian upstream deals closed in 2016, comprised of over 339,000 BOE/D.

Oil sands transactions topped the list with nearly $6 billion (comprised of 147,000 BOE/D) worth of transactions. Suncor Energy’s acquisition of Canadian Oil Sands.

The Montney was the most active shale play with over $4 billion (with 93,000 BOE/D) worth of deal. The largest transactions were Seven Generations purchase of assets from Paramount Resources for $1.9 billion, and Tourmaline’s asset acquisition from Shell for $1.369 billion. Those assets were formerly operated by Tourmaline’s management team when they ran Duvernay Oil Corp.

Have a look at the data visualized below:

Data from BOE Report M&A Database

Data from BOE Report M&A Database